Optimizing The Wheel Strategy: Advanced DTE, Delta, and Trade Exit Tactics

In the complex world of derivatives, where billions of dollars exchange hands daily, the precise management of parameters like Days-to-Expiration (DTE) and Delta is paramount for strategies like the Wheel. As options trading volumes continue their unprecedented growth, successful traders are those who move beyond mechanical execution to embrace a nuanced, data-driven approach to their trade exits.

The Wheel Strategy: An Advanced Perspective on Income Generation

The core concept of the Wheel Strategy, involving the sequential selling of cash-secured puts and subsequent covered calls upon assignment, appears deceptively simple. However, for intermediate to advanced traders, optimizing this strategy transcends basic entry criteria. It demands a sophisticated understanding of how DTE, Delta, and dynamic exit strategies intertwine to maximize premium capture, mitigate risk, and enhance overall portfolio performance. This is not about merely selling options; it's about intelligent risk management.

"Risk comes from not knowing what you're doing."- Warren Buffett

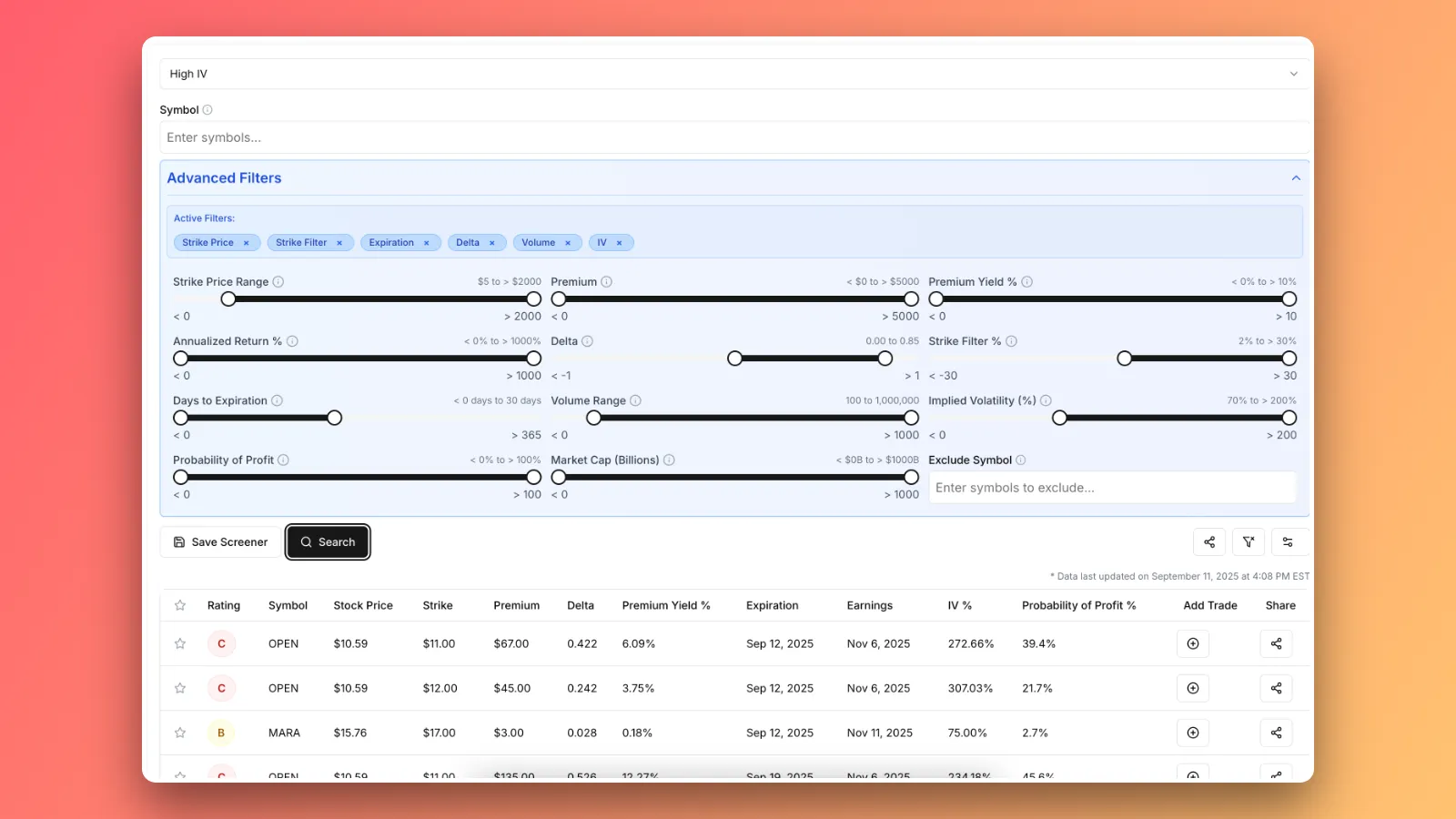

We highly recommend trying our Wheel Options screener here to follow along better.

Deconstructing DTE: Beyond Simple Expiration Management

The choice of Days-to-Expiration (DTE) is arguably one of the most critical decisions when initiating a cash-secured put or covered call. While shorter DTE options generally exhibit faster time decay (theta), they also carry higher gamma risk, leading to more pronounced price swings. Conversely, longer DTE options offer more time for the underlying to move in your favor but decay at a slower rate.

Optimal DTE Ranges: A Dynamic Framework

Many traders default to selling options in the 30-45 DTE range, aiming for a sweet spot between rapid theta decay and manageable gamma. However, a truly optimized approach considers prevailing market volatility (as measured by VIX), earnings calendars, and specific company events for the underlying asset, such as XYZ Corp. In periods of elevated implied volatility, selling longer-dated options (e.g., 60-90 DTE) might yield significantly higher premiums, allowing for earlier profit-taking or more flexible adjustment opportunities.

Consider the trade-off:

- Short DTE (0-20 Days): High theta decay, high gamma risk, requires active management. Suitable for experienced traders with conviction in short-term price stability.

- Mid DTE (30-60 Days): Balanced theta/gamma, common for systematic strategies. Offers reasonable decay without excessive sensitivity.

- Long DTE (60+ Days): Slower theta decay, lower gamma risk, offers more 'room' for price action. Potentially higher premium capture in high IV environments, but capital is tied up longer.

The objective is not just to collect premium but to collect premium efficiently, adjusting DTE based on market conditions rather than adhering to a rigid rule. For instance, if ABC Trading Group reports stellar earnings, and its implied volatility collapses, rolling a 45 DTE covered call down to 20 DTE might be less effective than rolling it to a 60 DTE to capture residual premium with reduced short-term price sensitivity.

Delta Precision: Orchestrating Probabilistic Outcomes

Delta, often understood as the probability of an option expiring in-the-money, is your primary tool for defining your risk exposure and the likelihood of assignment. When selling options, your chosen Delta dictates the balance between premium collected and your probability of success.

Calibrating Delta for Risk-Adjusted Returns

For cash-secured puts, a common approach is to target a Delta range of -0.20 to -0.30. This implies a 20-30% chance of the option expiring in-the-money, offering a decent premium while providing a buffer against moderate price declines. For covered calls, a Delta of +0.20 to +0.30 ensures that you collect a reasonable premium without immediately sacrificing the potential for further upside if the stock rallies significantly.

However, fixed Delta targets can be suboptimal. A more advanced technique involves adjusting Delta based on:

- Underlying Volatility: In high implied volatility environments, you might choose a lower absolute Delta (e.g., -0.15 for puts) to maintain the same probability of success while still collecting substantial premium.

- Technical Levels: Align your strike price with key support/resistance levels. If XYZ Corp has strong support at $100, selling a put with a strike at $100, even if its Delta is slightly higher than your usual target, might be strategically sound.

- Market Sentiment: During strong bullish trends, a slightly higher Delta on covered calls (+0.35) might be acceptable to capture more premium, assuming the stock might continue to rise but not violently enough to blow past your strike.

"It is not the employer who pays the wages. Employers only handle the money. It is the customer who pays the wages."- Henry Ford

This quote, while not directly about options, subtly reminds us that in options trading, the premium is effectively 'paid' by other market participants. Your strategy should aim to be on the receiving end, understanding the probabilities that dictate this exchange.

Mastering Trade Exits: Preserving Capital and Locking Profits

Perhaps the most neglected aspect of the Wheel Strategy is the art of the trade exit. Many traders allow options to expire worthless, missing opportunities to redeploy capital or lock in profits early. Strategic exits are crucial for long-term profitability and capital efficiency.

Early Exit Triggers: When to Fold

A common rule of thumb is to take profits on winning trades when 50-75% of the maximum premium has been realized. For example, if you sold a cash-secured put for $2.00, consider closing it when its value drops to $0.50-$1.00. This frees up capital to initiate new trades, mitigating 'gamma risk' which accelerates as DTE approaches zero.

Moreover, consider the following early exit conditions:

- Profit Target Hit: 50% to 75% of max profit.

- Unexpected Price Movement: If the underlying stock, say DEF Technologies, rallies significantly after you sold a put, closing early allows you to avoid potential assignment and redeploy capital.

- Implied Volatility Drop: A sharp decline in IV can significantly reduce the option's value, presenting an opportunity to buy back cheaply and resell a new option.

Rolling Strategies: Adapting to Market Shifts

When trades move against you, rolling becomes a critical tool. This involves buying back your existing option and simultaneously selling a new one with a different strike, DTE, or both. The goal is typically to 'roll out and down' (for puts) or 'roll out and up' (for calls) to collect more premium, adjust your break-even point, or avoid assignment.

| Scenario | Rolling Strategy | Objective |

|---|---|---|

| Cash-Secured Put in danger of ITM | Roll Out and Down | Avoid assignment, collect more credit, lower cost basis on potential assignment. Example: Buy back -0.25 Delta put, sell -0.20 Delta put at lower strike with more DTE. |

| Covered Call in danger of ITM | Roll Out and Up | Avoid early assignment, collect more credit, allow more upside. Example: Buy back +0.30 Delta call, sell +0.25 Delta call at higher strike with more DTE. |

| Option is Deep ITM (unrecoverable) | Take Assignment/Loss | Accept the shares (for put) or let shares be called away (for call), then reassess. Avoid throwing good money after bad. |

The decision to roll or take assignment is highly contextual. Ray Dalio's emphasis on "radical truth and radical transparency" applies here – be honest with yourself about a trade's prospects. Sometimes cutting a losing trade is the most profitable action.

Integrating DTE, Delta, and Exits for Wheel Strategy Synergy

The true power of the Wheel Strategy emerges when DTE, Delta, and trade exits are managed as an interconnected system. This holistic approach focuses on continuous optimization rather than isolated decisions.

A Holistic Framework for Consistent Income

Imagine initiating a wheel options trade on GrowthCo. You sell a 45 DTE cash-secured put with a -0.25 Delta. As time passes, and GrowthCo's price fluctuates, you continuously monitor:

- Current DTE: If it drops below 20 DTE and the option is still far OTM, consider buying it back to redeploy capital.

- Current Delta: If the put's Delta moves from -0.25 to -0.40 due to a price dip, it signals increased risk of assignment. This triggers a decision point: roll the put further out in time and potentially down in strike to maintain a desired probability, or prepare for assignment.

- Implied Volatility (IV): A spike in GrowthCo's IV might offer an excellent opportunity to roll your covered call to a higher strike, capturing richer premiums while maintaining a similar Delta profile.

This dynamic adjustment process allows you to maintain control, reduce overall portfolio risk, and enhance the consistency of your income generation. It's an active management strategy that rewards vigilance and adaptability.

Leveraging Advanced Analytics with the Wheel Strategy Screener

Navigating these variables manually across multiple potential underlyings can be overwhelming. This is where advanced tools become invaluable. A robust wheel strategy screener allows traders to quickly filter for opportunities based on specific DTE ranges, Delta targets, implied volatility, premium yield, and other crucial metrics. It provides the data-driven edge needed to identify optimal entry points and manage existing positions effectively.

By leveraging such a screener, traders can efficiently:

- Identify options that meet their precise DTE and Delta criteria.

- Spot unusual options activity or changes in IV that might signal adjustment opportunities.

- Backtest different DTE and Delta strategies to refine their approach.

Key Takeaways for Wheel Strategy Optimization

- Dynamic DTE Selection: Move beyond fixed DTE rules. Adjust your chosen DTE based on market volatility, earnings, and specific company events to optimize time decay and premium capture.

- Precision Delta Targeting: Calibrate your Delta not just for probability, but also in conjunction with technical support/resistance levels and prevailing market sentiment to improve trade quality.

- Proactive Trade Exits: Implement early profit-taking strategies (e.g., 50-75% max profit) to free up capital and reduce gamma risk.

- Strategic Rolling: Master the art of rolling (out and down for puts, out and up for calls) to adapt to adverse price movements, collect additional premium, and avoid unwanted assignment.

- Holistic Management: Treat DTE, Delta, and trade exits as an interconnected system for continuous optimization and enhanced income consistency.

- Leverage Tools: Utilize an advanced wheel strategy screener to streamline analysis and identify high-probability trades efficiently.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()