Strategic Stock Selection in 2025 For Enhanced Returns in Options Selling

Unlock higher options selling returns with strategic stock selection. Master fundamentals, volatility, & risk alignment for wheel strategy success.

While the allure of consistent income from selling options is undeniable, particularly through strategies like the wheel, veteran traders understand that the true edge lies not just in the strategy itself, but in the meticulous selection of underlying assets. This article delves into the critical concepts for strategically selecting stocks best suited for maximizing returns while mitigating risks when selling options, especially within the context of wheel options and related income-generating techniques. The article is structured to systematically unpack these five concepts for ampliying your stock selection game:

- Fundamentals First

- Volatility Balance

- Know Your Style

- Diversify Wisely

- Utilize Tools

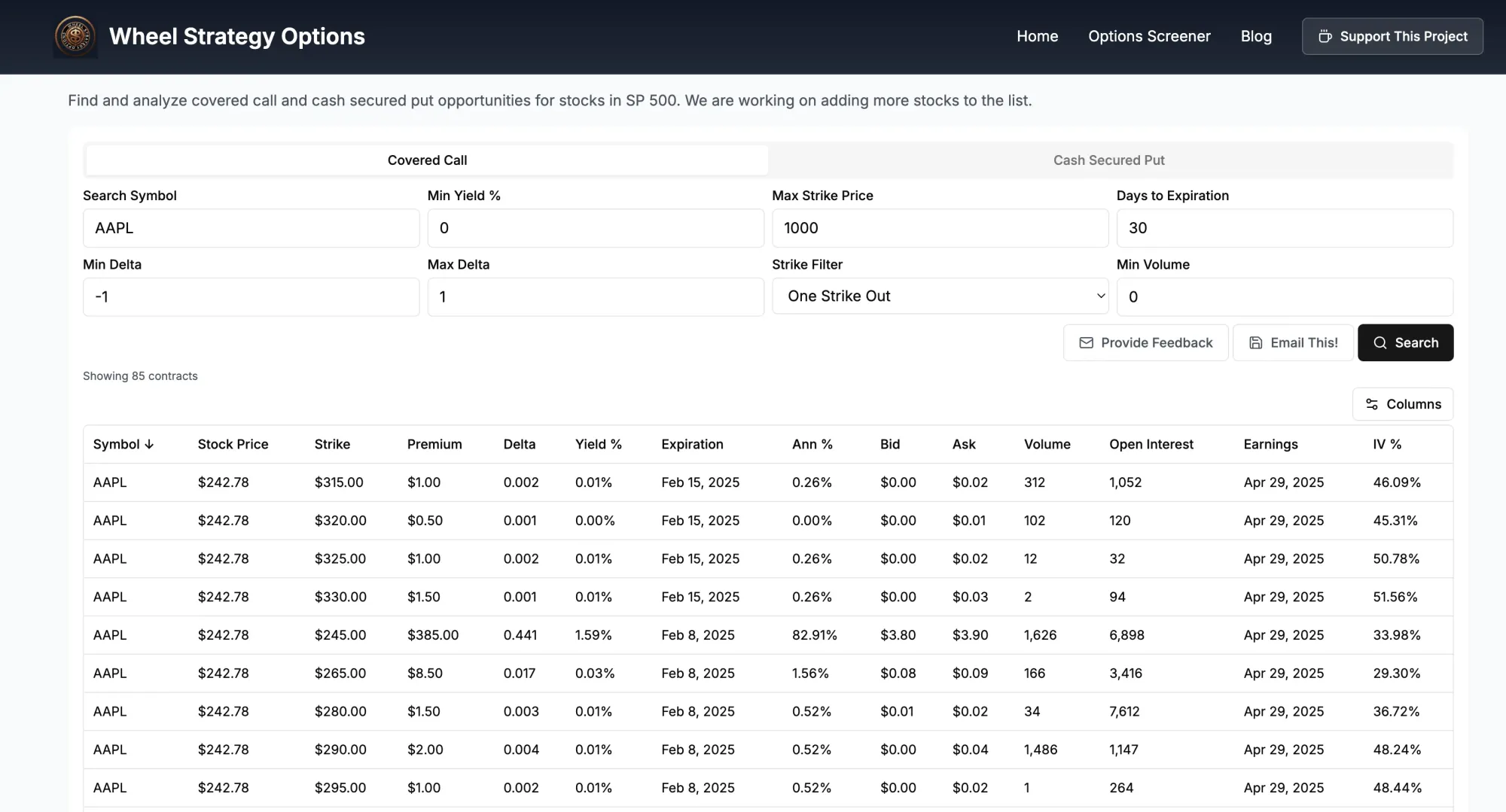

But remember, this is just one of the many key pieces we publish on selling options and wheel strategy. So please consider signing up for updates. We also would love for you to try our Wheel Options screener here to combine the strategy below with finding right trade opportunities.

Lets dive right in.

Beyond the Basics: Fundamental Pillars for Options Selling

Experienced options traders know that successful selling options, especially through strategies like the wheel, begins with a foundation of sound fundamental analysis. Choosing the right stock isn't just about finding a ticker; it's about identifying robust businesses you'd be comfortable owning, even if assignment occurs. As Benjamin Graham, the father of value investing, wisely stated:

“Buy not on optimism, but on arithmetic.”Benjamin Graham

This 'arithmetic' translates to a deep dive into company financials, profitability, and long-term viability.

Key Fundamental Factors to Evaluate:

- Financial Health and Profitability: Scrutinize financial statements for consistent revenue growth, healthy profit margins, and a strong balance sheet. Look for companies with manageable debt levels and robust cash flow generation. These metrics indicate the company's ability to weather economic downturns and sustain its stock price.

- Management Quality and Corporate Governance: Assess the quality and experience of the management team. Are they shareholder-friendly? Do they have a proven track record of strategic decision-making and value creation? Strong corporate governance practices are also crucial, ensuring transparency and accountability.

- Growth Prospects and Future Outlook: While past performance is important, consider the company's future growth prospects. Is it operating in a growing market? Does it have innovative products or services that are likely to drive future revenue and earnings growth? Understanding the long-term trajectory of the business is vital when considering holding the stock, potentially through assignment in a wheel options strategy.

Industry Leadership and Competitive Advantage: Investigate the company's position within its industry. Does it possess a sustainable competitive advantage – a "moat," as Warren Buffett describes it? This could be in the form of brand recognition, proprietary technology, or economies of scale. Companies with strong moats are better positioned to maintain market share and profitability over the long term.

"The key to investing is determining the competitive advantage of the business."Warren Buffett

For example, consider "XYZ Corp," a hypothetical leader in the cybersecurity industry. Before initiating a cash secured put strategy on XYZ Corp, a diligent trader would examine its consistently growing revenue, high recurring revenue from subscriptions, strong balance sheet with minimal debt, and the expanding cybersecurity market driven by increasing digital threats. These fundamental strengths make XYZ Corp a potentially suitable candidate for selling options.

Volatility and Price Action: Navigating the Options Terrain

Beyond fundamentals, understanding a stock's price behavior and volatility characteristics is paramount for optimizing option premiums and managing risk. The ideal stock for selling options exhibits a balance – enough volatility to generate attractive premiums, but not so erratic that it leads to unpredictable assignments or excessive stress. As the renowned investor Peter Lynch noted:

“Know what you own, and know why you own it.”Peter Lynch

In the context of options selling, "knowing what you own" extends to understanding how the stock price typically moves and reacts to market events.

Key Price & Volatility Considerations:

- Implied Volatility (IV) Levels: Seek stocks with reasonably elevated IV, as higher IV translates to richer option premiums. However, be wary of excessively high IV, which might signal heightened risk or upcoming significant events (like earnings announcements) that could trigger sharp price movements. Compare the stock's current IV to its historical IV range to gauge if it's relatively high or low.

- Historical Volatility (HV) and Price Range: Analyze the stock's historical price volatility. Does it typically trade within a predictable range, or is it prone to wild swings? Stocks with a history of range-bound trading can be advantageous for wheel strategies, increasing the probability of collecting premium without assignment. Reviewing a stock's historical volatility can be insightful, but remember, past performance is not necessarily indicative of future results.

- Liquidity of Options Chain: Ensure the stock has a liquid options market with tight bid-ask spreads and sufficient open interest across various strike prices and expiration dates. Liquidity is crucial for efficient order execution and minimizing slippage, especially when managing positions or rolling options.

- Correlation with Market Indices and Sectors: Understand how the stock typically correlates with broader market indices (like the S&P 500) and its sector. Stocks highly correlated with the market may experience broader swings during market volatility, while those with lower correlation might offer more stability, depending on market conditions.

Imagine "ABC Trading Group," a hypothetical mid-cap stock in the consumer staples sector. While its fundamental growth might be moderate, ABC Trading Group has historically exhibited consistent, range-bound price action with a predictable level of implied volatility. This makes it potentially attractive for selling covered calls or cash secured puts, as the predictable price movement increases the likelihood of profiting from time decay and volatility contraction, while the moderate volatility offers reasonable premium. Conversely, a highly volatile tech stock, even with strong fundamentals, might be less suitable for beginners in wheel strategies due to the increased risk of unexpected price surges or drops leading to premature assignment or losses.

Personalizing Your Stock Selection: Strategy and Risk Tolerance Alignment

Ultimately, the "best" stock for selling options is subjective and deeply intertwined with your personal trading strategy, risk tolerance, and financial goals. A highly aggressive trader seeking maximum premium might gravitate towards higher volatility stocks, accepting a greater risk of assignment. Conversely, a more conservative trader prioritizing capital preservation might prefer fundamentally robust, lower volatility stocks, even if the premium is less enticing. As Naval Ravikant wisely says:

“Risk is what's left over when you think you've thought of everything.”Naval Ravikant

Therefore, a comprehensive stock selection process includes an honest assessment of your own trading style and risk appetite.

Strategy & Risk Tolerance Alignment Checklist:

- Define Your Income Goals: Are you aiming for consistent, smaller premiums, or are you comfortable with potentially larger but less frequent payouts? Higher premium strategies often come with higher risk. Align your stock selection with your desired income stream.

- Assess Your Risk Tolerance: How comfortable are you with the possibility of stock assignment? Can you emotionally and financially handle potential drawdowns if the stock price moves against you? Choose stocks and strike prices that match your risk comfort level. If you are risk-averse, prioritize fundamentally strong companies you genuinely want to own at a good price.

- Time Horizon and Capital Commitment: How long are you willing to hold a position, and how much capital are you allocating to each trade? The wheel strategy, for instance, is a longer-term, capital-intensive approach. Select stocks and position sizes that align with your investment timeframe and capital availability.

- Diversification Considerations: Avoid over-concentration in a single stock or sector, even if it appears ideal for options selling. Diversification across different stocks and sectors is crucial for managing portfolio risk and mitigating the impact of adverse events affecting a specific company or industry.

For example, a retiree seeking stable income might prioritize dividend-paying, blue-chip stocks with moderate volatility for their covered call strategy. They may be willing to accept a lower premium for the peace of mind that comes with owning fundamentally sound, less volatile assets. Conversely, a younger, more aggressive trader might allocate a smaller portion of their portfolio to higher-growth, higher-volatility stocks, employing cash secured puts with the aim of capturing larger premiums and potentially owning these growth companies at a discount if assigned.

Conclusion: The Art and Science of Stock Selection for Options Income

Strategic stock selection for selling options is a blend of art and science. It requires diligent fundamental analysis, a nuanced understanding of price behavior and volatility, and a clear alignment with your personal trading style and risk tolerance. By moving beyond simply chasing high premiums and focusing on the underlying quality and characteristics of potential stocks, experienced traders can significantly enhance the probability of success and build a more robust and sustainable options income strategy.

To further refine your stock selection process, consider leveraging tools like the wheel strategy screener, which can help you filter and identify stocks that meet specific fundamental and volatility criteria, saving you valuable research time and improving your overall options trading outcomes.

Key Takeaways:

- Fundamentals First: Prioritize fundamentally sound companies you wouldn't mind owning long-term.

- Volatility Balance: Seek stocks with reasonable volatility – enough for premium, but not excessive risk.

- Know Your Style: Align stock selection with your personal risk tolerance and income goals.

- Diversify Wisely: Avoid over-concentration; diversify across stocks and sectors.

- Utilize Tools: Leverage screeners to efficiently identify suitable options selling candidates.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()