Analyzing stock types for selling options with Wheel Strategy

Not all stocks are equal for Wheel Strategy success! Uncover the 5 key ticker types perfect for selling options and boosting your portfolio.

Introduction

The options market continues to be a dynamic landscape for traders, and 2025 has seen its share of popular tickers. Option volumes have soared, and understanding why certain tickers attract wheel traders is crucial. This analysis delves into five hypothetical ticker types favored by wheel traders, exploring the factors behind their popularity.

Categorizing hypothetical investment types

Ticker Type A: The Stable Giant

Ticker A represents a well-established company in a mature industry. Its slow and steady growth makes it attractive to wheel traders looking for consistent premium income with relatively low volatility.

Why Traders Love It: High option premiums due to consistent demand, lower risk of significant price swings.

Ticker Type B: The Tech Darling

This high-growth tech company has generated significant buzz, leading to elevated option premiums.

Why Traders Love It: Potential for share price appreciation alongside premium income, although with higher risk.

Ticker Type C: The Comeback Kid

Ticker C represents a company recovering from a downturn. Increased volatility creates opportunities for higher premiums.

Why Traders Love It: Higher potential premiums due to volatility, but requires careful management of assignment risk.

Ticker Type D: The Dividend Aristocrat

This company boasts a long history of consistent dividend payouts, attracting income-focused wheel traders.

Why Traders Love It: Combined income from dividends and premiums, suitable for conservative strategies.

Ticker Type E: The Meme Stock Resurgence

This ticker experienced a resurgence in popularity due to renewed social media attention, leading to high volatility and premiums.

Why Traders Love It: High premiums due to volatility, but carries substantial risk and requires active management.

Key Factors Driving Ticker Selection

Several factors influence a wheel trader's ticker choices:

- Implied Volatility (IV): High IV often translates to higher premiums.

- Liquidity: Ample trading volume ensures easy entry and exit.

- Underlying Price: Share price impacts the strike prices available.

- Dividend Yield (if applicable): Enhances overall return for dividend-paying stocks.

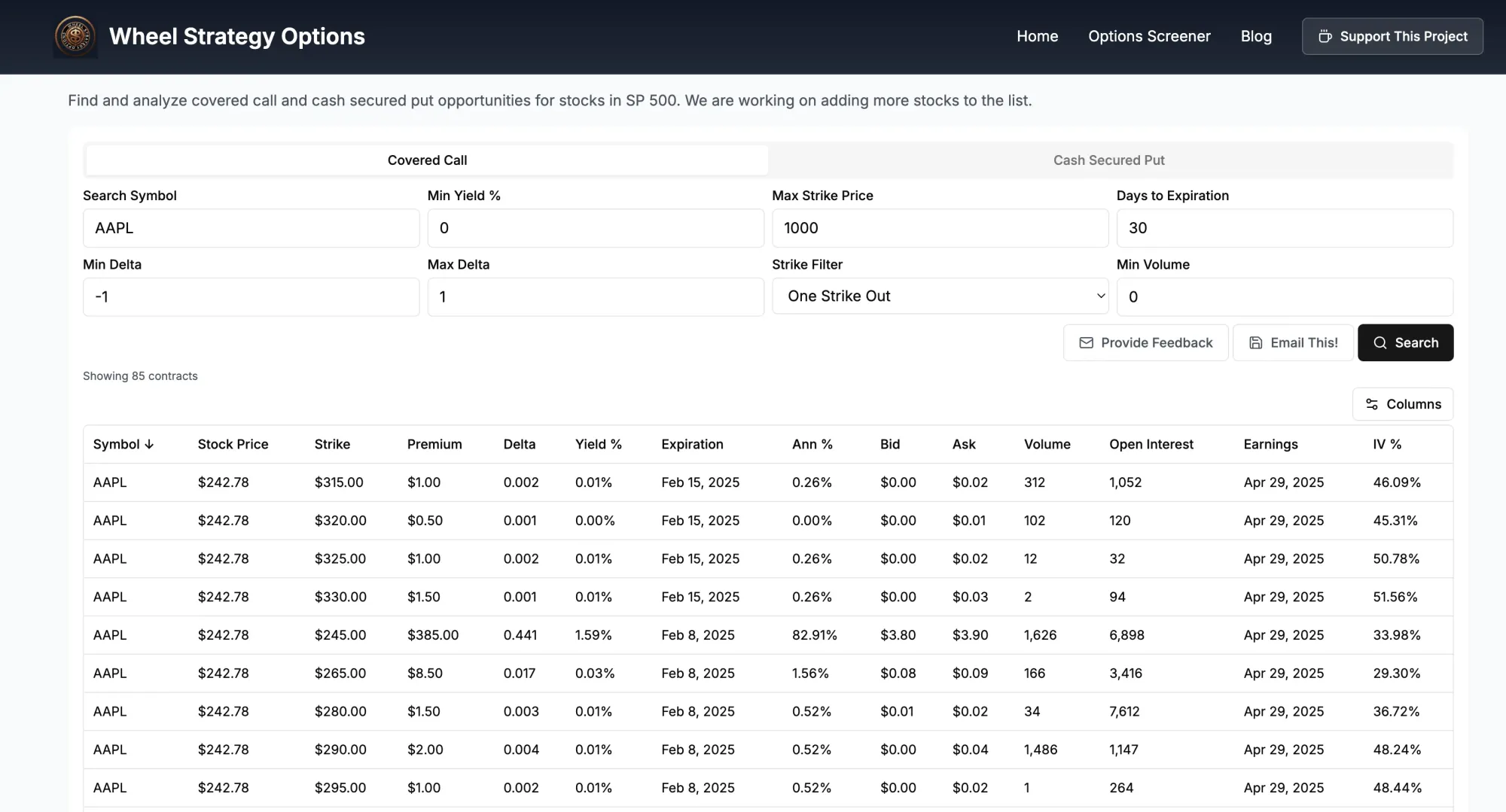

Carefully assess what type of tickers make sense for your income goals and then carefully use the filtering criteria like IV. Try our Wheel Options screener here to play around with this strategy.

Example Scenario

Imagine using the wheel strategy on Ticker B. You might sell a put option with a strike price slightly below the current market price, collecting a premium. If the price stays above the strike, you keep the premium. If it falls below, you are assigned the shares, but you can then sell covered calls to generate further income.

Comparing Tickers (Hypothetical Data)

| Ticker | IV | Avg. Volume | Dividend Yield |

|---|---|---|---|

| A | 20% | 1M | 2% |

| B | 40% | 2M | 0% |

| C | 50% | 1.5M | 0% |

| D | 15% | 500K | 4% |

| E | 70% | 3M | 0% |

Checklist for Choosing a Ticker

- Analyze IV and liquidity.

- Assess the risk profile of the underlying asset.

- Consider your income goals and risk tolerance.

- Backtest your strategy.

Summary

Different tickers cater to different trading styles and risk appetites. Understanding the factors that influence premiums is key to successful wheel trading. Careful analysis and risk management are essential.

Disclaimer: This article is for informational purposes only and not financial advice. Investments are subject to risk and should be carefully analyzed before making any decisions.

Follow us on:

Comments ()