Optimizing Profit-Taking: When to Close Cash-Secured Puts in the Wheel Strategy

In a market environment where option premiums have seen significant fluctuations, disciplined profit-taking is paramount for sustainable portfolio growth. For intermediate to advanced options traders employing the widely adopted Wheel Strategy, the decision of when to close cash-secured puts is not merely an exit point, but a strategic juncture that profoundly impacts overall capital efficiency and annualized returns.

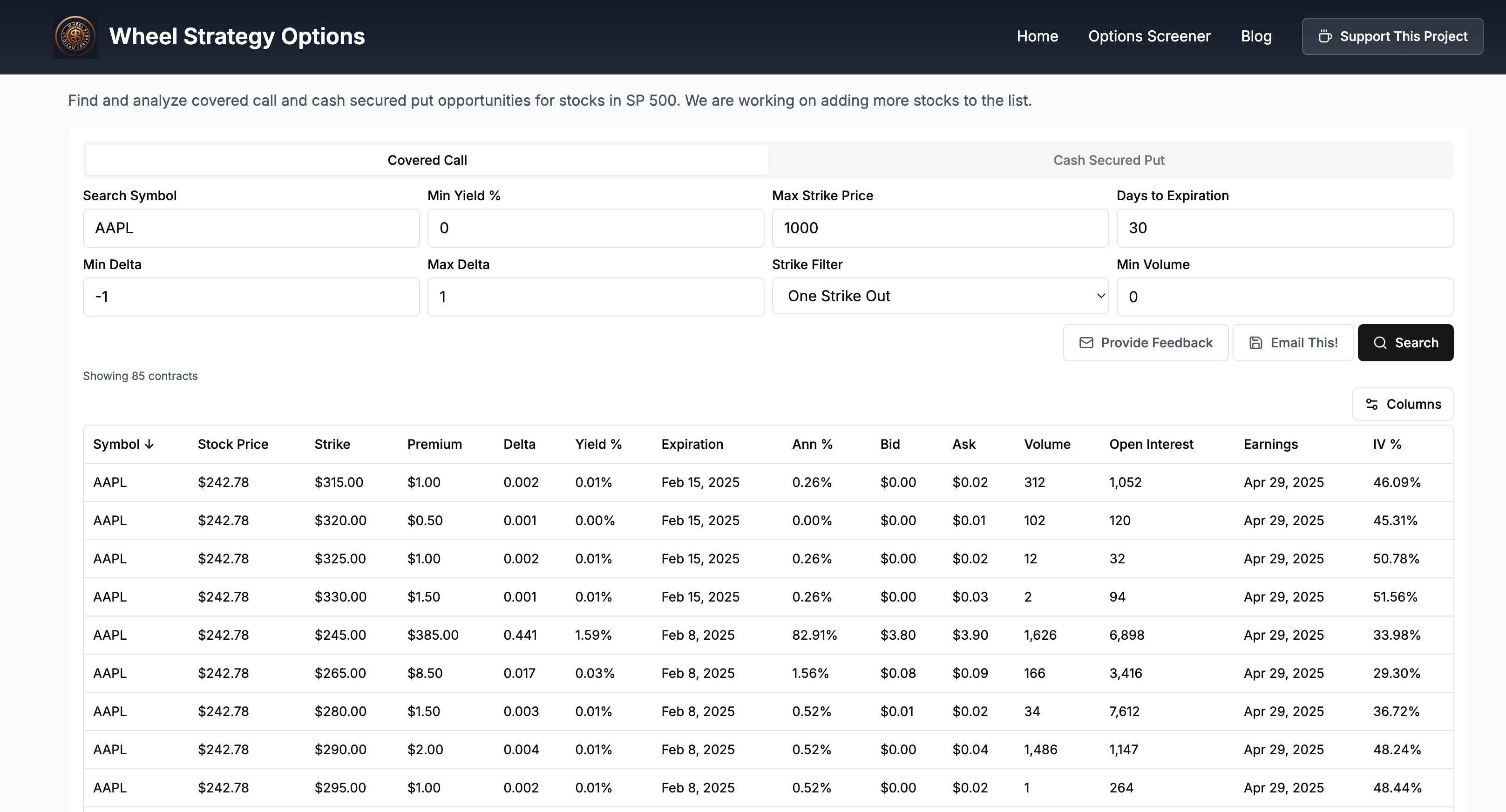

We highly recommend trying our Wheel Options screener here to follow along better.

The Core Dilemma: Balancing Premium Capture and Risk Exposure

Options trading inherently involves managing probabilities and leveraging time decay. The "sweet spot" for selling options, particularly cash-secured puts, lies in capturing sufficient premium while minimizing time-in-trade exposure. This is critically important for a capital-intensive strategy like the Wheel, where capital is tied up to collateralize the put.

The decision to close a cash-secured put prematurely is a nuanced one, often pitting the allure of capturing the last few basis points of premium against the imperative of freeing capital and mitigating gamma risk. As the great investor Warren Buffett once said,

“Our favorite holding period is forever.”- Warren Buffett

While this speaks to long-term equity investing, the underlying principle of patient, disciplined capital allocation applies to options: sometimes, the best decision for long-term capital preservation is to close a position and redeploy.

Strategic Profit-Taking Triggers for Cash-Secured Puts

The "70-80% Premium Capture" Rule of Thumb

Many experienced options traders advocate for closing a cash-secured put once 70-80% of the maximum possible premium has been realized. This strategy is rooted in the accelerating nature of theta decay. While options lose value every day, the rate of decay accelerates significantly during the last 30 days to expiration (DTE), often referred to as the "theta ramp." However, the marginal benefit of holding for the final percentage of premium often diminishes as gamma risk simultaneously increases.

| Premium Captured (%) | Time Remaining (Approx.) | Gamma Risk Level | Capital Efficiency |

|---|---|---|---|

| 50% | 50% | Low | Moderate |

| 75% | 25% | Increasing | High |

| 90%+ | <10% | High | Declining |

For instance, if you sold a cash-secured put on XYZ Corp for $2.00 (per share, i.e., $200 per contract) with 45 DTE, and after 25 days, the option's value has fallen to $0.40, you've captured $1.60 or 80% of the maximum premium. Holding for the remaining $0.40 means exposing your capital to potential adverse movements for another 20 days, during which gamma risk could rapidly escalate. As Naval Ravikant insightfully states,

“Opportunity cost is the real cost.”- Naval Ravikant

The opportunity to redeploy that capital into a new, potentially more efficient trade often outweighs the small remaining premium.

Proximity to Expiration (7-14 DTE Threshold)

As options approach their expiration date, especially within the final one to two weeks, the rate of time decay (theta) accelerates dramatically. However, this period also sees a sharp increase in gamma, which measures the rate of change of an option's delta. High gamma means that small price movements in the underlying asset can lead to significant and rapid changes in the option's value. This is often described as the "hockey stick" effect on an options risk graph.

Many seasoned traders employing the wheel options strategy will close or roll their cash-secured puts around 7-14 days to expiration (DTE) specifically to manage this escalating gamma risk. Holding past this point can expose capital to disproportionate price swings for minimal additional premium, turning a profitable trade into a problematic one in a blink. For example, if you have a cash-secured put on ABC Trading Group with 10 DTE and the market begins to show increased volatility, closing the position and initiating a new trade with more time value can be a prudent defensive maneuver.

Significant Price Movements or Technical Breakdowns

Even if a put is currently out-of-the-money and profitable, a sudden, adverse price movement in the underlying asset can quickly turn a profitable trade into a losing one, or one facing unwanted assignment. Monitoring key support levels, trend lines, and macroeconomic news is crucial. If the underlying asset breaks significant technical support, or a major negative catalyst emerges (e.g., an unexpected regulatory ruling, a severe industry downturn, or an earnings miss), closing the put, even for a smaller profit or a manageable loss, can prevent a larger drawdown or the undesirable assignment of shares.

This proactive risk management aligns with the philosophy of legendary investor Benjamin Graham, who emphasized the importance of a "margin of safety." For options traders, this translates to knowing when to exit, rather than hoping for a reversal, especially when the fundamental or technical picture of the underlying stock deteriorates.

Capital Redeployment Opportunities

A fundamental tenet of the wheel options strategy is capital efficiency. Since cash-secured puts tie up a significant amount of capital, identifying superior investment opportunities elsewhere can be a compelling reason to close an existing profitable put, even if it hasn't reached its theoretical maximum profit potential. This requires an active market scan and a keen eye for undervalued opportunities or positions with a better risk-reward profile.

To facilitate this, a robust wheel strategy screener can be an invaluable tool. It allows traders to quickly identify new potential trades that offer higher annualized returns or less risk for the capital deployed, thereby optimizing the overall efficiency of the capital account. This continuous search for better opportunities is what truly maximizes returns in an active `selling options` strategy.

Advanced Risk Management and Capital Allocation Nuances

Volatility Contraction (IV Crush)

Implied volatility (IV) is a major component of option premium. When you sell a cash-secured put, you are effectively selling this volatility. If you initiate a trade when IV is high (e.g., before an earnings announcement, drug trial results, or a major economic data release) and then IV collapses post-event ("IV crush"), the option's extrinsic value can plummet. This significant drop in premium, even if the underlying stock moves adversely but not catastrophically, presents an excellent opportunity for early profit realization.

This is a proactive closing strategy: aiming to capture the IV premium before it evaporates. Savvy traders often sell puts leading into an event, then buy them back immediately after, capitalizing on the IV contraction rather than waiting for time decay alone.

Avoiding Assignment and Transition to Covered Calls

While the ultimate goal of the wheel strategy is often to get assigned shares to then sell `covered calls`, there are scenarios where avoiding assignment might be preferable. If the underlying stock exhibits fundamental deterioration (e.g., worsening financials, loss of competitive edge) or if you simply wish to avoid holding shares of a particular company for strategic reasons, closing a deep in-the-money put for a manageable loss might be a superior option to taking assignment of potentially depreciating shares.

Alternatively, rolling the put further out in time or down to a lower strike can also serve to avoid assignment, though this often involves realizing a loss on the original position and taking on new risk. As Ray Dalio frequently advocates for,

“The biggest mistake investors make is to believe that the future is going to be like the past.”- Ray Dalio

Adapting your position management to evolving market realities, even if it means deviating from the typical `wheel options` flow, is a hallmark of sophisticated trading.

Strategic Rolling Decisions

Sometimes, closing a put isn't the final step, but a precursor to a strategic roll. Rolling involves buying back the existing put and simultaneously selling a new put with a different strike price and/or expiration date. This maneuver is frequently employed to:

- Collect additional premium (rolling out in time).

- Avoid assignment by moving the strike price further out-of-the-money (rolling down).

- Adjust to new market views or extend the trade horizon.

The decision to roll out, roll down, or roll out and down factors heavily into the "when to close" equation, as it's often a simultaneous action designed to optimize the trade given current market conditions. It's a testament to the flexibility inherent in `selling options` and the adaptability required of a proficient options trader.

Leveraging Technology for Precision Exits

In today's dynamic markets, manual tracking of countless option positions and their optimal exit points can be overwhelming and prone to error. Advanced analytical tools and screeners provide invaluable assistance, enabling traders to make more informed and timely decisions. A specialized wheel strategy screener, for instance, can not only help identify promising cash-secured puts for entry based on specific criteria but also assist in monitoring existing positions for ideal profit-taking thresholds or risk mitigation triggers. These tools provide real-time data on premium decay, implied volatility changes, and days to expiration (DTE), enabling more informed and timely decisions for all `selling options` strategies, ultimately enhancing the efficiency and profitability of your wheel options approach.

Summarizing Key Takeaways

- Optimal Profit Capture: Aim to close cash-secured puts when 70-80% of the maximum premium is collected, leveraging the diminishing returns of theta decay.

- Manage Gamma Risk: Consider closing or rolling positions around 7-14 DTE to mitigate accelerating gamma risk as expiration nears.

- Adapt to Market Shifts: Be prepared to close puts early if the underlying stock shows significant technical breakdowns or fundamental deterioration.

- Capital Efficiency: Proactively close trades to free up capital for potentially more lucrative `selling options` opportunities.

- Harness IV Crush: Strategically close positions after an expected implied volatility contraction (e.g., post-earnings) to lock in profits from premium decay.

- Utilize Tools: Employ a reliable wheel strategy screener to identify optimal entry/exit points and monitor positions effectively.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()