Unlock Consistent Income: Master Covered Calls with this FREE Simple Calculator

Generate consistent income by selling covered calls. Use our calculator to simplify strategy & understand risks. #coveredcalls #options

In today's market, where volatility dances like a caffeinated kangaroo, generating consistent portfolio income is more crucial than ever. With the average dividend yield of the S&P 500 hovering around a mere 1.5%, sophisticated traders are increasingly turning to strategic options plays to enhance returns. Let's explore how covered calls can be your secret weapon for predictable cash flow, and how our intuitive calculator can make it ridiculously easy.

Covered Calls: Your Portfolio's Personal ATM?

Alright, seasoned traders, let’s cut to the chase. You're holding stocks – hopefully good ones, not just that meme stock your cousin told you about at Thanksgiving. Covered calls are like renting out your shares for a bit of extra income. You're essentially selling options against stock you already own, agreeing to sell those shares at a specific price (the strike price) if the option buyer decides to exercise their right. For this "agreement," you get paid a premium upfront. Think of it as collecting rent on your assets – except instead of tenants, you have option buyers, and instead of rent, you get option premiums. Fancy, right?

Meet Your New Best Friend: The Covered Call Calculator

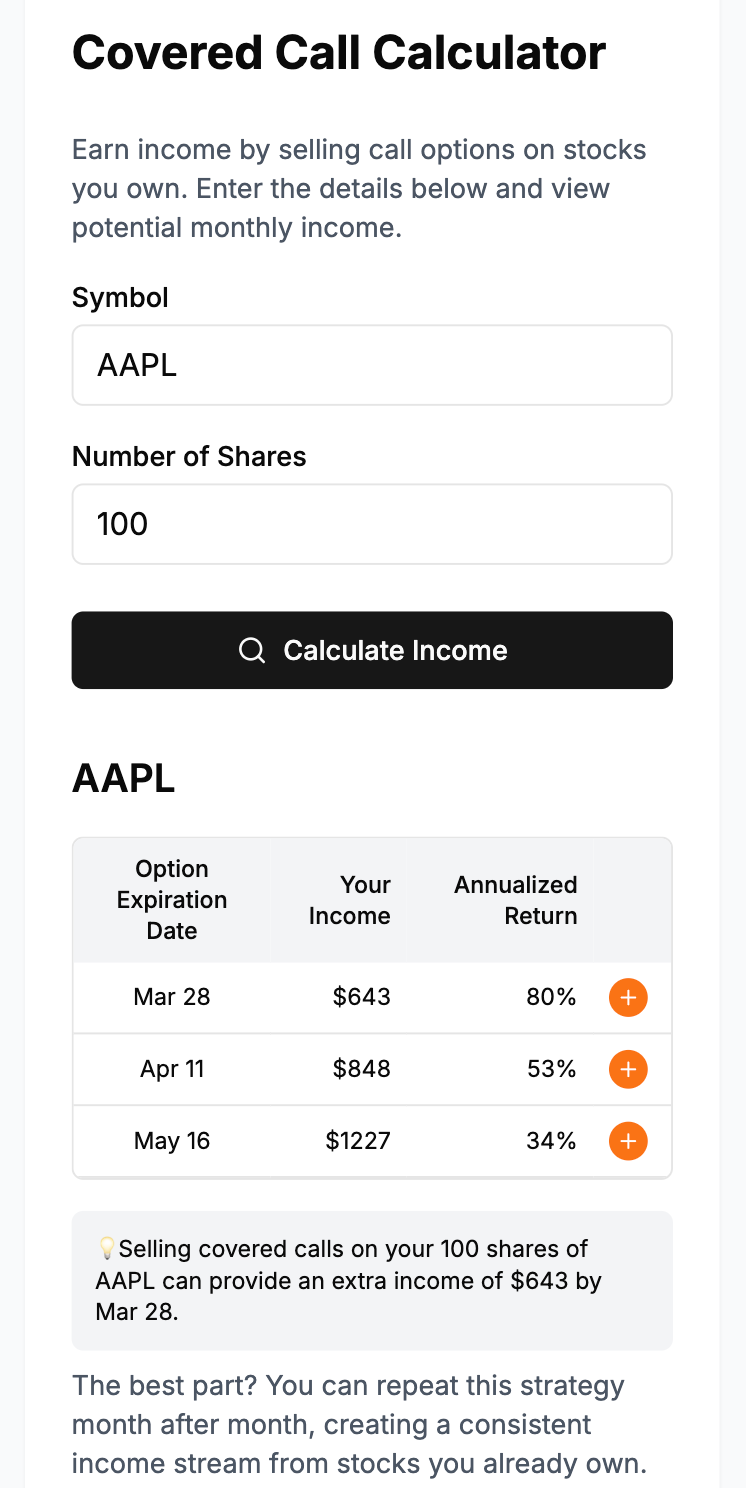

Now, you might be thinking, "Options strategies? Sounds complicated. Spreadsheets? Ugh." Fear not, my friend! We’ve built a covered call calculator so simple, it’s practically foolproof. Seriously, if you can order a pizza online, you can use this thing. Head over to our covered call calculator – go ahead, open it in a new tab, we'll wait. See? Clean, straightforward. No Ph.D. in astrophysics required.

How to Use the Calculator (Without Breaking a Sweat)

- Enter Your Stock Details: Pop in the ticker symbol of the stock you own (or are thinking of owning for this strategy). Let’s say, for example, "XYZ Corp". Don't worry, we're not judging your stock picks… much. Also, enter the number of stocks you own.

- Hit Calculate Income: Yeah, that's it!

- Calculate and Behold! Hit that "Calculate" button and BAM! The calculator spits out the potential premium you could earn and the annualized yield (because who doesn't love annualized yields?)

Beyond the Buttons: Real-World Covered Call Considerations

Calculators are cool, but they're not crystal balls. Executing covered calls effectively requires a bit more brainpower than just punching in numbers. Let's dive into the nitty-gritty.

Stock Selection: Not All Stocks Are Created Equal

Just like you wouldn't rent out a dilapidated shack for premium prices, you shouldn't slap covered calls on just any stock. Ideal candidates for selling covered calls are generally:

- Stable or Slowly Growing: You want stocks that aren’t going to moonshot overnight, leaving you regretting capping your upside. Think solid, established companies – "ABC Trading Group" type of vibes, not fly-by-night startups.

- Volatile Enough for Decent Premiums: Low volatility means low premiums. You need a stock with enough price movement to make the option premiums worthwhile, but not so volatile that you're constantly worried about huge price swings against you. It's a Goldilocks situation.

- Stocks You Don't Mind Selling (Eventually): Remember, you might have to part with your shares if the option is exercised. Don't use covered calls on your "forever stocks" unless you're truly okay selling them at the strike price.

Strike Price Selection: The Art of the "Just Right"

Choosing the strike price is like choosing the spice level for your dish – too mild, and it's bland; too spicy, and it's painful. Here’s a quick rundown:

| Strike Price | Potential Premium | Probability of Assignment | Upside Potential |

|---|---|---|---|

| In-the-Money (Below Current Price) | Highest | Highest | Lowest (Limited to Premium) |

| At-the-Money (Around Current Price) | Medium | Medium | Medium |

| Out-of-the-Money (Above Current Price) | Lowest | Lowest | Highest (Up to Strike Price) |

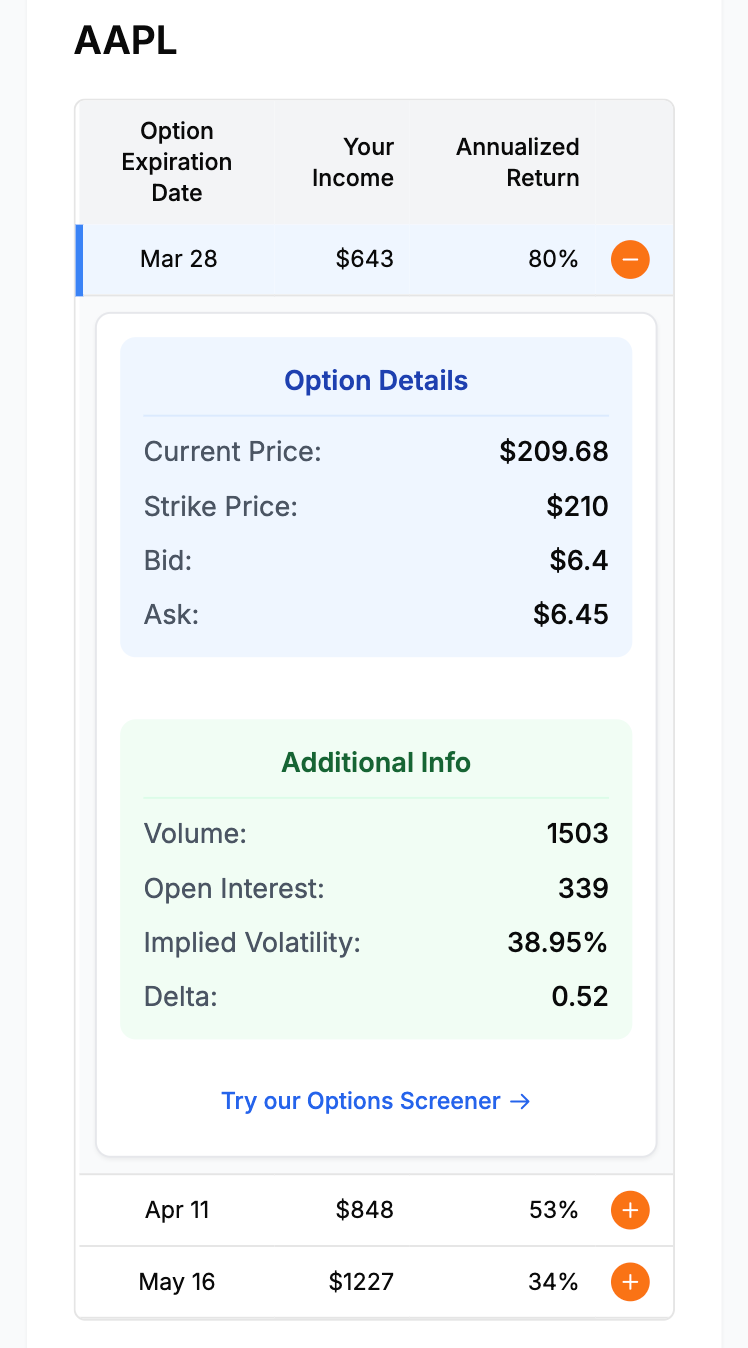

Pro-Tip: Use the calculator to see how different strike prices impact your potential return and probabilities. Experiment and find your sweet spot!

Expiration Dates: Time is Money (Literally)

Shorter expiration dates mean faster premium collection, but also more frequent management. Longer expiration dates give you less frequent income but more time for the stock to move. Consider your trading style and how actively you want to manage your covered call positions.

Risk Management: Don't Be a Cowboy

Covered calls are generally considered a lower-risk options strategy (compared to, say, naked puts or longing volatile meme stocks). However, risks still exist:

- Downside Risk: If the stock price tanks, you still own the stock and it loses value. The premium you collected offers some downside protection, but it's not a magic shield.

Opportunity Cost: If the stock price skyrockets past your strike price, you miss out on the additional gains beyond the strike. As Warren Buffett famously said,

“Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”- Warren Buffett

In covered calls, sometimes you’re stuck with a thimble when it's raining gold.

Market Conditions: Know the Weather

Covered calls tend to perform best in neutral to slightly bullish markets. In strongly bullish markets, you might miss out on upside. In strongly bearish markets, the downside risk becomes more pronounced. As Nassim Nicholas Taleb wisely notes,

“Missing a train is only painful if you run after it! Similarly, not matching the market beaters is only painful if you try to.”- Nassim Nicholas Taleb

Sometimes, in a raging bull market, just owning the stock outright might be simpler and more rewarding than capping your upside with covered calls. Know your market environment.

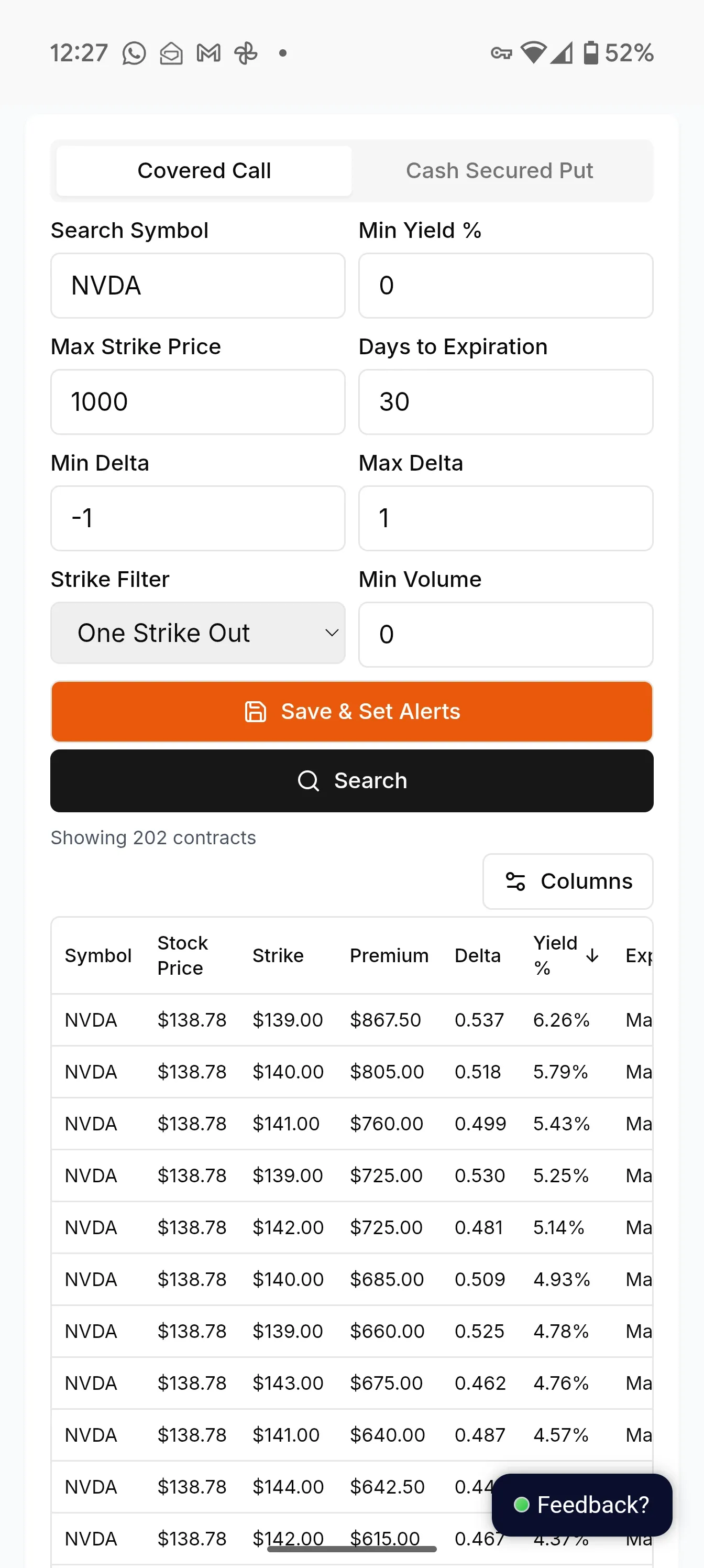

Ready to put this into practice? Head over to our wheel strategy screener to find stocks that might be prime candidates for the wheel options strategy, including selling covered calls and cash secured puts. And while you're at it, why not subscribe to our newsletter below for more insights, tips, and maybe even a stock pick or two? We promise not to spam you… too much.

Key Takeaways: Covered Calls in a Nutshell

- Covered calls are a strategy to generate income on stocks you own by selling call options.

- Our covered call calculator makes it easy to evaluate potential trades.

- Stock selection, strike price, and expiration date are crucial considerations.

- Manage risk and be aware of opportunity cost and downside risk.

- Market conditions influence the effectiveness of covered calls.

- Use our wheel strategy screener to find potential opportunities.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()