Navigating the AI-Driven Wheel: A Cautious Approach for Options Trading Success

While the allure of Artificial Intelligence (AI) in financial markets is undeniable, particularly for strategies like the wheel, experienced options traders understand that algorithms are tools, not oracles. Recent market corrections have starkly reminded us that even the most sophisticated models can falter when faced with unforeseen black swan events, as evidenced by the significant losses incurred by numerous quant funds in the 2020 volatility spike. Therefore, while AI offers exciting possibilities for identifying and executing wheel strategy trades, a cautious, experience-driven approach is paramount.

The Allure of AI in Options Trading: A Double-Edged Sword

AI's promise in options trading, specifically for the wheel strategy, lies in its ability to process vast datasets and identify patterns invisible to the human eye. Imagine an AI sifting through years of historical pricing data, volatility metrics, earnings reports, and even sentiment analysis to pinpoint optimal candidates for selling options – both cash secured puts and covered calls. This capability is incredibly enticing. AI algorithms can theoretically optimize strike price selection, expiration timing, and position sizing with a speed and precision that surpasses manual analysis. The potential to enhance returns and streamline the often time-consuming aspects of the wheel strategy is significant.

However, this power comes with inherent risks. As Nassim Nicholas Taleb wisely noted,

“Models are to be used to open your mind, not to constrain it.”- Nassim Nicholas Taleb

Over-reliance on AI without critical human oversight can lead to several pitfalls, especially in dynamic and unpredictable markets.

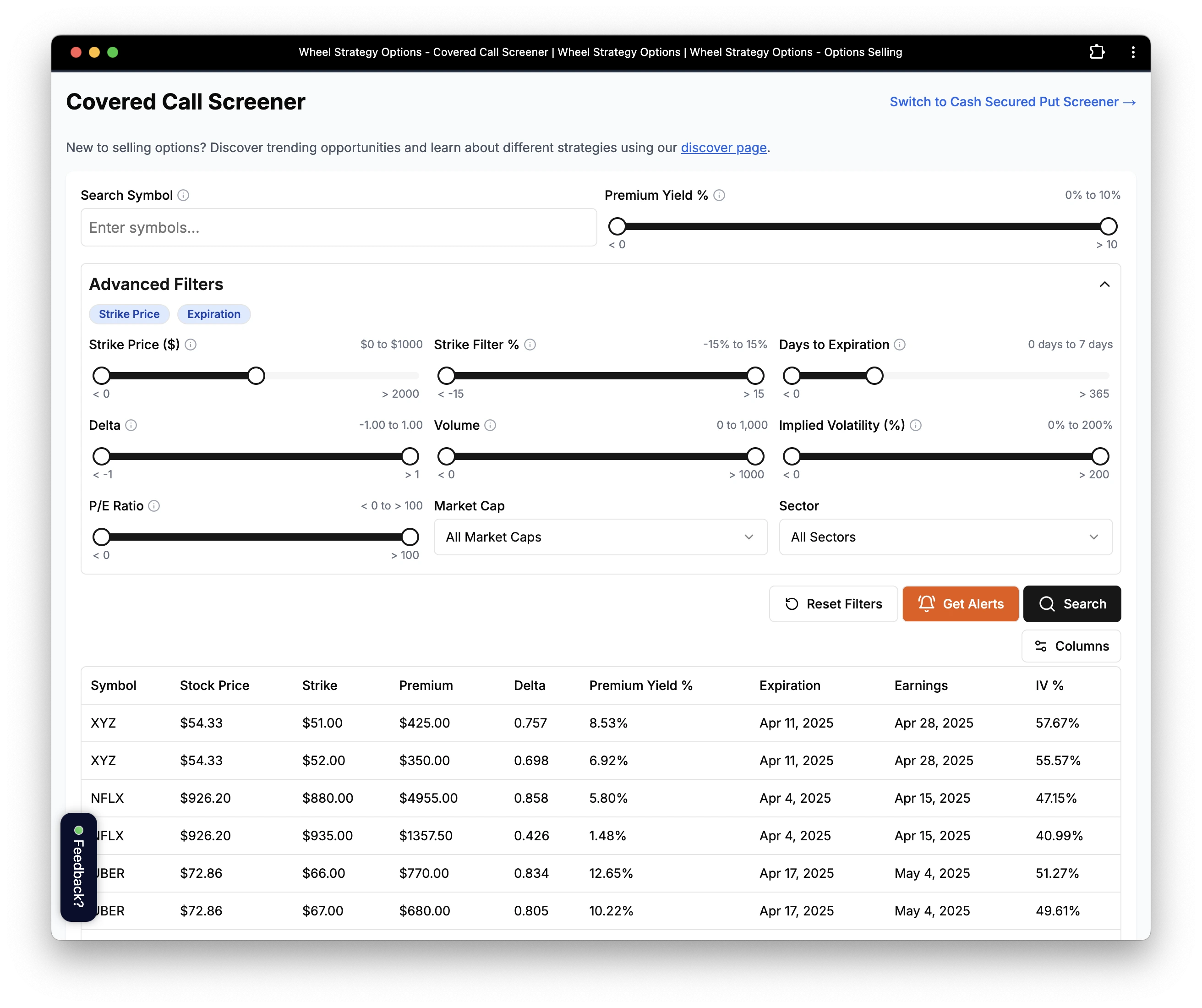

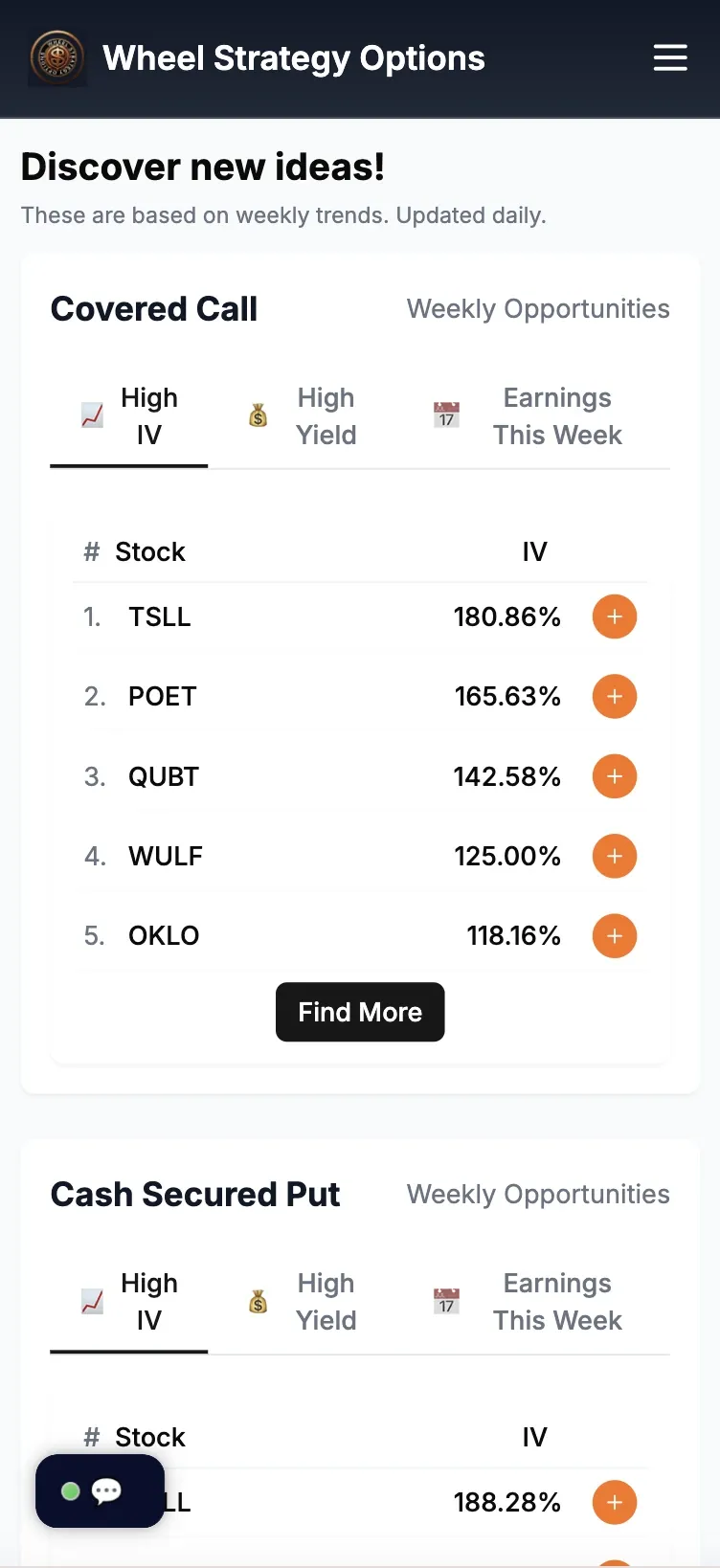

We highly recommend trying our Wheel Options screener to discover human-guided covered call and cash secured put contracts.

Black Box Blind Spots: AI Limitations in Wheel Strategy

One of the primary concerns is the “black box” nature of many AI algorithms. Complex neural networks, for instance, can generate trading signals without providing clear, interpretable reasoning. This lack of transparency makes it difficult for traders to understand *why* an AI is recommending a particular trade. For experienced wheel strategy practitioners, understanding the underlying rationale is crucial for risk management and adapting to changing market conditions. Blindly trusting AI-generated signals without critical evaluation is akin to navigating unfamiliar terrain without a map – potentially perilous.

Overfitting and Data Bias: AI's Achilles' Heel

AI models are trained on historical data. If this data is not representative of future market behavior, or if the model is “overfitted” to noise in the historical data, its predictive power can be severely compromised. For example, an AI trained on a prolonged period of low volatility might incorrectly assess risk and generate overly aggressive selling options strategies when volatility spikes. Similarly, biases in the training data, such as an over-representation of bull markets, can lead to models that are ill-prepared for downturns. In the context of the wheel strategy, this could translate to selling cash secured puts on fundamentally weak companies that the AI misinterprets as attractive due to past price patterns.

The Human Element: Essential Oversight for AI-Driven Trading

Experienced traders bring to the table something AI currently lacks: nuance, contextual understanding, and adaptability grounded in years of market experience. Consider the impact of unforeseen geopolitical events, regulatory changes, or company-specific news that may not be fully captured in historical datasets. A seasoned trader can quickly assess these qualitative factors and adjust their wheel strategy accordingly. AI, in its current form, often struggles to incorporate such qualitative, real-time information effectively.

Practical Steps: Integrating AI Cautiously into Your Wheel Strategy

The key is to view AI as a powerful *augment* to your existing wheel strategy, not a complete replacement for your own judgment and experience. Here are practical steps for cautious integration:

Backtesting and Validation (with Critical Scrutiny)

Thoroughly backtest any AI-driven trading signals or strategy recommendations using *out-of-sample* data – data the AI has not been trained on. However, remember that backtesting is not foolproof. As Peter Lynch famously said,

“If you spend more than 13 minutes analyzing economic and market forecasts, you've wasted 10 minutes.”- Peter Lynch

Focus on stress-testing the AI’s performance under various market conditions, including volatility spikes and market corrections. Critically evaluate the backtesting methodology itself – are there biases? Are the assumptions realistic? Don't be swayed by impressive backtest results alone; dig deeper into the underlying logic.

Risk Management: AI-Augmented, Human-Controlled

Never relinquish control of your risk management to an AI. Use AI to *inform* your decisions, but always set your own risk parameters and position sizing based on your personal risk tolerance and capital allocation strategy. For example, if an AI suggests selling a cash secured put on “ABC Trading Group” at a strike price that seems aggressive, even with the AI’s “high probability” rating, your experience might tell you to opt for a more conservative strike or avoid the trade altogether. Remember, the wheel strategy, especially when selling options, requires diligent risk management.

Focus on AI as a Screener and Idea Generator

Initially, leverage AI primarily for tasks where it excels: screening vast universes of stocks to identify potential wheel candidates based on your pre-defined criteria. Use the wheel strategy screener to quickly filter stocks based on factors like implied volatility, dividend yield, and technical indicators. Let AI help you generate trade ideas, but always conduct your own fundamental and technical analysis before executing any trade. AI can be exceptionally useful in identifying stocks that meet certain volatility or liquidity thresholds suitable for selling options, but human judgment is still needed to assess the underlying quality of the company and the overall market context.

Beyond Automation: The Strategic Edge of Experienced Traders

Ultimately, the most successful approach to integrating AI into your wheel strategy is to maintain a healthy skepticism and prioritize experience-driven oversight. AI is a tool that can enhance your efficiency and potentially uncover new opportunities, but it cannot replace the nuanced judgment, adaptability, and risk awareness that come from years of trading experience. Embrace AI’s capabilities, but always tread cautiously and remember that in the realm of options trading, especially with strategies like the wheel involving selling options, informed human discretion remains the ultimate edge.

Key Takeaways:

- AI can be a powerful tool for generating wheel strategy trade ideas, but it's not a foolproof solution.

- Be wary of the “black box” nature of some AI algorithms and the potential for overfitting and data bias.

- Always maintain human oversight and critical evaluation of AI-generated trading signals.

- Use AI to augment your existing wheel strategy, focusing on screening and idea generation initially.

- Prioritize risk management and never relinquish control to an AI.

- Experienced traders' nuanced judgment and adaptability remain crucial for navigating market complexities.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()