Optimizing Your Wheel Strategy: The Indispensable Role of a Dedicated Trade Tracker

In the complex realm of options trading, where precision can often dictate profitability, the sheer volume of trades executed daily has surged significantly. With average daily options volume often exceeding 40 million contracts, according to industry reports, intermediate to advanced traders employing strategies like the Wheel recognize the critical need for meticulous organization. However, many still grapple with the limitations of manual tracking, inadvertently leaving substantial edge on the table.

The Hidden Costs of Manual Tracking for the Wheel Strategist

For the disciplined trader running the Wheel strategy—an iterative process involving selling options, specifically initiating with cash secured puts, potentially taking assignment, and then writing covered calls—manual tracking quickly becomes a quagmire of inefficiencies. Spreadsheets, while offering a basic framework, inherently lack the dynamic capabilities required for sophisticated analysis.

Consider the time sink: manually logging every entry, exit, adjustment, expiration, and assignment for multiple underlying assets. This process is not only tedious but highly prone to error, particularly when managing a portfolio of 10 or more positions. A single miscalculation can skew performance metrics, leading to flawed decision-making. More critically, spreadsheets fail to provide real-time capital allocation insights, making it difficult to gauge true portfolio exposure or available capital for new opportunities without significant manual computation.

“You need to know your facts, and you need to get them straight.”- Charlie Munger

The absence of granular, automated performance insights is perhaps the most significant drawback. Without a dedicated system, it's challenging to accurately assess the true profitability of each Wheel cycle, identify which underlying assets consistently yield superior returns, or even determine the optimal strike prices and expiration dates for your particular approach. This lack of data prevents traders from objectively evaluating their edge, leading to a reliance on anecdotal experience rather than quantifiable results.

Beyond Spreadsheets: What a Dedicated Tracker Offers

A dedicated trade tracker transcends the capabilities of basic spreadsheets by offering automation, advanced analytics, and a consolidated view of your trading activity. It transforms raw trade data into actionable intelligence, empowering you to refine your wheel options strategy with unprecedented precision.

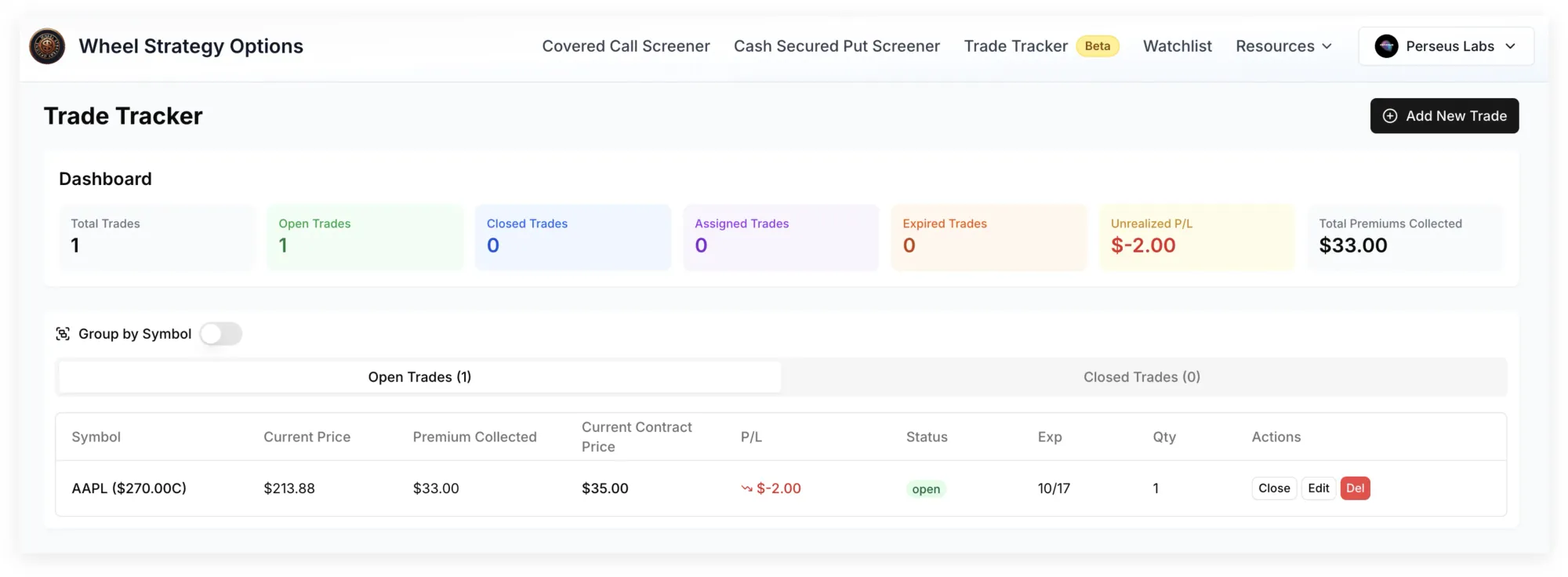

Granular Performance Metrics & Realized P&L

Imagine instantly knowing your real-time return on capital for each cash secured put, the actual annualized return on your assigned shares, or the precise income generated from your covered calls. A specialized tracker provides these metrics and more, calculating realized and unrealized profit & loss (P&L) at every stage of the Wheel. It compiles comprehensive statistics such as win rates, average profit per trade, average duration of trades, and even performance broken down by underlying asset or strategy subtype (e.g., short-term vs. long-term Wheels).

Here’s a comparative look at capabilities:

| Feature | Manual Spreadsheet | Dedicated Trade Tracker |

|---|---|---|

| Real-time P&L Calculation | ❌ Manual/Lagging | ✅ Automated/Dynamic |

| Capital Allocation Tracking | ❌ Error-prone | ✅ Precise/Visual |

| Wheel Cycle Tracking | ❌ Disjointed | ✅ Integrated/Seamless |

| Strategy Performance Breakdown | ❌ Requires extensive setup | ✅ Built-in Analytics |

| Tax Reporting Exports | ❌ Manual aggregation | ✅ Automated/Simplified |

Streamlined Workflow and Opportunity Identification

One of the most valuable aspects of a dedicated tracker is its ability to streamline the entire trading workflow. It automates the tracking of expiration dates, assignment statuses, and rolling opportunities. For instance, when a cash secured put is nearing expiration, the tracker can flag it, prompting you to decide whether to roll, let it expire, or prepare for assignment. Similarly, it can identify when shares are assigned and alert you to the optimal time to begin writing covered calls against them.

Consider a scenario with ABC Trading Group, where you've sold a put. As expiration approaches, the tracker not only highlights the expiry but, based on your established parameters, might suggest potential roll-down or roll-out options, saving valuable analysis time. If assigned, it automatically transitions the position, making it clear you now hold 100 shares and are ready to initiate the next leg of your wheel options strategy.

Risk Management & Position Sizing with Clarity

Effective risk management is paramount in options trading. A dedicated tracker provides an immediate and clear overview of your portfolio’s exposure to different underlying assets, sectors, and overall market movements. It can quantify your maximum potential loss on open positions, help you visualize your capital at risk, and ensure you adhere to your predetermined position sizing rules.

“Risk comes from not knowing what you're doing.”- Warren Buffett

By providing this transparent view, traders can avoid over-concentration in a single stock or sector, or inadvertently exposing too much capital to high-volatility plays. This holistic view is virtually impossible to maintain accurately and consistently with manual methods, especially in a dynamic market environment.

Elevating Your Decision-Making: A Data-Driven Edge

Moving from intuition to data-driven insights is the hallmark of professional trading. A robust tracker empowers you to analyze your trading history to identify repeatable patterns of success and failure. Which strike prices or expiration cycles consistently generate the best premium relative to risk? Which underlying assets frequently lead to profitable assignments and subsequent covered call income?

By answering these questions with hard data, you can refine your criteria for selecting new Wheel candidates, optimize your entry and exit points for selling options, and even adjust your rolling strategies. This iterative process of analysis and adjustment, powered by precise data, leads to a continuous improvement cycle in your trading performance.

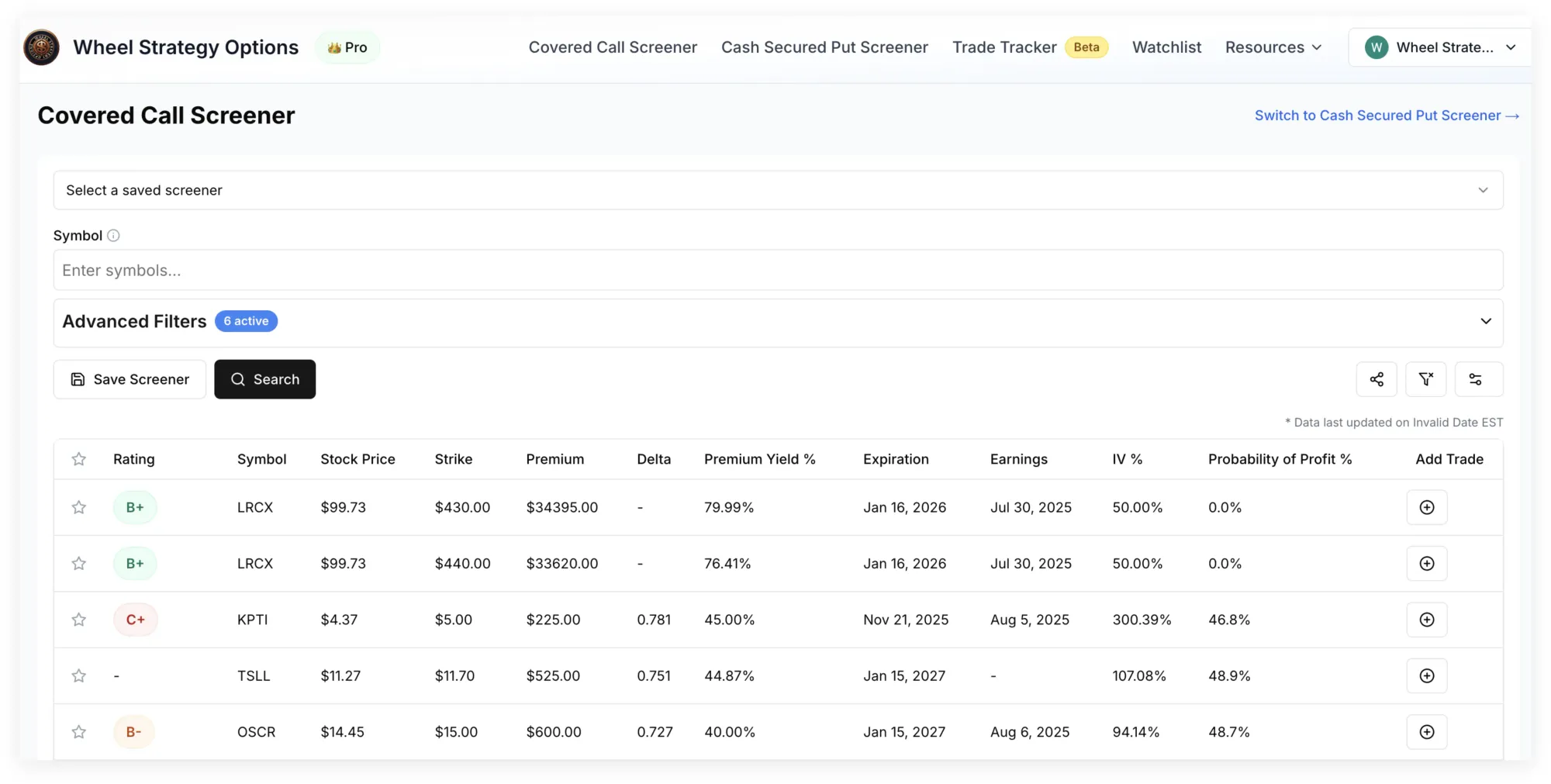

To identify the best opportunities for your next Wheel cycle, a powerful tool is indispensable. You can leverage the advanced capabilities of a wheel strategy screener to filter stocks that align with your risk profile and return objectives, integrating seamlessly with the insights gleaned from your trade tracker.

For example, if your tracker reveals that cash secured puts on technology stocks with implied volatility between 30% and 40% typically lead to profitable assignment followed by successful covered calls, you can use the screener to quickly identify new opportunities fitting these precise criteria. This synergy between tracking and screening creates a powerful feedback loop for optimization.

The Psychological Advantage of Precision

Trading is as much a psychological game as it is an analytical one. The mental burden of managing numerous positions, remembering every detail, and calculating P&L on the fly can lead to stress, fatigue, and ultimately, emotional decision-making. A dedicated tracker alleviates this burden significantly.

With clear, accurate, and easily accessible data, traders experience reduced anxiety and enhanced confidence. This clarity helps combat common biases like recency bias (overemphasizing recent good or bad trades) or confirmation bias (only seeing data that supports pre-existing beliefs). Instead, you’re presented with an objective reality of your performance, fostering discipline and rational thought.

“The first principle is that you must not fool yourself and you are the easiest person to fool.”- Richard Feynman

This psychological edge allows you to remain calm under pressure, stick to your trading plan, and make adjustments based on facts, not fear or greed. It’s an investment not just in your trading strategy, but in your overall mental well-being as a trader.

Implementing Your Tracker: Best Practices

Even with an advanced tracker, consistency is key. Ensure timely and accurate entry of trades if there's any manual component, or verify data if automated imports are used. Regularly review your performance reports—weekly or monthly—to identify trends, refine your underlying selection, and adjust your strike/expiration selection strategy. Use the insights to critically evaluate your rules for initiating cash secured puts and managing covered calls.

We highly recommend trying our Wheel Options screener to supercharge your wheel strategy trade discovery.

Key Takeaways

- Manual options tracking is inefficient, error-prone, and hinders advanced performance analysis for the Wheel strategy.

- A dedicated trade tracker provides granular P&L, streamlines workflow, and enhances risk management for selling options.

- Automated insights from a tracker enable data-driven decision-making, moving beyond intuition.

- The psychological benefits include reduced stress, increased confidence, and objectivity in trading.

- Integrate tracker insights with tools like a wheel strategy screener for a powerful, optimized trading cycle.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()