Selling Options for Income: A Practical Guide

Selling options can generate income by receiving premiums for selling the right to buy or sell an asset. This guide provides a practical approach to selling options, including covered calls and cash-secured puts, with risk management techniques.

Introduction

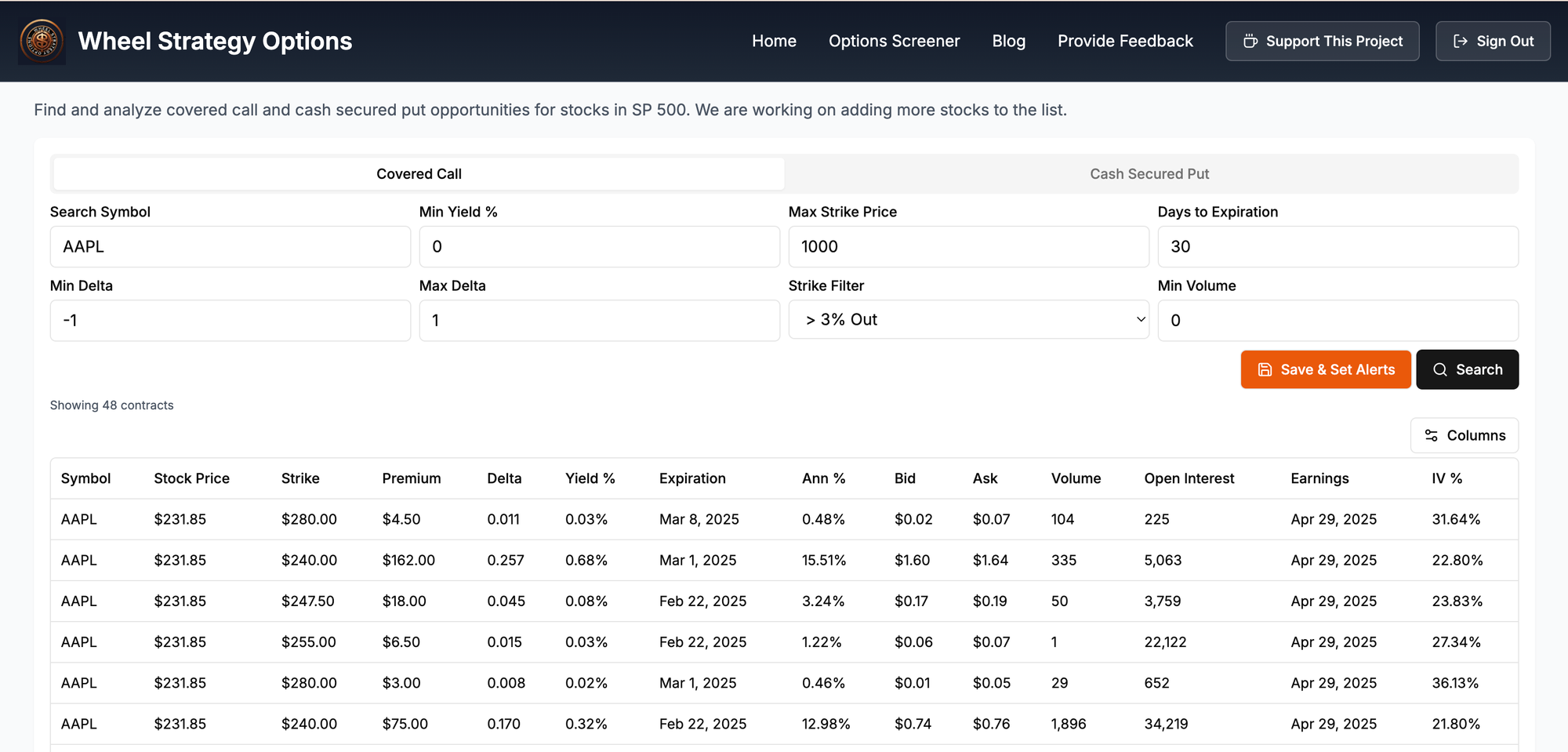

Selling options can be a powerful tool for generating income, but it requires a solid understanding of the mechanics and risks involved. This guide provides a step-by-step approach to selling options effectively, focusing on practical examples and risk management techniques. We highly recommend trying our Wheel Options screener here to follow along better.

Understanding Option Premiums

When you sell an option, you receive a premium upfront. This premium is your income. The buyer of the option pays this premium for the right, but not the obligation, to buy (call option) or sell (put option) the underlying asset at a specified price (strike price) before a certain date (expiration date).

Covered Call Options

A covered call involves selling a call option on a stock you already own. Let's say you own 100 shares of ABCD stock currently trading at $50. You could sell a call option with a strike price of $55 expiring in one month. If ABCD stays below $55, you keep the premium and the stock. If ABCD goes above $55, your shares will be called away at $55, and you keep the premium plus the $55 per share.

Example: You receive a $1 premium per share for selling the call. If ABCD stays below $55, your profit is $100 (premium). If ABCD rises to $60, your profit is $600 (from the sale at $55) + $100 (premium) - $500 (original cost basis) = $200.

Risk: You limit your upside potential if the stock price rises significantly.

Cash-Secured Put Options

A cash-secured put involves selling a put option and setting aside enough cash to buy the underlying asset if the option is exercised. Let's say you are bullish on EFGH stock, currently trading at $40. You could sell a put option with a strike price of $35 expiring in one month. If EFGH stays above $35, you keep the premium. If EFGH falls below $35, you are obligated to buy 100 shares at $35.

Example: You receive a $0.50 premium per share. If EFGH stays above $35, your profit is $50. If EFGH falls to $30, you buy the shares at $35. Your effective purchase price is $34.50 ($35 - $0.50 premium).

Risk: Your maximum loss is the strike price minus the premium received per share, multiplied by 100.

Managing Risk

Position Sizing: Never risk more than you can afford to lose on a single trade. Diversify your options portfolio. Defined Risk Trades: Stick to strategies with defined risk like covered calls and cash-secured puts.

Rolling Options: If a trade is moving against you, you can roll the option to a later expiration date or a different strike price to avoid assignment or maximize profit.

Choosing the Right Options

Liquidity: Trade options with sufficient volume and open interest to ensure easy entry and exit. Implied Volatility: Higher implied volatility generally means higher premiums but also higher risk. Time Decay (Theta): Options lose value over time, and sellers benefit from this time decay.

Example Scenarios

Scenario 1: You sell a covered call on IJKL stock at a strike price you're comfortable selling at. The stock price remains below the strike price. You keep the premium as income.

Scenario 2: You sell a cash-secured put on MNOP stock believing the price will stay above the strike price. The stock price falls below the strike price. You are assigned the shares at the strike price, effectively buying the stock at a discount due to the premium received.

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Investments are subject to risk, and you should carefully analyze any investment before making decisions.

Comments ()