Covered Call and Cash-Secured Put Explained

Understanding the Wheel Options Strategy

The Wheel Options strategy is a defined-risk approach that combines selling covered calls and cash-secured puts to generate income. It's best suited for stable, dividend-paying stocks or ETFs. This strategy capitalizes on time decay (theta) and implied volatility.

Covered Call Leg

When you own 100 shares of a stock, you can sell a covered call option. This gives the buyer the right, but not the obligation, to buy your shares at a specific price (strike price) on or before a certain date (expiration date). In return, you receive a premium.

Example: You own 100 shares of XYZ stock trading at $50. You sell a covered call with a $55 strike price expiring in 30 days for a $1 premium per share. If XYZ stays below $55, you keep the premium ($100). If it goes above $55, your shares may be called away, but you profit from the price appreciation and the premium.

Cash-Secured Put Leg

If you don't own the underlying stock, you can sell a cash-secured put. This gives the buyer the right, but not the obligation, to sell you 100 shares at the strike price on or before the expiration date. You receive a premium for this obligation.

Example: XYZ stock is trading at $45. You sell a cash-secured put with a $40 strike price expiring in 30 days for a $0.50 premium per share. If XYZ stays above $40, you keep the premium ($50). If it falls below $40, you're obligated to buy 100 shares at $40, but your effective purchase price is reduced by the premium received ($39.50).

Managing the Wheel

The key to successful wheeling is choosing the right stocks and strike prices. Look for stocks with consistent price movement and reasonable implied volatility. Using a screener can help identify suitable candidates and manage your positions effectively.

Risk/Benefit Analysis

- Benefits: Income generation, defined risk, potential for capital appreciation.

- Risks: Missing out on large price gains (covered calls), forced to buy at unfavorable prices (cash-secured puts), capital loss if the underlying drops significantly.

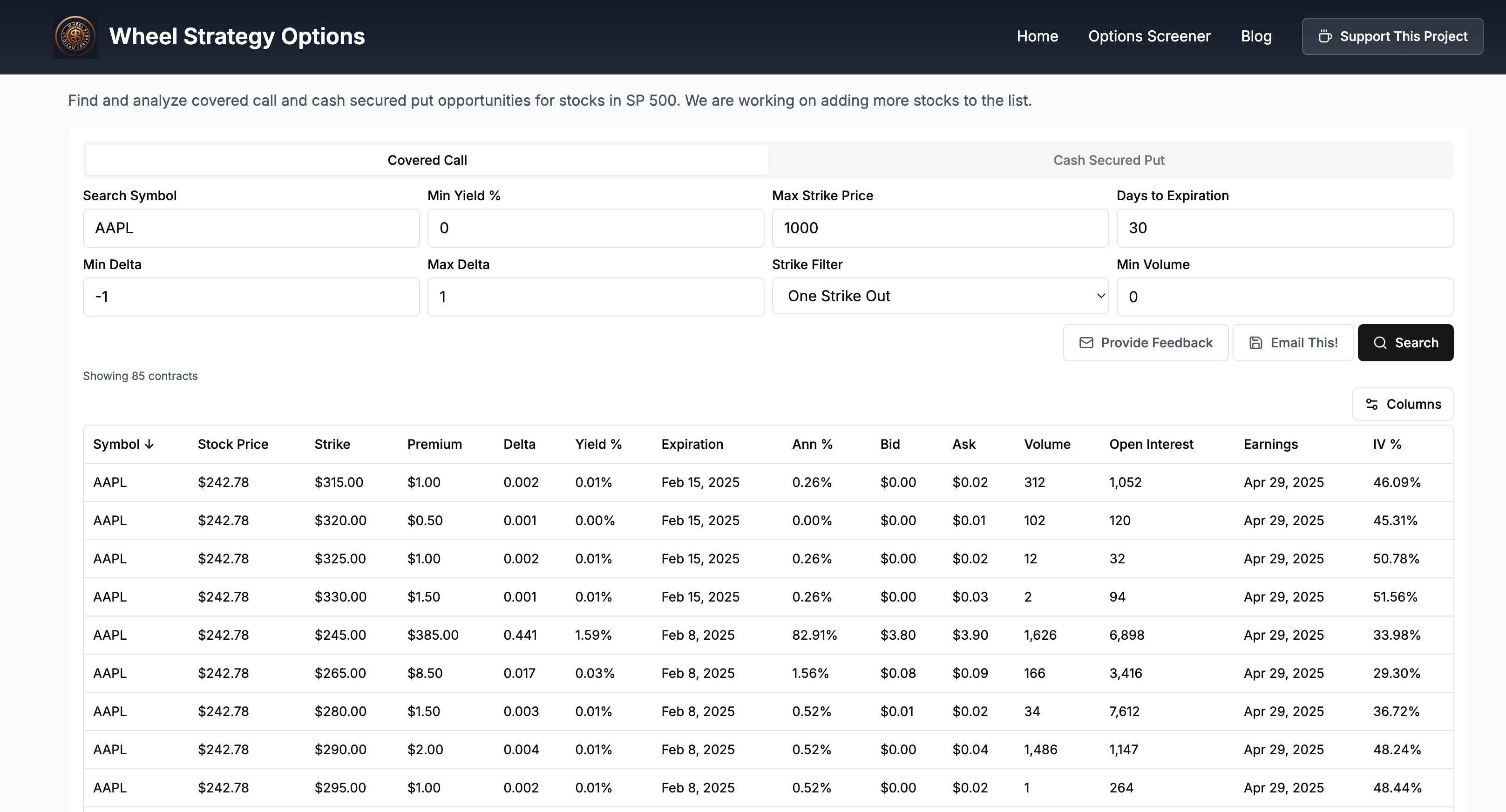

Screener Functionality

Our screener can help you find optimal wheel opportunities by filtering stocks based on metrics like IV rank, delta, and dividend yield. It also helps manage open positions and visualize potential profit/loss scenarios.

Disclaimer: This article is for educational purposes only and should not be construed as financial advice. Investments are subject to risk and should be carefully analyzed before making any decisions.

Follow us on:

Comments ()