Options Selling Made Easy: Top Brokerage Platforms Compared

Compare top brokerage platforms for selling options like covered calls & cash-secured puts. Analyze fees, tools, & usability for optimal wheel strategy execution.

Best Brokerage Platforms for Selling Options: In-Depth Comparison

In today's volatile market, generating consistent income through selling options has become increasingly attractive. With the VIX experiencing significant fluctuations, now more than ever, traders need robust platforms to execute their strategies effectively.

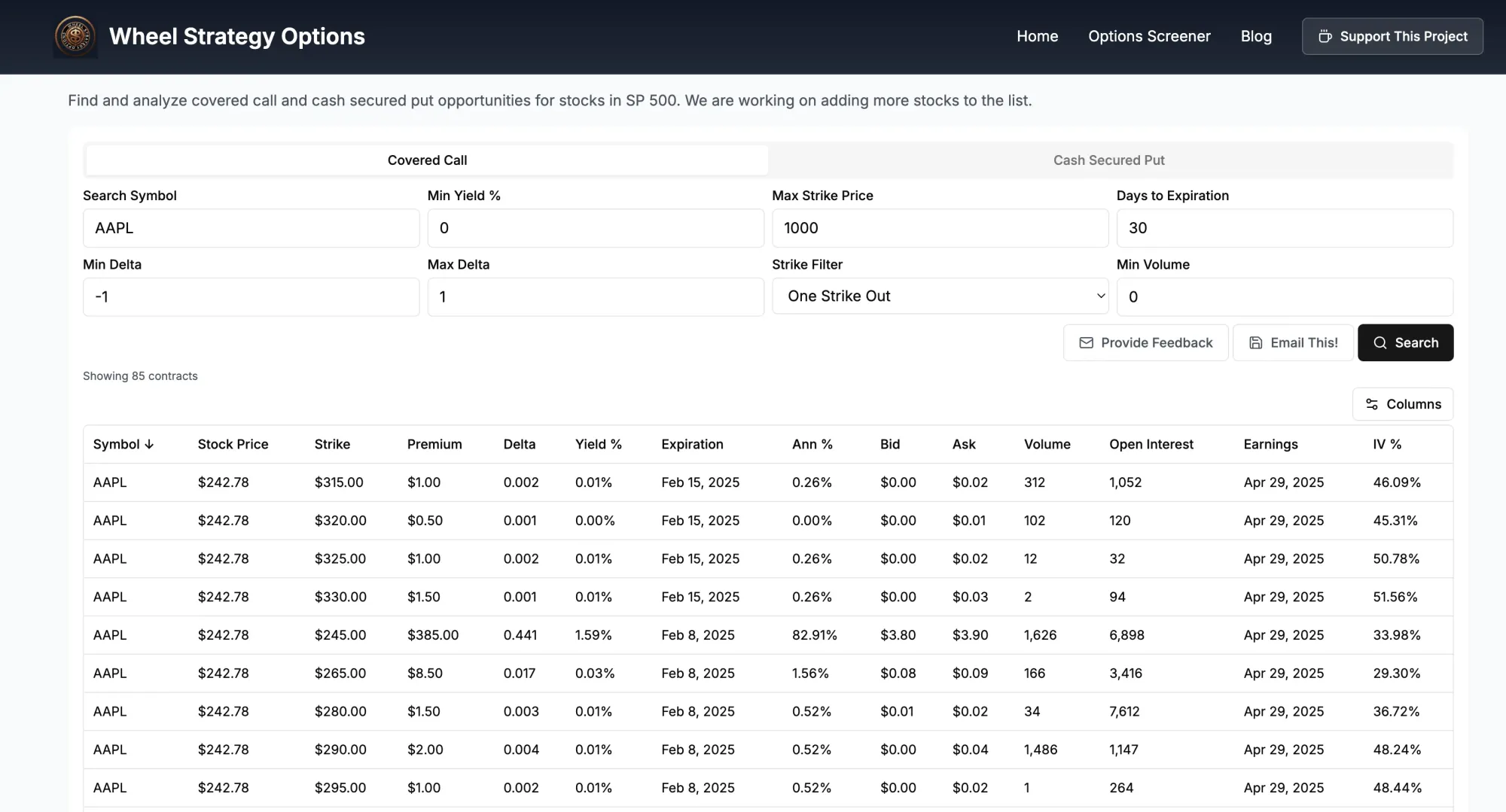

This in-depth analysis compares nine leading brokerage platforms—Interactive Brokers, Charles Schwab, E*TRADE, Robinhood, Webull, TradeStation, Fidelity Investments, tastytrade, and Ally Invest—to help you choose the best platform for selling options, including covered calls and cash-secured puts, and potentially implementing the wheel strategy. As an addition, we highly recommend trying our Wheel Options screener to elevate your option selling game into the next orbit.

Disclaimer: Platform features and prices are like your favorite memes—always changing and never up-to-date. This guide is your trusty sidekick, but do your own homework before making the big decisions. We're here to accelerate your journey, not be the ultimate truth-tellers! But know that nobody paid us to write this.

Platform Features and Tools

Each platform offers unique features catering to different trader needs. Interactive Brokers boasts advanced charting, analytical tools, and a vast array of tradable instruments, appealing to professional traders. Schwab and Fidelity provide robust research tools, educational resources, and excellent customer service, ideal for investors seeking a comprehensive approach.

E*TRADE, tastytrade, and TradeStation focus on options-centric features, including powerful options analytics, strategy builders, and specialized tools for selling options. Robinhood and Webull cater to mobile-first users with simplified interfaces, although they may lack the depth of features for more sophisticated option strategies.

Commission and Fee Structure

| Broker | Options Commission | Other Fees |

|---|---|---|

| Interactive Brokers | $0.65 per contract | Various fees for data, inactivity, etc. |

| Charles Schwab | $0.65 per contract | Limited other fees. |

| E*TRADE | $0.65 per contract | Some fees for specific services. |

| Robinhood | $0 commission | Limited other fees. |

| Webull | $0 commission | Limited other fees. |

| TradeStation | Varies based on plan | Platform fees may apply. |

| Fidelity Investments | $0 commission | Limited other fees. |

| tastytrade | $1 to open + $0 to close | Limited other fees. |

| Ally Invest | $0 commission | Limited other fees. |

Commission and fee structures are crucial factors, especially for high-volume options traders. While Robinhood and Webull offer zero commission trades, it's vital to consider potential hidden costs. Other platforms balance commissions with valuable research tools, customer support, and other functionalities.

Comparison of the Most Popular Platforms

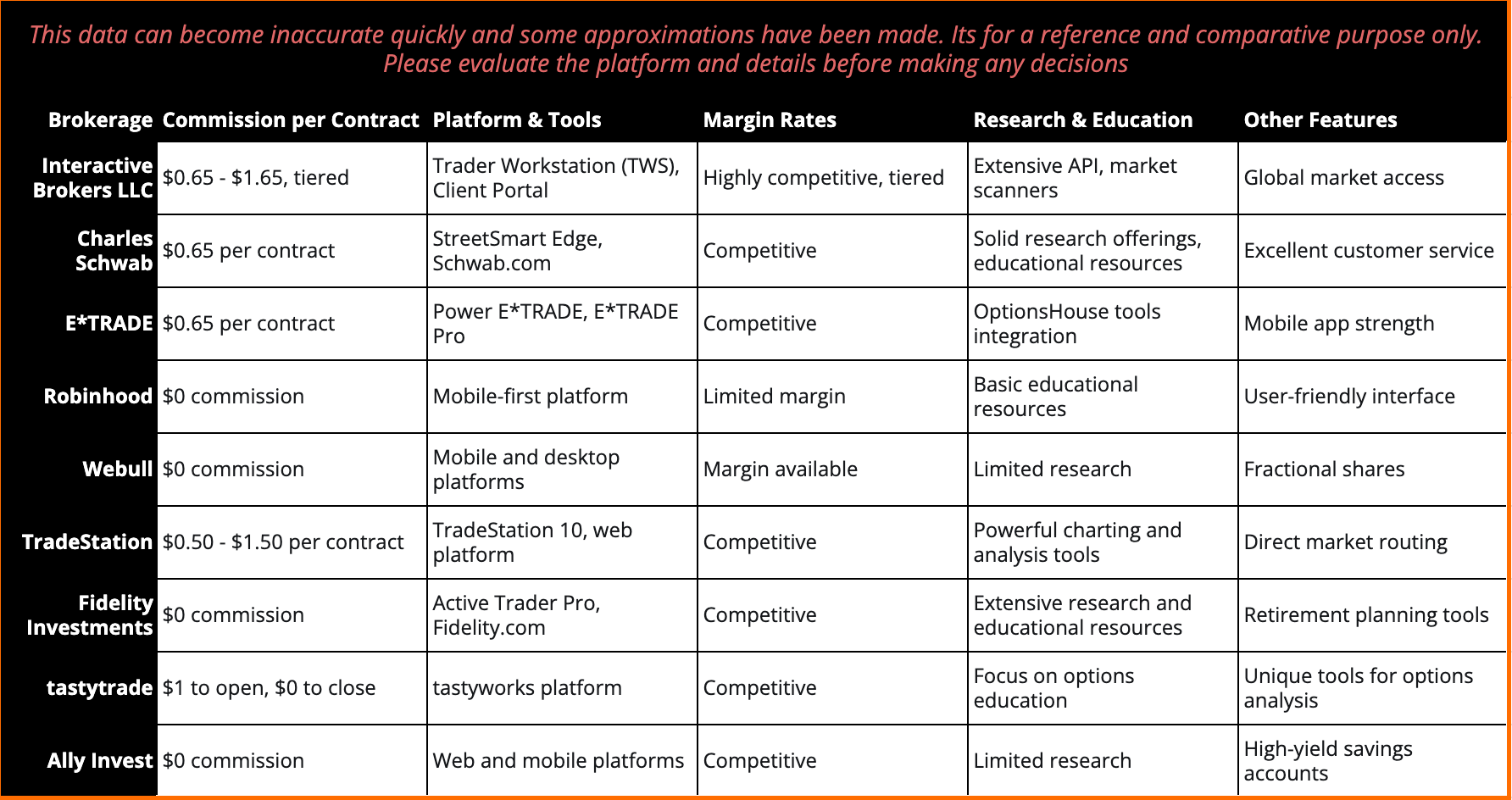

This table is structured as a feature-based comparison of different brokerage firms, designed to provide a quick overview for users looking to choose a brokerage.

Important Insights from the Comparison

To save you some time, here are 5 insightful conclusions from the brokerage comparison table:

- The Rise of Zero-Commission Trading: A significant trend is the prevalence of zero-commission brokerages like Robinhood, Webull, Fidelity, and Ally Invest. This contrasts with traditional brokers who still charge per contract, indicating a major shift in the industry towards commission-free trading to attract users, especially beginner investors.

- Platform Choice Reflects Target Audience: Brokerages tailor their platform offerings to their target audience. Zero-commission brokers often prioritize user-friendly mobile platforms (Robinhood, Webull, Ally Invest), appealing to a mobile-first generation. In contrast, brokers with per-contract fees tend to offer more sophisticated desktop platforms with advanced tools (TradeStation, Interactive Brokers), catering to active and professional traders who require robust analytics and features.

- 'Competitive Margin Rates' are the Norm, but Margin Availability Varies: While most brokerages advertise "competitive" margin rates, suggesting this is a standard industry offering to attract traders leveraging margin, there are nuances. Some platforms like Robinhood and Webull explicitly state "limited margin" or "margin available," indicating potentially restricted access or less favorable margin terms compared to platforms highlighting "highly competitive, tiered" margin like Interactive Brokers.

- Research and Education Differentiate Beyond Price: With commission becoming less of a differentiator, research and educational resources become key competitive advantages. Brokerages vary significantly in their offerings, ranging from basic educational resources (Robinhood, Webull) to extensive research and education (Fidelity, Interactive Brokers) and niche specializations like options education (tastytrade). This reflects an effort to attract and retain users by catering to different levels of investor knowledge and trading styles.

- 'Other Features' Highlight Brokerage Specialization: The 'Other Features' column reveals how brokerages aim to distinguish themselves beyond core trading functionalities. These unique features cater to specific investor needs and preferences, such as global market access (Interactive Brokers), strong customer service (Charles Schwab), mobile app excellence (E*TRADE), fractional shares trading (Webull), retirement planning tools (Fidelity), focus on options trading (tastytrade), and high-yield savings accounts (Ally Invest). This indicates a move towards offering specialized services to attract niche markets and enhance user stickiness.

Key Takeaways

In conclusion, navigating today's dynamic market and effectively selling options for income necessitates choosing the right brokerage platform. As this comparison has shown, the landscape is diverse, with key trends emerging such as the rise of zero-commission trading and brokerages specializing their platforms for different trader types. For instance, while mobile-first platforms like Robinhood and Webull offer accessibility, sophisticated options traders may find the advanced charting and analytics of Interactive Brokers or TradeStation more suitable. Ultimately, the "best" platform hinges on individual needs and priorities. Therefore, to maximize your options trading success, carefully weigh factors like platform features, commission structures, research resources, and your own trading style. By making an informed decision and leveraging the right tools, you can empower yourself to navigate the options market effectively and pursue your financial goals.

And don't forget to try our Wheel Options screener here to follow along better.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()