Strategic Early Exits: Maximizing CSP Profits with the 50% Rule in Wheel Options Trading

Options premiums, particularly for short-dated contracts, often experience their most significant decay in the final third of their lifespan. However, astute traders understand that capturing the majority of this decay early can dramatically enhance profitability and capital efficiency within strategies like the wheel options approach.

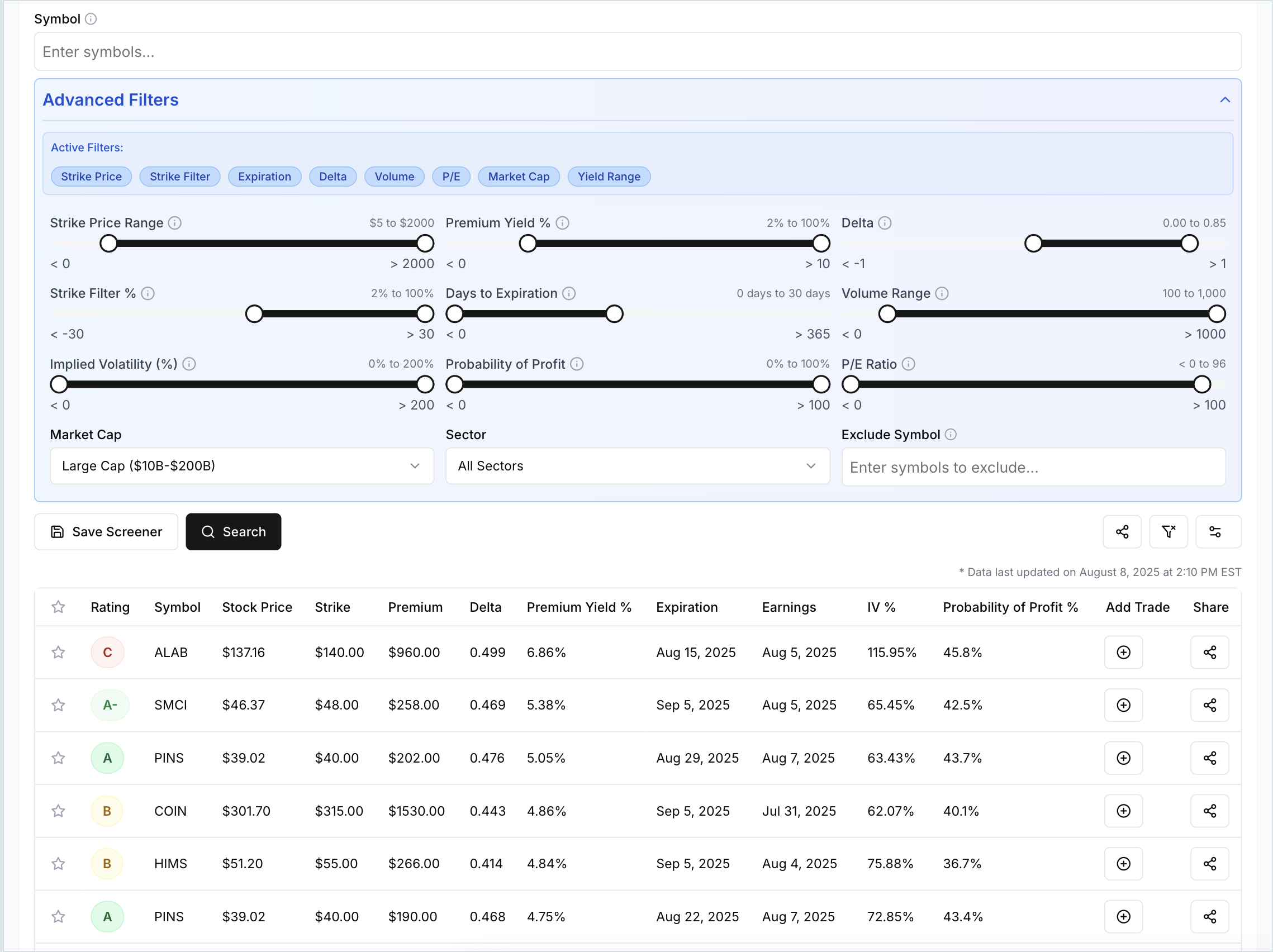

We highly recommend trying our Wheel Options screener here to follow along better.

Decoding the 50% Rule: The Cornerstone of Optimal CSP Exits

The 50% Rule, a well-regarded heuristic among experienced selling options practitioners, posits that an options contract should generally be closed once 50% of the maximum potential profit has been realized. While seemingly straightforward, its application within cash-secured puts (CSPs) and subsequent covered calls in the wheel strategy is nuanced, aiming to balance profit capture with ongoing capital deployment efficiency and risk management.

This rule isn't about greed; it's about optimizing the trade-off between time decay and event risk. As an option approaches expiration, its time value erodes non-linearly, with the decay accelerating significantly closer to expiry. By closing a CSP at 50% profit, a trader effectively harvests the 'easy money' from initial time decay while minimizing exposure to tail risks, unexpected news, or adverse market movements that could erode remaining premium or lead to assignment.

The Mechanics of Premium Decay and Capital Velocity

Understanding the interplay of Theta (time decay) and Vega (volatility sensitivity) is crucial when applying the 50% Rule. Options premiums are composed of intrinsic value and extrinsic value. The extrinsic value, primarily time value and implied volatility, diminishes with each passing day. The rate of this decay (Theta) is not constant; it accelerates as the option approaches its expiration date. However, significant extrinsic value can still be held by longer-dated or higher-volatility options.

Consider the trade-off: capturing the remaining 50% of profit often requires holding the position for a disproportionately longer period, exposing capital to unnecessary risk. Instead, by closing early, that capital can be redeployed into a new trade, potentially compounding returns. This emphasis on 'capital velocity' is a hallmark of sophisticated options trading. As Charlie Munger wisely noted,

“The big money is not in the buying and selling, but in the waiting.”- Charlie Munger

While Munger often referred to long-term investing, his emphasis on intelligent inaction or opportune action equally applies to efficient capital deployment in options, where waiting for the last bit of premium can be counterproductive.

Why Early Exits Matter: Beyond Simple Profit-Taking

The benefits of early exits extend far beyond merely locking in gains:

- Enhanced Capital Efficiency: Redeploying capital allows for more trades over a given period, leading to potentially higher annualized returns. This is particularly critical in the wheel strategy, where the goal is consistent income generation.

- Reduced Exposure to Tail Risk: The longer an options contract is held, the greater the chance of an unforeseen event (earnings surprise, geopolitical news, sector-specific downturn) causing an adverse price movement. Exiting early mitigates this 'event risk.'

- Lower Delta Risk: As options approach expiration, their Delta can become more sensitive, especially for out-of-the-money options that move closer to the money. Early exits reduce this increasing directional risk.

- Opportunity Cost Mitigation: Holding a trade for the final few dollars of premium might prevent you from entering a superior, higher-probability trade that emerges.

- Psychological Advantage: Consistently taking smaller, frequent profits can build confidence and reinforce positive trading habits, avoiding the emotional rollercoaster of holding to expiry.

Practical Application: Implementing the 50% Rule with Cash Secured Puts

Let's illustrate with a scenario:

Scenario: XYZ Corp. Cash-Secured Put

Imagine you initiate a cash secured put on XYZ Corp. You believe XYZ Corp. is fundamentally sound and would be comfortable owning its shares at a lower price. Current share price: $105.

You sell 1 XYZ Corp. put option with a strike price of $100, expiring in 30 days, for a premium of $2.00 ($200 per contract). Your maximum potential profit is $200.

According to the 50% Rule, you would look to close this position when the premium decays to $1.00 ($100 per contract).

| Metric | At Trade Entry | After 10 Days (Target Exit) | At Expiration (Hypothetical) |

|---|---|---|---|

| XYZ Corp. Share Price | $105.00 | $104.50 (Stable) | $103.00 (Still above strike) |

| Put Strike Price | $100.00 | $100.00 | $100.00 |

| Days to Expiration (DTE) | 30 days | 20 days | 0 days |

| Premium Collected | $2.00 | N/A | N/A |

| Current Put Premium (to buy back) | N/A | $1.00 | $0.05 |

| Profit Realized | N/A | $1.00 (50% of max) | $1.95 (97.5% of max) |

| Capital Deployed | $10,000 | $10,000 (Released) | $10,000 (Released) |

In this example, after just 10 days, the premium for the $100 put might have decayed to $1.00 due to time erosion and stable price action. By buying back the put for $1.00, you realize a $1.00 profit per share ($100 per contract), which is exactly 50% of your maximum potential profit. You've held the trade for only one-third of its lifespan but captured half the premium. Your $10,000 in collateral is now free to be redeployed into a new cash secured put or another opportunity, significantly boosting your annual return potential compared to waiting the full 30 days for the final $1.00 of premium.

Advanced Considerations: Volatility, DTE, and Market Context

While the 50% Rule provides an excellent framework, it's not a rigid dogma. Experienced traders adapt it based on market conditions:

- Implied Volatility (IV): A sudden collapse in IV can cause premiums to drop quickly, reaching the 50% profit target much faster. Conversely, a spike in IV might delay the target or even put the trade underwater. Understanding Vega sensitivity is key.

- Days to Expiration (DTE): The rule is most effective for shorter-dated options (e.g., 30-60 DTE). For very short-dated options (e.g., 7 DTE), reaching 50% might happen within a day or two, making an early exit almost instantaneous. For longer-dated options, the 50% target might take longer to achieve.

- Market Sentiment and News Flow: In a highly uncertain or volatile market, taking profit early becomes even more critical to reduce exposure. If a major economic report or earnings announcement for XYZ Corp. is due, an early exit might be prudent, even if slightly below 50% profit, to avoid binary risk.

- Underlying Asset's Behavior: Some stocks are inherently more volatile than others. Adjusting the target slightly for highly volatile assets or extremely stable ones can be beneficial.

Integrating the 50% Rule into Your Overall Wheel Strategy

The 50% Rule is a powerful tool within the larger wheel strategy framework. When you consistently apply it to your cash secured puts:

- You cycle capital faster, potentially selling more puts in a year.

- If a put is assigned, you seamlessly transition to selling covered calls. The same principle of taking early profits (e.g., 50% of the premium collected) can also be applied to covered calls, though assignment risk management becomes a more prominent factor.

- It helps maintain a higher win rate, as you're not trying to extract every last penny, which often comes with disproportionately higher risk.

This systematic approach helps automate decision-making, reducing emotional biases. As Benjamin Graham advocated,

“The investor’s chief problem—and even his worst enemy—is likely to be himself.”- Benjamin Graham

The 50% Rule provides a clear, objective benchmark to counteract this self-sabotage by promoting disciplined profit-taking.

The Psychological Discipline of Early Exits

One of the biggest hurdles for traders is overcoming the desire to squeeze every last dollar out of a trade. This often leads to holding positions for too long, only to see profits diminish or even turn into losses. The 50% Rule instills a disciplined approach, promoting consistent, smaller wins over attempting to hit a home run every time. This aligns with the wisdom of Naval Ravikant, who suggests,

“Playing iterated games with other people where nobody gets too greedy is the only way to get rich.”- Naval Ravikant

In options trading, this translates to taking profits when they are readily available and redeploying capital strategically, rather than getting 'greedy' for the remaining premium.

For traders seeking to systematically identify high-probability options trades and manage their wheel strategy effectively, a robust tool is indispensable. The wheel strategy screener on wheelstrategyoptions.com can help you filter potential trades based on your specific criteria, helping you pinpoint optimal entry points for cash-secured puts and manage your portfolio with precision.

Key Takeaways for Optimal CSP Exits:

- The 50% Rule is a powerful heuristic for closing cash-secured puts once half of the maximum premium is realized.

- Early exits significantly boost capital efficiency and reduce exposure to unforeseen market events and tail risk.

- Premium decay (Theta) accelerates closer to expiration, making the initial phase of a trade the most efficient for profit capture.

- While a valuable guideline, the 50% Rule should be adapted based on implied volatility, days to expiration, and overall market context.

- Consistently applying this rule enhances discipline and contributes to higher annualized returns within the broader wheel strategy.

- Leverage tools like a dedicated wheel strategy screener to streamline your trade identification and management processes.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()