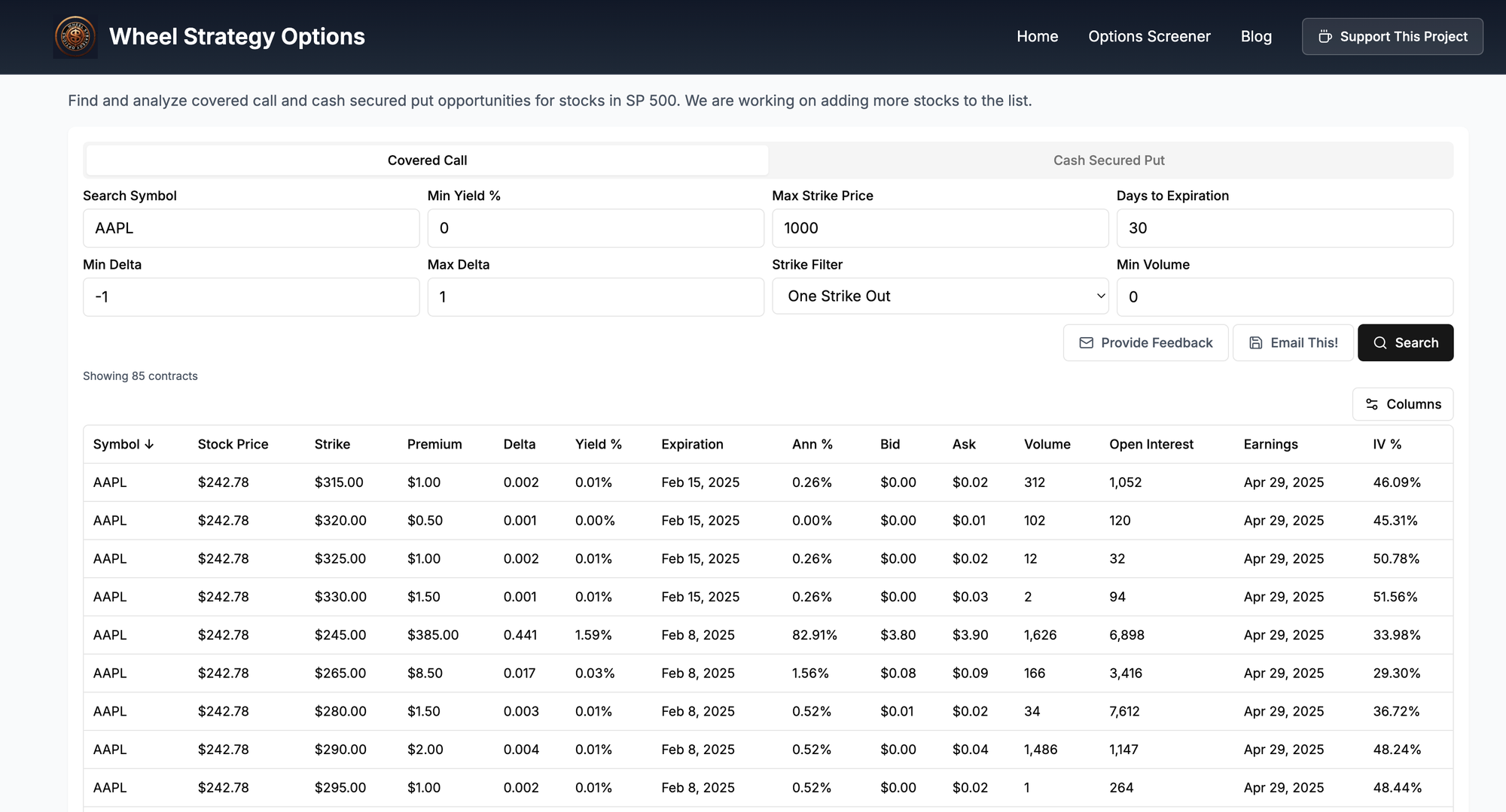

The Ultimate Guide to Using a Wheel Strategy Options Screener

If you're trading the Wheel Strategy, an options screener can be a game-changer in optimizing your trades. Whether you're selling covered calls or cash-secured puts, the right filters help you find high-probability trades that maximize premiums while managing risk. In this guide, we'll break down the key components of a Wheel Strategy Options Screener, explain how to use each filter effectively, and show you how our powerful tool at WheelStrategyOptions.com can help you boost returns and automate trade selection.

What is the Wheel Strategy?

The Wheel Strategy is a systematic options trading method that involves:

- Selling cash-secured puts on a stock you wouldn’t mind owning.

- If assigned, holding the stock and selling covered calls to generate income.

- If called away, repeating the process to create a continuous income cycle.

This strategy works best with liquid stocks and options that offer high premiums and good trading volume. To filter through thousands of options contracts efficiently, traders rely on an options screener to find the best trades.

Understanding the Wheel Strategy Options Screener

With WheelStrategyOptions.com, we provide a custom-built screener to help traders execute the Wheel Strategy with precision. Our screener includes two core functionalities:

1. Covered Call Screener

This tool helps you find the best covered call opportunities by identifying stocks you own (or want to own) with profitable call option premiums. You can fine-tune your search using various filters.

2. Cash-Secured Put Screener

This tab will help traders find high-probability put-selling opportunities, filtering for stocks with strong premiums and manageable risk.

Breakdown of Filtering Options in the Screener

To make the most of the screener, let’s analyze each filter and its purpose:

1. Search Symbol

- Enter a specific stock ticker (e.g., CLSK) to filter trades only for that stock.

- Helps if you have a stock in mind and want to evaluate its option chain.

2. Min Yield %

- Defines the minimum return you want from selling an option, based on the premium received vs. stock price.

- Example: A 2% minimum yield filter will exclude low-premium trades.

- Higher values target higher return trades, but with potentially greater risk.

3. Max Strike Price

- Limits the highest strike price you’re willing to consider for your options trade.

- Helps avoid deep out-of-the-money calls with low premiums.

- Example: Setting this to $1000 ensures you don’t screen calls too far from the current price.

4. Days to Expiration

- Filters options by their expiration date (e.g., 30 days from today).

- Shorter expirations provide faster premium collection and more frequent trade opportunities.

- Longer expirations may offer higher premiums but less flexibility.

5. Min Delta / Max Delta

- Delta measures how much an option price moves relative to stock price changes (ranges from -1 to 1).

- For covered calls:

- A lower delta (0.2-0.4) finds options that generate premium but have a lower chance of assignment.

- A higher delta (0.6-0.8) increases the likelihood of stock assignment but offers larger premiums.

- For cash-secured puts:

- Negative delta values reflect put options with different probabilities of assignment.

- Our screener allows full customization with Min Delta: -1, Max Delta: 1, ensuring you can find both aggressive & conservative trades.

6. Strike Filter

- This setting allows you to filter how far the strike price is from the current stock price.

- Example: One Strike Out focuses on calls or puts that are just one level above/below the current price.

- Useful for balancing premium collection vs. probability of assignment.

7. Min Volume

- Ensures that screened options have sufficient liquidity.

- Setting this to 0 (default) includes all options, but filtering for higher volume can help reduce slippage.

- Example: A minimum volume of 500 contracts ensures options have tight bid-ask spreads and active trading.

Why Our Screener is Essential for Wheel Strategy Traders

If you’re serious about running the Wheel Strategy, an optimized screener is essential. Here’s why traders choose WheelStrategyOptions.com:

- Customizable Filters: Fine-tune your search to match your risk-reward preferences.

- Automated Trade Selection: Save time by instantly filtering thousands of options contracts.

- Data-Driven Insights: Find the best trades based on real-time volume, delta, and premium yield.

- Better Risk Management: Identify trades that balance profitability with assignment risk.

Final Thoughts

The Wheel Strategy is one of the most powerful options trading methods for consistent income, but success depends on picking the right trades. Our Wheel Strategy Options Screener at WheelStrategyOptions.com gives you the tools needed to find the best covered calls & cash-secured puts with minimal effort. Start optimizing your strategy today and turn your options trading into a profitable, repeatable system!

Disclaimer

The Wheel Strategy Options Screener provided on WheelStrategyOptions.com is for informational and educational purposes only. It is not financial advice and should not be considered as such. The use of this tool and any information derived from it is at your own risk.

Options trading involves substantial risk and is not suitable for every investor. There is no guarantee of profitability or protection against losses. You should carefully consider your investment objectives, risk tolerance, and financial situation before engaging in options trading.

We do not provide personalized investment advice or recommend specific securities or strategies. Always consult with a qualified financial advisor or conduct your own independent research before making any investment decisions.

By using this tool, you acknowledge and agree that WheelStrategyOptions.com and its affiliates are not responsible for any losses incurred as a result of using this screener.

Ready to find your next winning trade? Try the Wheel Strategy Options Screener NOW!

Want to stay ahead? Subscribe to our newsletter for weekly insights on the best Wheel Strategy trades!

Related Reads:

Follow us on:

Comments ()