Why is the Wheel Strategy Called the Triple Income Strategy?

The Wheel Options Strategy, often called the "triple income" strategy, offers income potential from cash-secured puts, covered calls, and asset appreciation. Learn how it works and maximize its potential

In today's volatile market, where the VIX has averaged significantly higher than its historical average over recent years, options strategies that generate income have become increasingly attractive to sophisticated traders. Especially selling options with the wheel strategy, often referred to as the "triple income strategy," stands out for its potential to capitalize on market fluctuations while managing risk.

Decoding the "Triple Income" of the Wheel Strategy

The "triple income" moniker, while evocative, can be misleading if not fully understood. It doesn't imply three distinct income streams, but rather highlights the three primary ways the wheel strategy can generate profit:

- Premium from selling cash-secured puts: This is the first potential income source. By selling a cash-secured put, you receive a premium upfront. If the underlying price stays above the strike price at expiration, the put expires worthless, and you keep the premium.

- Share price appreciation (if assigned): If the put is assigned, you purchase the underlying asset at the strike price. If the price subsequently appreciates, you profit from the price increase when you eventually sell the shares via covered calls.

- Premium from selling covered calls: Once you own the underlying asset, you generate income by selling covered call options. This provides ongoing premium income as long as you continue to own the shares.

Understanding the Nuances: It's Not Always a "Triple"

It's crucial to recognize that all three income sources might not materialize in every wheel cycle. Market conditions and underlying asset price movements play a significant role. For instance:

- If the underlying price remains above the put's strike price, you only realize income from the put premium (source 1).

- If assigned but the underlying price remains relatively flat, you primarily profit from put and call premiums (sources 1 and 3).

- The "triple" income scenario materializes only when you profit from all three: initial put premium, share price appreciation, and covered call premiums.

Advanced Considerations for Experienced Traders

Managing Risk and Volatility

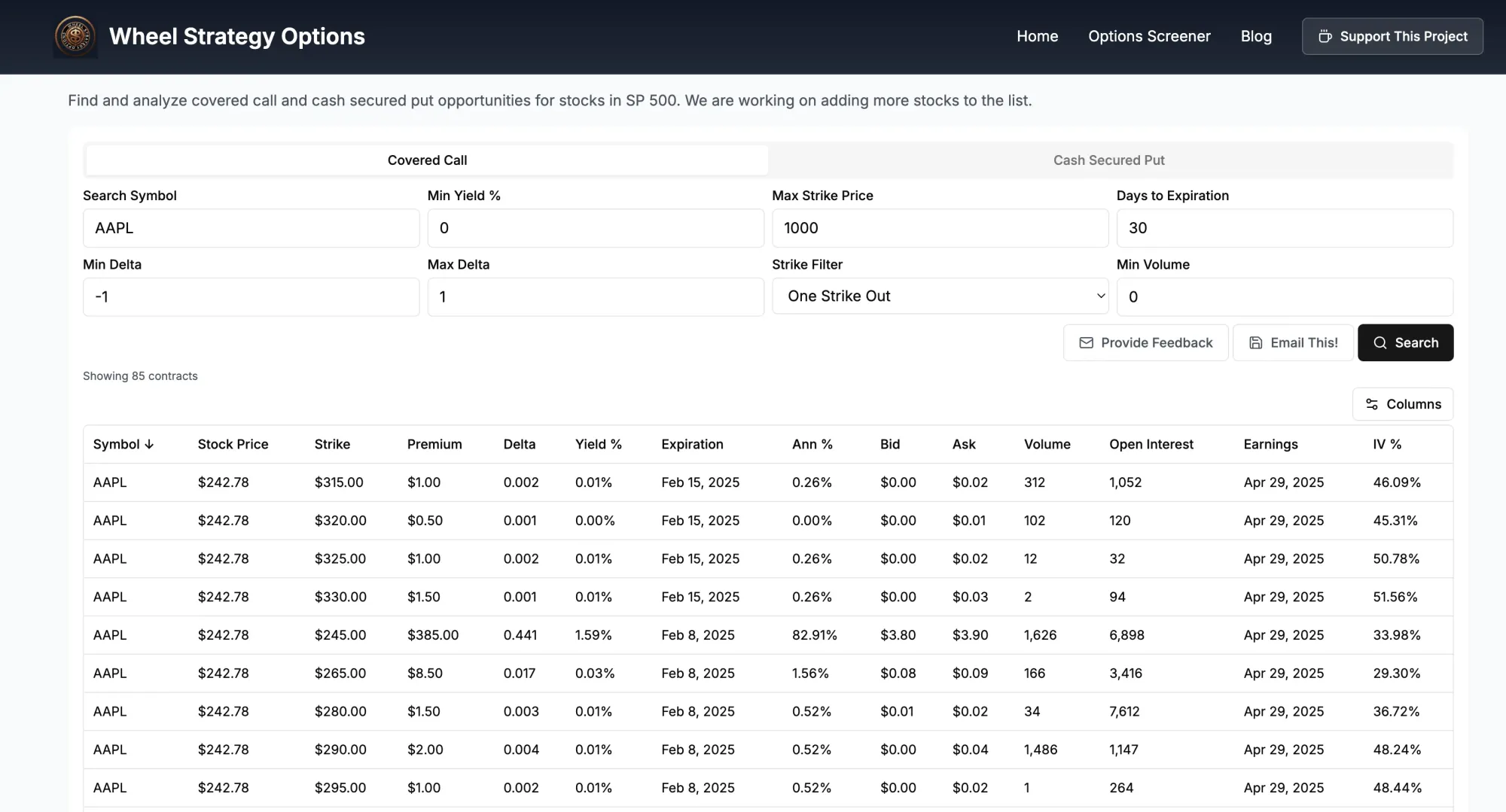

While the wheel strategy can generate income, it's not risk-free. Proper risk management is paramount. Use the wheel strategy screener to identify suitable underlying assets and manage position sizing based on your risk tolerance. Consider factors like implied volatility, historical volatility, and potential price swings when selecting strike prices and expiration dates.

Tax Implications

Different tax rules apply to premiums received from options and capital gains from share appreciation. Consult with a tax professional to understand the tax implications of the wheel strategy in your specific jurisdiction.

As Warren Buffett wisely noted,

Risk comes from not knowing what you're doing.- Warren Buffett

Thorough research and understanding of options mechanics are essential for success with the wheel strategy.

Optimizing the Wheel Strategy

Consider these factors to optimize your wheel strategy execution:

- Underlying asset selection: Choosing stable, fundamentally sound companies with liquid options can improve the consistency of your income stream. Learn more about this topic in our blog post:

- Strike price and expiration selection: Balancing risk and reward by choosing appropriate strike prices and expiration dates based on your outlook for the underlying asset.

- Managing assignment: Having a plan for managing assignments and rolling strategies to mitigate potential losses. Learn more here:

Key Takeaways

- The "triple income" refers to potential income from put premiums, share appreciation, and covered call premiums.

- Not all three income sources are realized in every wheel cycle.

- Risk management and understanding options mechanics are crucial.

- Utilizing tools like the wheel strategy screener can significantly enhance your decision-making process.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()