Vega, Gamma, Rho: Decoding The Greeks for Wheel Options

Introduction

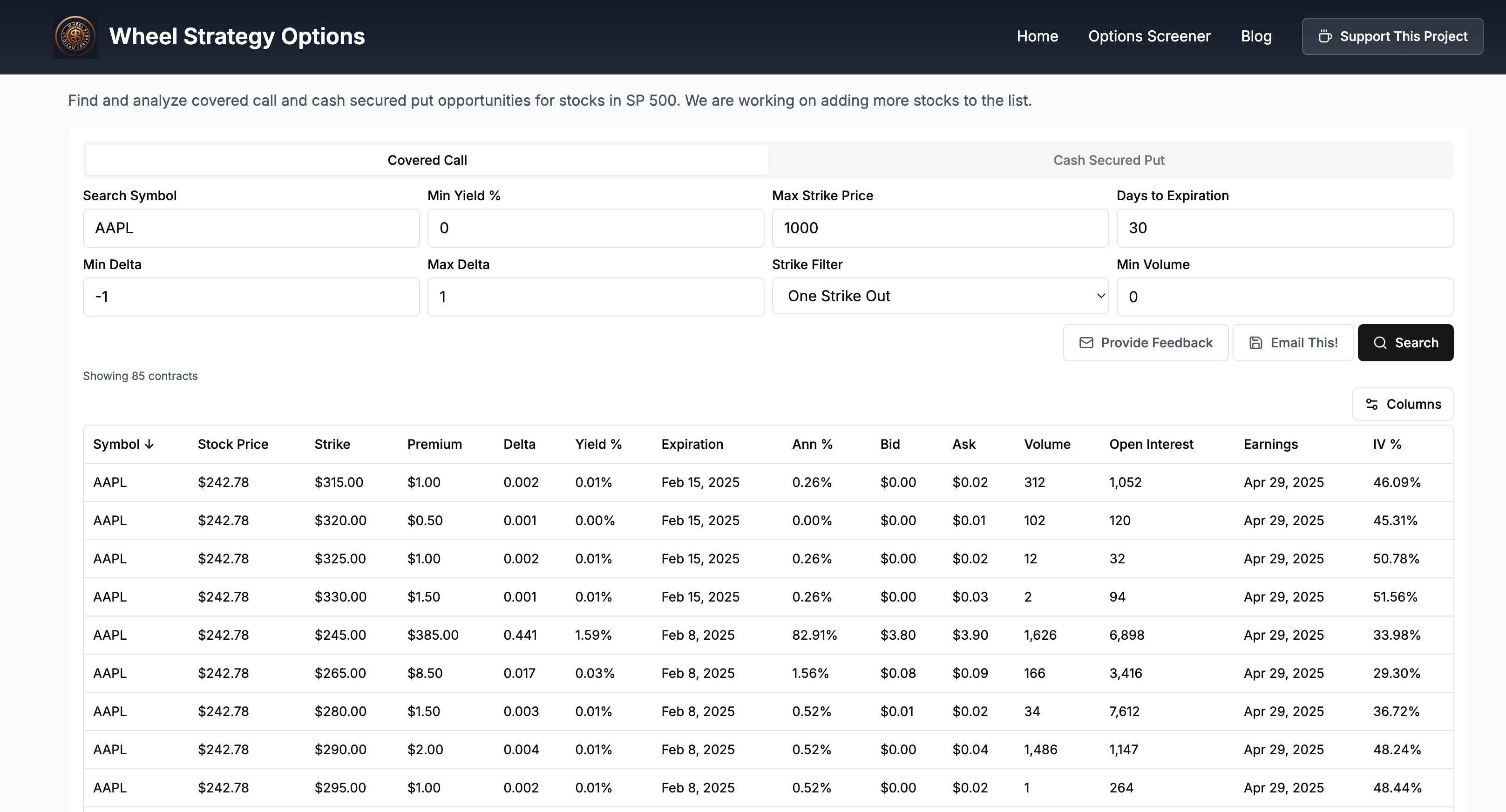

The Wheel options strategy, while seemingly straightforward, involves navigating the complexities of various option Greeks. Understanding these Greeks—specifically Vega, Gamma, and Rho—is crucial for informed trading decisions and risk management. Let's delve into how these Greeks affect your Wheel strategy. We highly recommend trying our Wheel Options screener here to follow along better.

Vega: Volatility's Impact on Wheel Options

Vega measures the sensitivity of an option's price to changes in implied volatility. A higher Vega signifies a larger price swing with volatility fluctuations. For Wheel traders selling options, high volatility (and thus high Vega) is desirable as it increases the premiums received. Conversely, a drop in volatility can erode profits. For example, if you sell a call option on stock ABC with a Vega of 0.10, a 1% increase in implied volatility could theoretically increase the option's price by $0.10.

Managing Vega Risk

One way to manage Vega risk is by selling options closer to their expiration date, as shorter-term options have lower Vega. You could also consider strategies like calendar spreads to offset Vega risk.

Gamma: Acceleration of Price Changes

Gamma measures the rate of change in an option's delta with respect to the underlying asset's price movements. A high Gamma means the delta will change rapidly, particularly near the strike price. This is relevant for Wheel traders as it affects the speed at which your position shifts from profitable to at-risk. Imagine selling a put on stock DEF with a high Gamma. A sudden price drop in DEF could quickly push the option in-the-money, requiring assignment.

Navigating Gamma Risk

Managing Gamma risk often involves adjusting your strike prices strategically. Choosing strikes further out-of-the-money can mitigate the impact of sudden price swings.

Rho: Interest Rate Sensitivity

Rho quantifies the impact of interest rate changes on option prices. It's generally less significant than Vega or Gamma for short-term options typically used in the Wheel strategy. However, for longer-term positions, Rho can become a factor. A higher interest rate generally increases call option prices and decreases put option prices.

Rho in the Wheel Strategy

While Rho's influence is typically minimal in the Wheel strategy due to the short-term nature of the options involved, being aware of its implications during periods of significant interest rate changes is important, especially if you hold LEAPS or longer-dated options as part of your strategy.

Example Scenario

Let's say you're selling a put option on stock GHI. High implied volatility inflates the premium, offering attractive income. However, a sudden drop in GHI's price, coupled with high Gamma, could quickly push your position into a loss. Monitoring these Greeks provides a better understanding of the potential profit and loss scenarios.

Risk-Benefit Analysis

Benefits: Understanding the Greeks helps you to price options more effectively, time your trades better, and manage risks. Risks: Ignoring the Greeks can lead to unexpected losses. Market conditions can change rapidly, impacting option prices in unpredictable ways.

Conclusion

Vega, Gamma, and Rho are vital considerations for any options trader, including those using the Wheel strategy. By understanding how these Greeks affect your positions, you can make more informed decisions, optimize your strategy, and navigate the inherent risks of options trading more effectively.

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Investments are subject to risk and should be carefully analyzed before making any decisions.

Comments ()