Selling Options With The Wheel Strategy During Market Corrections

Navigating Market Corrections with the Wheel Options Strategy

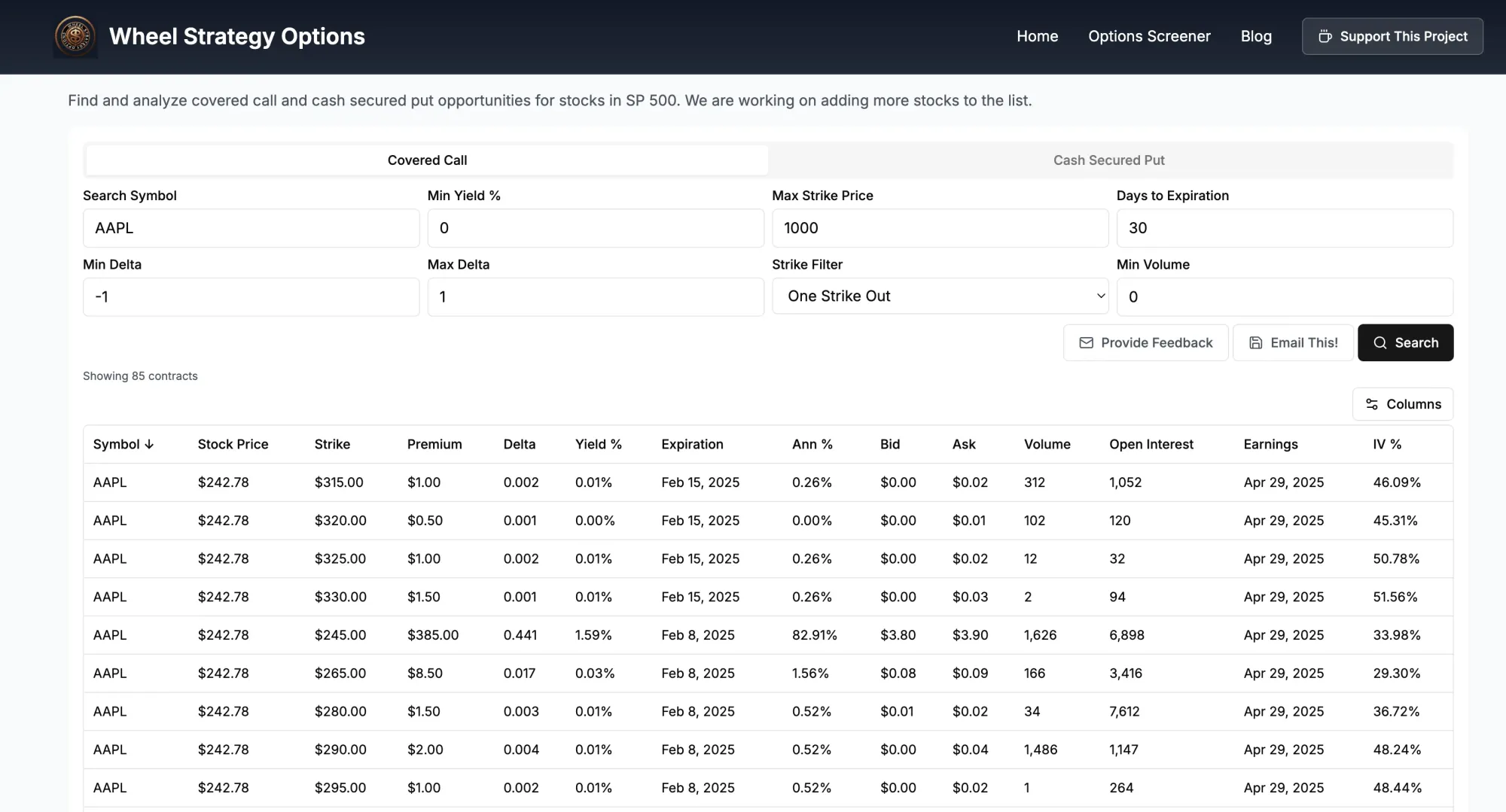

Market corrections, defined as a 10% drop from recent highs, are an inevitable part of the stock market cycle. A study by J.P. Morgan found that market corrections occur on average once a year. These periods of uncertainty present unique challenges and opportunities for options traders. This article delves into how the Wheel strategy can be adapted and utilized during these volatile times. We highly recommend trying our Wheel Options screener here to follow along better.

Understanding the Shifting Landscape

During corrections, implied volatility (IV) tends to spike. This rise in IV can be beneficial for options sellers as premiums increase. However, the increased risk of assignment requires a careful approach. Let's explore how to adjust your Wheel strategy accordingly.

Managing Risk and Premium

The heightened volatility during a correction increases the likelihood of your put options being assigned. Therefore, it's crucial to select underlying assets with strong fundamentals and a business model you understand well. This preparedness allows you to confidently own the shares if assigned.

Another strategy is to sell puts further out-of-the-money (OTM). While this lowers the premium received per trade, it provides a larger buffer against price declines, reducing the risk of assignment. Consider also shortening the duration of your put options to capitalize on the increased time decay of options with high IV.

Adapting Strike Selection

Choosing the right strike price is even more critical during market corrections. While it may be tempting to chase higher premiums by selling puts closer to the money, this significantly increases your assignment risk. A more prudent approach is to select strikes further OTM, balancing premium capture with assignment risk.

Capital Allocation and Diversification

Diversification is key during market turmoil. Avoid concentrating your capital in a single underlying asset. Instead, spread your positions across multiple uncorrelated assets to mitigate risk. Consider reducing the capital allocated to each position, allowing you to manage potential losses more effectively.

Example Scenario

Imagine a hypothetical scenario where the market is experiencing a correction. A stock, currently trading at $100, sees its IV spike. Instead of selling at-the-money (ATM) puts at the $100 strike, an investor using the Wheel strategy might opt to sell puts at the $90 strike. This offers a lower premium but a wider safety margin should the stock price continue to decline.

Monitoring and Adjustment

Continuous monitoring of your positions is essential during market corrections. Be prepared to adjust your strategy as market conditions evolve. This may involve rolling your puts down and out to collect additional premium while reducing your risk, or even closing positions if the outlook for the underlying asset deteriorates significantly.

Rolling Strategies during Corrections

Rolling put options can be an effective way to manage risk and potentially increase profits. If a stock price moves against you, rolling your short puts further out in time or further OTM can provide more time for the stock to recover or widen the buffer between the strike price and the current market price. Remember that rolling isn't always a guaranteed solution and involves additional commissions and the potential for reduced overall profit.

Recognizing Opportunities

Market corrections can present opportunities to acquire quality stocks at discounted prices. If your puts are assigned, view it as an opportunity to enter a long position at a price you had pre-determined acceptable. You can then continue the Wheel strategy by selling covered calls against your newly acquired shares.

Managing Emotions

Fear and greed are often amplified during market corrections. It's essential to stick to your trading plan and avoid making impulsive decisions. Fear can lead to premature exits, while greed can result in taking on excessive risk. Maintaining a disciplined approach is crucial for navigating these turbulent times.

Key Takeaways

- Increased IV: Take advantage of higher premiums, but manage assignment risk.

- Strike Selection: Prioritize further OTM strikes for a larger buffer.

- Diversification: Spread your capital across multiple uncorrelated assets.

- Monitoring: Continuously monitor positions and adjust strategy as needed.

- Rolling Options: Use rolling strategies to manage risk and potentially enhance profits.

- Disciplined Approach: Stick to your trading plan and avoid emotional decisions.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Investments are subject to risk, and you should consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Comments ()