Wheel Strategy Screeners for Directional Edge On Options Trading

Introduction

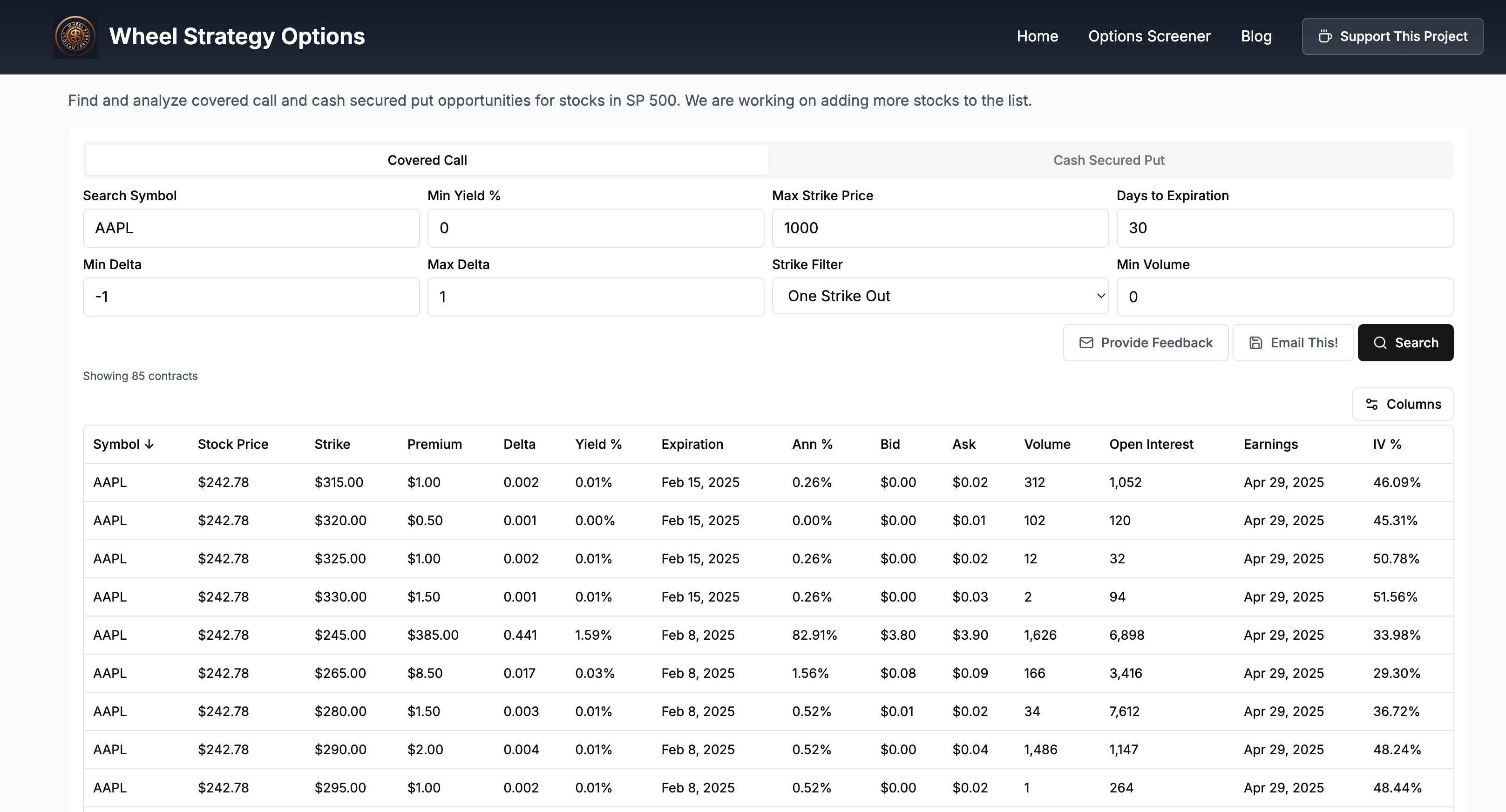

The Wheel Options Strategy, while powerful, requires careful execution. This article dives deep into how screeners can be leveraged to maximize returns when you anticipate a specific market direction—up or down. To follow along, we highly recommend opening our wheel strategy screener in another tab by clicking here.

Screeners for Bullish Wheel Setups

Underlying Asset Selection

When bullish, target assets showing strong upward momentum but with a hint of potential consolidation or pullback. This allows you to collect premium on puts while expecting the price to stay above your strike, eventually letting the put expire worthless. Look for stocks with:

- Positive recent earnings reports

- Analyst upgrades

- Relative strength against the broader market

Example: Imagine company FGH showing a steady uptrend. Use a screener to find puts with a strike price slightly below the current market price, offering a good premium but with a delta of around -0.30 to -0.40. This balances premium with the risk of assignment.

Optimizing Put Premium

Screen for puts with:

- High implied volatility (IV): Elevated IV suggests higher premiums. Screeners can filter by IV rank or percentile.

- Optimal Days to Expiration (DTE): Balance time decay with the probability of profit. Look for 30-45 DTE for a sweet spot.

Example: If FGH is at $100, a screener might highlight a 30-DTE put at $95 with an IV rank of 70 and a premium of $2. This presents a potential 2% return on capital in 30 days if FGH stays above $95.

Screeners for Bearish Wheel Setups

Identifying Downward Momentum

For bearish scenarios, target assets exhibiting weakness or topping patterns. The goal is to sell covered calls on assets expected to decline, collecting premium as the calls expire worthless. Look for stocks with:

- Negative earnings surprises

- Analyst downgrades

- Breaking down below key support levels

Example: Company ABC is showing signs of weakness. Screen for calls with a strike price slightly above the current market price. This lets you collect premium while anticipating a price drop below your strike.

Maximizing Call Premium

Similar to the bullish scenario, high IV and optimal DTE are key:

- High IV Rank: Look for calls on ABC with high IV rank, indicating inflated premiums.

- Suitable DTE: Aim for 30-45 DTE to capitalize on time decay.

Example: If ABC is at $50, a screener might show a 30-DTE call at $55 with a high IV rank and a $1 premium. This provides a potential 2% return (on the capital required to own 100 shares) in 30 days if ABC stays below $55.

Risk Management

Screeners can't predict the future. Implement risk management strategies:

- Position Sizing: Never allocate too much capital to a single trade.

- Stop-Loss Orders: Consider using stop-loss orders to limit potential losses on the underlying asset if assigned.

- Rolling: Use screeners to identify opportunities to roll positions if the price moves against you.

Conclusion

Screeners are invaluable tools for maximizing returns with the Wheel Strategy. By targeting specific criteria based on market direction, traders can identify high-probability setups with favorable premiums. Combining screener insights with sound risk management principles is crucial for long-term success.

Follow us on:

Disclaimer: This article is for informational purposes only and not financial advice. Investments are subject to risk and should be carefully analyzed before making any decisions.

Comments ()