Unlocking Nvidia's Potential: Selling Options and Wheel Strategy for NVDA

Unlock Nvidia's potential with wheel options. Explore NVDA's strengths, risks, and advanced wheel strategies for seasoned traders. #options #NVDA

Nvidia's (meteoric rise has captivated investors, but what if you could generate consistent income from its price swings, regardless of direction? The wheel options strategy, a powerful combination of selling options, cash-secured puts, and covered calls, offers a compelling approach for seasoned traders. Lets assess NVDA from the lens of options selling.

Understanding NVDA's Volatility: A Double-Edged Sword

NVDA's stock price is notoriously volatile, offering both opportunities and risks for options traders. As Charlie Munger wisely said,

Understanding this volatility is crucial for successful wheeling. High volatility generally translates to higher option premiums, a key ingredient in the wheel strategy. However, rapid price swings can also lead to unexpected assignment, requiring careful risk management.

Evaluating NVDA for the Wheel: Strengths and Weaknesses

Strengths:

- High Liquidity: NVDA options enjoy exceptional liquidity, making it easier to enter and exit positions with minimal slippage.

- Volatility Premium: NVDA's inherent volatility translates to higher premiums for options sellers, enhancing potential income generation.

- Strong Growth Potential: While not a guarantee, NVDA's history of growth and innovation offers a bullish backdrop for covered call writing.

Weaknesses:

- Price Fluctuations: Sudden and significant price drops can lead to assignment on cash-secured puts, requiring a larger capital outlay.

- Market Sentiment Shifts: Negative news or sector-wide downturns can quickly erode NVDA's price, impacting the profitability of covered calls.

Crafting Your NVDA Wheel Strategy: A Tactical Approach

When wheeling NVDA, it's crucial to tailor your strategy to your risk tolerance and market outlook. Consider the following:

- Put Selection: Select strike prices for your cash-secured puts that align with your acceptable entry point for NVDA shares. Factor in potential price drops based on historical volatility and market analysis.

- Covered Call Strike Prices: For covered calls, choose strike prices that provide a desirable balance between income generation and potential upside. If you're bullish, choose higher strike prices to maximize profit if the price continues to rise.

- Position Sizing: Don't overextend yourself. Size your positions based on your capital and risk tolerance. Avoid allocating too much capital to a single underlying asset.

- Continuous Monitoring: Actively manage your NVDA wheel positions. Adjust strike prices and expiration dates as needed to adapt to changing market conditions.

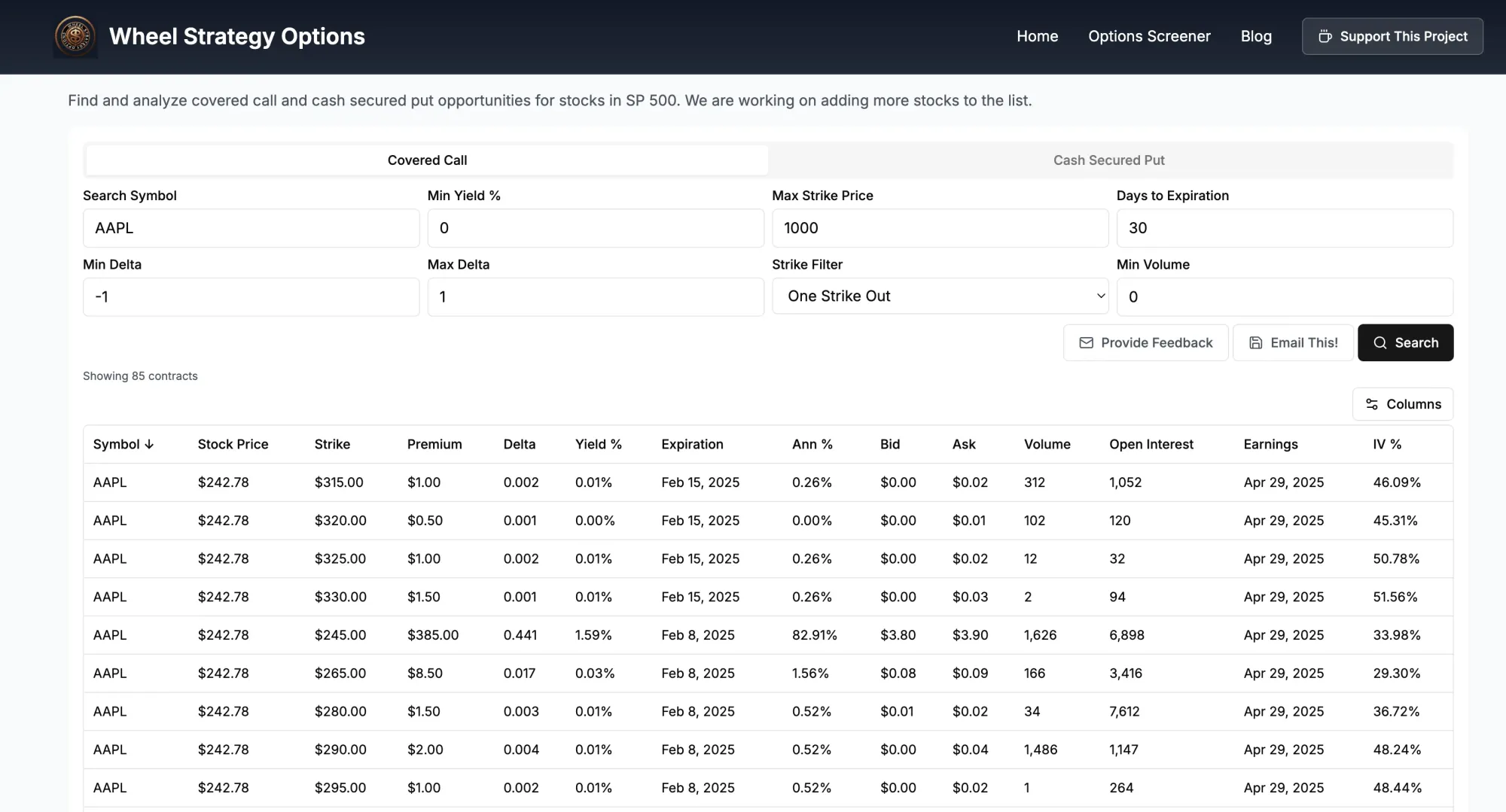

Enhance your wheel strategy analysis by using our wheel strategy screener. It can help you identify optimal options contracts for your desired risk/reward profile.

Navigating Potential Risks: Prudent Risk Management

While the wheel offers attractive income potential, it's essential to acknowledge and manage risks effectively. NVDA's inherent volatility can exacerbate these risks. Thoroughly research NVDA's financials, competitive landscape, and industry trends to make informed decisions.

Key Takeaways

- NVDA's volatility offers high option premiums but also necessitates careful risk management.

- Tailor your wheel strategy to your risk tolerance, factoring in NVDA's price fluctuations.

- Continuous monitoring and adjustments are crucial for successful NVDA wheeling.

- Utilize the wheel strategy screener to optimize your options selections.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()