Optimizing Options Selection: Essential Criteria for High-Probability Cash-Secured Puts & Income Spreads

In an era characterized by persistent market volatility and a global search for yield, generating consistent income through strategic options trading has become a paramount objective for sophisticated investors. For those well-versed in the mechanics of selling options, particularly through the popular wheel options strategy, the true challenge lies not in understanding the framework, but in optimizing the selection of underlying assets and strike prices for high-probability, high-conviction trades.

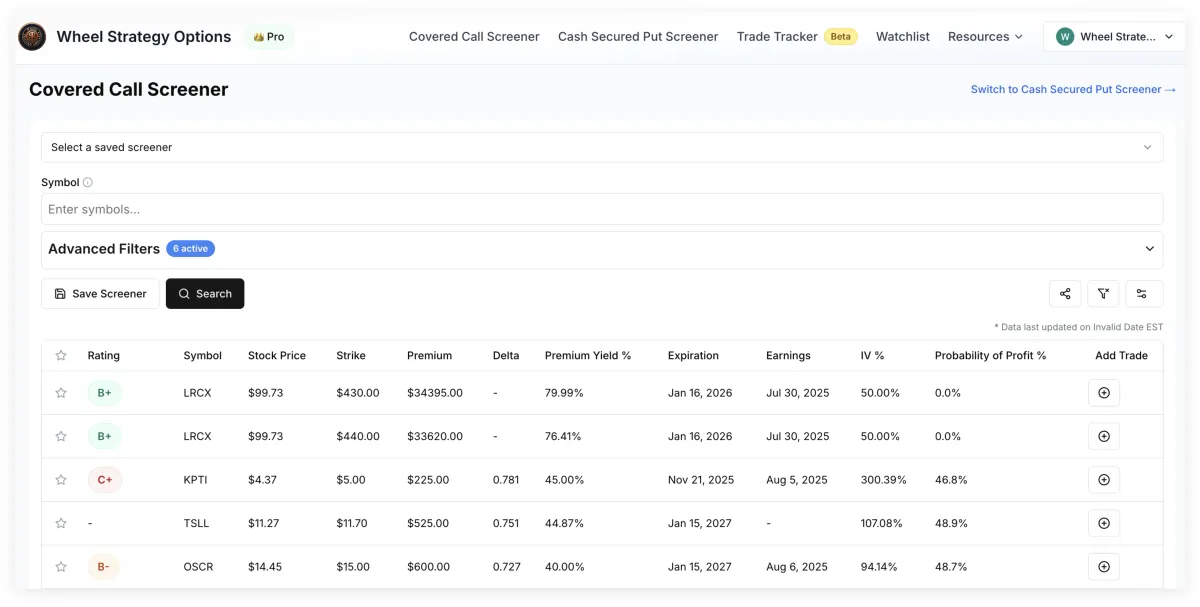

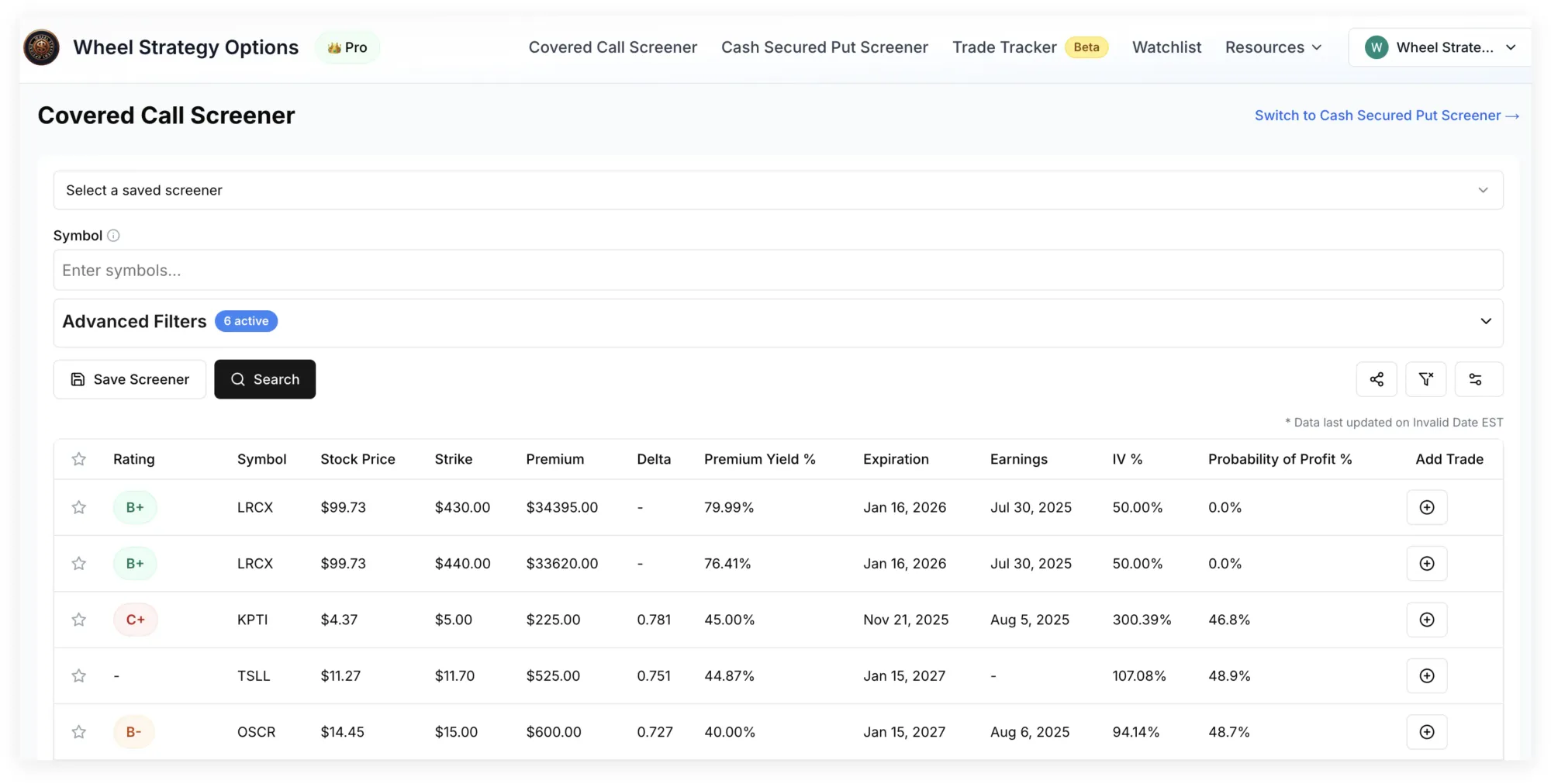

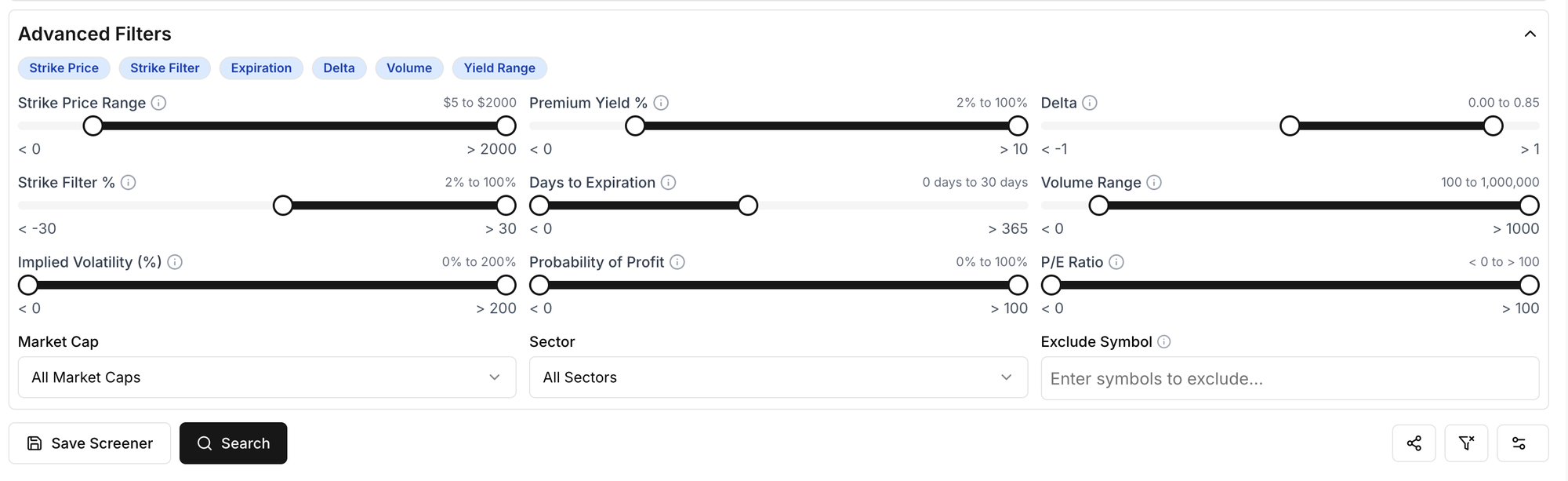

We highly recommend trying our Wheel Options screener here to follow along better.

The Core Challenge: Beyond Basic Strategy

Many intermediate traders quickly grasp the mechanics of initiating positions with cash-secured puts and transitioning to covered calls. However, the path to consistent profitability within the wheel strategy hinges critically on a nuanced selection process. It's not merely about finding any stock with options liquidity; it's about identifying opportunities where the probabilities are demonstrably skewed in your favor, minimizing the likelihood of assignment on undesirable assets, and maximizing premium capture for the risk undertaken.

As the legendary investor Peter Lynch once famously stated, "Know what you own, and know why you own it." While he was referring to long-term stock investing, this principle is profoundly relevant to options traders. When you sell a put, you are essentially committing to owning a stock at a certain price. Therefore, the due diligence applied to a potential long-term equity purchase should largely mirror the analysis for a candidate underlying for a cash-secured put.

Fundamental Pillars for High-Probability Cash-Secured Puts

Underlying Quality & Financial Health

The foundation of a high-probability cash-secured put strategy rests squarely on the quality of the underlying asset. Traders should prioritize companies with robust financial fundamentals, regardless of whether they intend to hold the stock long-term if assigned. This includes:

- Strong Balance Sheet: Look for low debt-to-equity ratios, ample cash reserves, and a healthy current ratio. A resilient balance sheet provides a critical buffer against unforeseen economic downturns or industry-specific challenges, ensuring the company's ability to navigate adverse conditions without significant equity erosion.

- Consistent Profitability & Cash Flow: Companies with a track record of consistent earnings growth and robust positive free cash flow generation are less likely to experience sharp, unexpected declines. This indicates operational efficiency and sustainable business models.

- Competitive Moat: Does the company possess a sustainable competitive advantage (e.g., strong brand recognition, proprietary technology, high switching costs, network effects, or cost advantages)? A "moat," a concept popularized by Warren Buffett, protects market share and profitability from competitive pressures, providing long-term stability.

- Sector Stability & Growth: While high-growth, high-volatility sectors can offer alluring premiums, they often come with disproportionately higher risk. Stable sectors with consistent demand, like established consumer staples, mature technology, or regulated utilities, can provide more reliable income generation with less drastic downside potential.

Consider a hypothetical "XYZ Corp" in the mature technology sector. It consistently generates strong free cash flow, boasts a fortress-like balance sheet, and maintains a dominant market position due to its proprietary software ecosystem. Selling options via cash-secured puts on XYZ Corp at a strike price well below its current trading range, or even near a historical long-term support level, offers a significantly higher probability of premium decay without assignment. If assigned, you would acquire shares in a fundamentally sound company at a discount, setting the stage for future covered calls.

It's far better to buy a wonderful company at a fair price than a fair company at a wonderful price.- Warren Buffett

This timeless wisdom from Buffett directly applies to put selling. Focus on companies you'd be comfortable owning, even if the put gets assigned. This aligns your options strategy with sound long-term investment principles.

Volatility & Implied Volatility (IV) Analysis

Implied Volatility (IV) is the options trader's lifeblood, directly influencing the premium received. However, it's a double-edged sword. While high IV means higher premiums, it also reflects greater perceived risk by the market and wider potential price swings.

- IV Rank/Percentile: Instead of raw IV, which isn't comparable across different stocks, analyze IV Rank or IV Percentile. These metrics compare the current IV to its historical range (e.g., over the last 52 weeks). An IV Percentile above 50% generally indicates IV is elevated relative to its recent history, potentially offering better premiums for options sellers. Selling into elevated IV, with the expectation of mean reversion, is a cornerstone of profitable premium selling.

- The Sweet Spot: The ideal scenario for selling options is when IV is elevated but expected to decline (mean reversion). This provides a dual tailwind: premium capture from time decay (Theta) and additional premium decay from falling IV (Vega).

- Avoid Earnings & Binary Events: IV often spikes dramatically before earnings announcements or other significant company events. While the premiums are alluring, the binary, unpredictable outcome of such events introduces extraordinary, unquantifiable risk that can quickly erode any premium gain and lead to significant losses. These events can result in "gaps" that blow past your strike price.

Volatility is not risk. Risk is ruin.- Nassim Nicholas Taleb

Taleb's perspective is crucial for options sellers. Chasing excessively high IV on a fundamentally weak or speculative stock can lead to catastrophic losses if that implied volatility manifests as real price movement against your position, resulting in deep in-the-money assignment.

Technical Analysis & Support Levels

Beyond fundamental strength, technical analysis provides critical insights into optimal strike selection. Identifying robust support levels for cash-secured puts and resistance for covered calls significantly improves the probability of success, offering a quantifiable edge.

- Key Price Levels: Utilize historical price action to identify major support zones. This includes previous strong lows, pivot points, and significant psychological levels (e.g., round numbers like $100).

- Moving Averages: Long-term moving averages (e.g., 50-day, 100-day, 200-day Simple Moving Average) often act as dynamic support/resistance. Selling puts near these rising averages can provide a strong foundation.

- Fibonacci Retracements & Bollinger Bands: These tools can help identify potential reversal points or overextended price action, guiding strike selection for optimal entry.

- Volume Analysis: Look for increased volume accompanying price action at support levels, which can confirm the strength of the buying interest there.

- Patience & Discipline: Do not chase premiums. Wait for the underlying to approach your identified support levels. Selling a cash-secured put at a strike significantly below the current price, near strong, established support, provides a substantial margin of safety.

The big money is not in the buying or the selling, but in the waiting.- Charlie Munger

Munger's wisdom underscores the paramount importance of patience. Rushing into a trade because of perceived high premiums without a strong technical rationale often leads to suboptimal outcomes and unnecessary risk exposure.

Strategic Considerations for Income Spreads (Credit Spreads)

While the wheel strategy primarily utilizes simple cash-secured puts and subsequently covered calls, understanding and potentially integrating income spreads (specifically credit spreads like credit put spreads or credit call spreads) can add versatility and defined risk to a trader's arsenal, especially when a strong directional bias exists but full assignment or substantial capital commitment is undesirable.

Defining Risk Tolerance & Capital Allocation

Credit spreads define both maximum profit (the premium collected) and maximum loss (the width of the spread minus premium received), making them highly appealing for managing risk. The width of the spread directly dictates the capital at risk and the potential profit. A narrower spread typically means less premium but often a higher probability of profit, assuming the short strike is adequately out-of-the-money.

Before entering any spread, clearly define your maximum acceptable loss per trade and ensure the trade aligns with your overall portfolio capital allocation strategy. This structured approach helps prevent single trades from disproportionately impacting your entire capital base.

Directional Bias & Market Context

Income spreads are inherently directional, albeit with a built-in margin of error. A credit put spread profits from a neutral to bullish outlook, expecting the underlying to stay above the short put strike. Conversely, a credit call spread profits from a neutral to bearish outlook, expecting the underlying to stay below the short call strike. Unlike selling a naked put which carries the commitment to own shares, a credit put spread simply expects the price to stay above a certain threshold, offering flexibility.

For instance, if "ABC Trading Group" is showing signs of weakening after a significant rally, but you don't anticipate a catastrophic crash, selling a credit call spread with strikes above current resistance could be a prudent move. This allows you to profit from a neutral to slightly bearish outlook, without the unlimited risk exposure of a naked call and with a defined maximum loss.

Option Chain Analysis: Delta, Theta, Vega

For income spreads, the Greeks become even more critical in optimizing trade selection and managing the trade post-entry:

- Delta: Traders typically aim for a collective net delta that aligns with their directional bias but remains relatively low for high-probability out-of-the-money (OTM) spreads. For credit put spreads, a short put strike with a delta between -0.10 and -0.30 is common, implying a 10-30% theoretical probability of expiring in-the-money. This ensures a healthy buffer from the current price.

- Theta: Time decay is your fundamental ally as an options seller. Spreads generally benefit significantly from Theta decay, especially as expiration approaches. Shorter-dated spreads (30-45 days to expiration) often offer the optimal balance between rapid theta decay and sufficient time to manage unexpected price movements.

- Vega: This measures sensitivity to IV changes. For a credit spread, you are net short Vega, meaning a decrease in IV (post-entry) will benefit your position. This reinforces the strategy of initiating selling options positions when IV is relatively high and expecting it to revert lower, capitalizing on both time and volatility decay.

Advanced Selection Metrics & Screening

Beyond the foundational criteria, several advanced metrics and considerations can further refine your options selection, distinguishing merely good trades from truly exceptional, high-probability setups.

Earnings & Event Risk Mitigation

As touched upon earlier, earnings reports and other scheduled corporate events (e.g., FDA approvals, major court rulings, product launches) introduce substantial binary risk. A stock might meet or beat earnings expectations but still drop significantly due to weak guidance, or vice versa, causing unpredictable gaps. For high-probability selling options strategies like cash-secured puts and credit spreads, it is generally prudent to:

- Avoid holding positions through earnings: Close out trades before the announcement, or at least roll them significantly out in time and potentially further OTM, adjusting strikes for safety.

- Scan for upcoming events: Utilize comprehensive financial calendars and company news feeds to identify and proactively avoid potential landmines. Even seemingly minor events can trigger unexpected volatility.

Liquidity: Open Interest & Volume

Liquidity is non-negotiable for efficient options trading. Illiquid options chains can lead to wide bid-ask spreads, making it difficult to enter or exit positions efficiently, resulting in significant slippage that erodes potential profits. Always prioritize underlying assets and specific strike/expiration combinations with:

- High Open Interest (OI): A high number of outstanding contracts indicates significant market participation and institutional involvement, ensuring depth.

- High Daily Volume: Consistent daily trading volume ensures you can get in and out of trades at competitive prices with minimal slippage.

A rule of thumb for beginners is often 100+ open interest and 50+ daily volume for the specific strike and expiration you're considering, though experienced traders often require significantly more, especially for larger position sizes.

Return on Capital (ROC) & Probability of Profit (POP)

Quantifying potential returns and probabilities is paramount for assessing the attractiveness of a trade. These metrics allow for objective comparison between multiple potential opportunities:

- Return on Capital (ROC): Calculate the premium received as a percentage of the capital reserved (for cash-secured puts, this is strike price * 100) or the maximum potential loss (for spreads). For instance, if you collect $1.50 premium on a $100 strike put, your ROC is $1.50 / $100 = 1.5%. A target ROC of 1-3% per month, annualized to 12-36% (before assignment or losses), is often sought by income-focused traders.

- Probability of Profit (POP): While not a guarantee, POP (often approximated by 1-Delta for OTM options or derived from option pricing models) helps gauge the theoretical likelihood of a trade expiring profitably. Combining high ROC with a high POP (e.g., >70-80%) indicates a favorable risk-reward profile, balancing yield with statistical edge.

Consider this comparative table for two hypothetical cash-secured put candidates:

| Metric | Option A (XYZ Corp Put) | Option B (ABC Trading Group Put) |

|---|---|---|

| Underlying Quality | High (Strong fundamentals, market leader) | Medium (Growth, but less stable earnings) |

| Current IV Percentile | 75% (Elevated but reasonable) | 90% (Very High, unsustainable, high tail risk) |

| Premium Received | $1.50 | $2.50 |

| Strike Price | $95 (Near strong technical support) | $45 (Above recent support, closer to current price) |

| Capital Required (per contract) | $9,500 | $4,500 |

| Return on Capital (ROC) | 1.58% ($150 / $9500) | 5.56% ($250 / $4500) |

| Approx. Probability of Profit (POP) | 85% (Delta -0.15) | 60% (Delta -0.40) |

While Option B offers a higher immediate ROC, its lower POP and less stable underlying make it a significantly higher-risk proposition for selling options. Seasoned traders often prioritize a higher POP on a quality underlying, even if it means a slightly lower initial premium, understanding that avoided losses contribute more to long-term capital preservation and growth than chasing outsized, high-risk premiums.

To streamline this rigorous selection process, sophisticated traders often leverage specialized tools. Our wheel strategy screener is designed to filter potential opportunities based on these precise criteria, allowing you to quickly identify high-probability setups and optimize your wheel options candidates.

The Human Element: Discipline and Adaptation

Even with the most stringent selection criteria, the market remains dynamic and unpredictable. No set of rules guarantees success without the human elements of discipline, continuous learning, and adaptability. Emotional biases, such as fear of missing out (FOMO) or anchoring to original trade ideas, can derail even the best-laid plans.

The vast majority of people are driven by emotion, not reason. The consequences of this are the market, and everything else in life.- Ray Dalio

Dalio's insight reminds us that market movements are often irrational and driven by collective human psychology. Traders must remain objective, stick to their pre-defined criteria, and be prepared to adapt their strategy as market conditions evolve. Maintaining a detailed trade journal, meticulously reviewing past trades (both winners and losers), analyzing what worked and what didn't, and continuously refining your selection filters are crucial for long-term success in selling options and managing a robust wheel strategy portfolio. Embrace the iterative process of learning and refinement.

Key Takeaways for Optimizing Options Selection

- Prioritize underlying quality with strong financials and competitive moats for all options trades, especially cash-secured puts.

- Target elevated Implied Volatility (IV) Rank/Percentile (above 50%) but strictly avoid binary event risk like earnings.

- Utilize technical analysis to anchor your strike prices at significant support or resistance levels, enhancing your margin of safety.

- For spreads, clearly define risk tolerance and capital allocation, understanding max loss and profit.

- Ensure sufficient liquidity (Open Interest & Volume) to minimize slippage and facilitate efficient trade management.

- Focus on a strong combination of Return on Capital (ROC) and Probability of Profit (POP), valuing higher probability over chasing extreme premiums.

- Cultivate discipline and adaptability; the market is dynamic, and continuous learning is paramount for consistent success.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()