Navigating Market Downturns with the Wheel Strategy: Is it Wise to Sell Options?

Is selling options and using the wheel strategy wise in a falling market? Explore adapting the wheel for downturns, managing risk, and expert insights.

The market's been doing the cha-cha slide lately – two steps forward, one step back, and sometimes just straight down. With volatility on the rise and red days feeling more frequent than green, seasoned options traders are asking a crucial question: Is deploying the wheel strategy, with its core components of selling options, still a smart move when the market is showing its bearish teeth? Let's dive deep into the nuances, because, as any experienced trader knows, the market rarely offers simple 'yes' or 'no' answers.

Understanding the Wheel Strategy in Bull vs. Bear Markets

For those already familiar with the rhythmic dance of the wheel strategy, you know it’s a method designed to generate income through systematically selling options. It typically begins with selling cash secured puts on stocks you wouldn't mind owning at the right price. If assigned, you transition to selling covered calls on those shares, aiming to get called out at a profit or continue collecting premium. In essence, it’s about leveraging time decay and volatility to your advantage.

In a bull market, or even a sideways-moving market, the wheel strategy can feel like printing money (figuratively, of course... we wish!). Premiums are decent, stocks are generally trending upwards or sideways, making it easier to sell options and either profit from them expiring worthless or getting assigned and then called away at a gain. However, when the market dons its bearish cloak, things get… trickier. Imagine trying to do the cha-cha in quicksand – that's wheeling in a significant downturn.

Challenges in a Falling Market

- Increased Assignment Risk for Cash Secured Puts: When stocks are dropping, the likelihood of your cash secured puts being assigned skyrockets. While the plan is to own the stock eventually, being assigned rapidly and potentially at a price higher than the current market value can sting, especially if the downtrend continues.

- Decreased Premium for Covered Calls: As stock prices fall, so does implied volatility (sometimes, not always!), and consequently, the premium you can collect from selling covered calls might shrink. Selling covered calls when your underlying stock is depreciating feels a bit like trying to catch water in a sieve – you're working hard for diminishing returns.

Psychological Impact of Potential Losses: Let's be honest, seeing red in your portfolio isn't fun. The wheel strategy, even though designed for income generation, can lead to psychological stress in a bear market. Continuously being assigned puts at lower prices, or watching your covered call positions stagnate while the underlying stock slides, can test your resolve. As Charlie Munger famously said,

-Charlie Munger

And navigating a bear market with options strategies definitely isn't easy!

The Bearish Wheel: Adapting Your Approach

Now, before you throw in the towel and declare the wheel strategy useless in a downturn, hold on! Like a seasoned surfer adjusting to changing wave conditions, the wheel strategy can be adapted for a falling market. It's not about abandoning ship, but rather, about adjusting your sails.

Not a “One-Size-Fits-All” Market

First and foremost, recognize that market downturns aren’t monolithic. There are rapid corrections, drawn-out bear markets, and volatile choppy periods. Your approach needs to be flexible and responsive to the specific market conditions. What worked in a bull market might need a significant tweak (or a complete overhaul) in a bear market.

Defensive Adjustments for Falling Markets

Here are some tactical adjustments to consider when employing the wheel strategy during market declines:

Cash Secured Puts (CSPs)

- Wider Strikes & Lower Deltas: Be more conservative with your strike prices. Instead of chasing aggressive premiums by selling at-the-money or slightly in-the-money puts, consider selling out-of-the-money puts with lower deltas. This reduces your probability of assignment (though premium collected will be less). Think of it as wading into the shallow end of the pool instead of diving headfirst into the deep end during a storm.

- Shorter Expirations: Opt for shorter expiration cycles (weekly or bi-weekly instead of monthly). This allows for quicker adjustments based on market movements and reduces the time your capital is at risk in a potentially downward trending stock. As Nassim Nicholas Taleb might suggest, in uncertain times, optionality and flexibility are your best friends.

- Smaller Position Sizes: Reduce your position sizes. If you typically sell CSPs on 10 contracts, consider scaling back to 5 or even fewer. Capital preservation becomes paramount in a downturn, and smaller positions offer greater flexibility and reduce potential losses if assigned.

Covered Calls (CCs)

- Higher Strikes (Out-of-the-Money): When selling covered calls on assigned shares, aim for higher, out-of-the-money strike prices. While this might mean lower premiums, it gives your stock more room to recover before being called away, and maximizes your potential upside if a rally occurs. Remember, patience is a virtue, especially in a bear market.

- Patience - Waiting for Rallies: Don't rush to sell covered calls immediately after being assigned shares from a put. Wait for potential short-term rallies or stabilization in the stock price. Volatility often spikes during downturns, which can lead to better covered call premiums on upswings.

Focus on Dividend Stocks?: Consider focusing your wheel strategy on high-quality, dividend-paying stocks, especially in a bear market. The dividends provide some income and cushion even if the stock price stagnates or declines, and the covered call premium is just the cherry on top. As Peter Lynch wisely advised,

Go for a business that any idiot can run - because sooner or later, any idiot probably is going to run it.

- Peter Lynch

Focusing on fundamentally sound companies is always a good strategy, particularly in uncertain times.

Example Scenario: XYZ Corp in Downturn

Let's imagine XYZ Corp, a placeholder stock, is trading at $50. You were happily wheeling it when it was at $60, but now the market is pulling back.

| Action | Bull Market Approach (XYZ at $60) | Bear Market Adjustment (XYZ at $50) | Rationale in Bear Market |

|---|---|---|---|

| Cash Secured Put Strike | $59 (Slightly in-the-money) | $48 (Out-of-the-money) | Lower assignment risk, prioritize capital preservation |

| Cash Secured Put Expiration | Monthly | Weekly/Bi-weekly | Increased flexibility, faster adjustments |

| Covered Call Strike (if assigned at $59) | $61 (Slightly out-of-the-money) | $53 (Out-of-the-money, further OTM if needed) | Increase probability of upside capture if stock recovers |

| Position Size | 10 Contracts | 5 Contracts | Reduce overall risk exposure |

Risk Management is Paramount (Especially Now)

In any market, risk management is crucial, but in a falling market, it becomes absolutely non-negotiable. Think of it as tightening your seatbelt when the turbulence hits.

- Stop-Loss Considerations: While the wheel strategy isn't inherently about stop-losses on options contracts themselves, consider setting stop-losses on the underlying stock if you get assigned. This is a debated topic in the wheel strategy community (some are against it, as the strategy is designed to own the stock), but in a severe downturn, pre-defined exit points can prevent catastrophic losses.

- Diversification – Sector and Stock Selection: Don't wheel the same stock or sector repeatedly, especially if that sector is facing headwinds. Diversify across different sectors and stocks to mitigate sector-specific risks. And most importantly, choose fundamentally sound companies. As Benjamin Graham, the father of value investing, advocated, focus on value and quality, especially in uncertain times.

- "Know Your Stocks": This is not the time to wheel meme stocks or companies with shaky financials. Focus on high-quality, fundamentally strong businesses that you genuinely believe in and wouldn't mind holding for the long term if necessary.

Capital Allocation: Don't allocate all your trading capital to the wheel strategy, especially in a downturn. Maintain a higher cash reserve. As Warren Buffett often emphasizes,

Cash is oxygen. Cash is like oxygen, you know? If you don’t have oxygen around, it’s not that you suffocate in 10 minutes, but it’s the first thing you miss.

- Warren Buffett

Cash provides flexibility and opportunities when markets are down.

Expert Opinions on Selling Options in Bear Markets

What do the financial giants say about selling options, particularly in less-than-ideal market conditions? Opinions vary, but some common threads emerge.

Many value investors, like Warren Buffett and Charlie Munger, while not explicitly endorsing the wheel strategy, advocate for selling options under specific circumstances, primarily to enhance returns on existing holdings or to acquire assets at more favorable prices. Their approach is generally conservative and focused on long-term value rather than short-term premium collection.

Ultimately, the wisdom of selling options in a bear market often boils down to individual risk tolerance, market outlook, and strategy adaptation. There’s no universal consensus, but a cautious, adaptable, and risk-aware approach is generally recommended.

Alternatives and Considerations

Is the wheel strategy the *only* option in a falling market? Absolutely not. Here are some alternative approaches to consider:

- Halting the Wheel Temporarily: Sometimes, the most prudent move is to simply pause the wheel strategy. If you believe the market is entering a significant and prolonged downturn, reducing your exposure and waiting for more favorable conditions might be the wisest course of action. Cash is a position, remember?

- Adjusting to Other Options Strategies: Explore other options strategies that might be more suitable for bearish markets, such as bear call spreads, bear put spreads, or even inverse ETFs. These strategies are designed to profit from downward price movements.

- Focusing on Learning/Paper Trading: Market downturns can be excellent learning opportunities. Instead of aggressively trading, use this time to paper trade, refine your strategies, and deepen your understanding of market dynamics. Consider it like a market “tuition fee” – learn valuable lessons without risking substantial capital.

Conclusion: Wheeling in the Wind (or Against It?)

So, is it wise to sell options and use the wheel strategy when the market is falling? The answer, as you’ve probably gathered, is a resounding “it depends!” It's not a black and white situation. The wheel strategy isn't inherently broken in a bear market, but it requires significant adjustments, heightened risk awareness, and a more defensive approach. It demands adaptability and a willingness to deviate from the “textbook” bull market application.

If you approach it cautiously, reduce your risk exposure, focus on quality stocks, and adjust your option parameters, the wheel strategy can still generate income even in a downturn. However, it’s crucial to understand that the risk-reward profile shifts, and capital preservation becomes paramount.

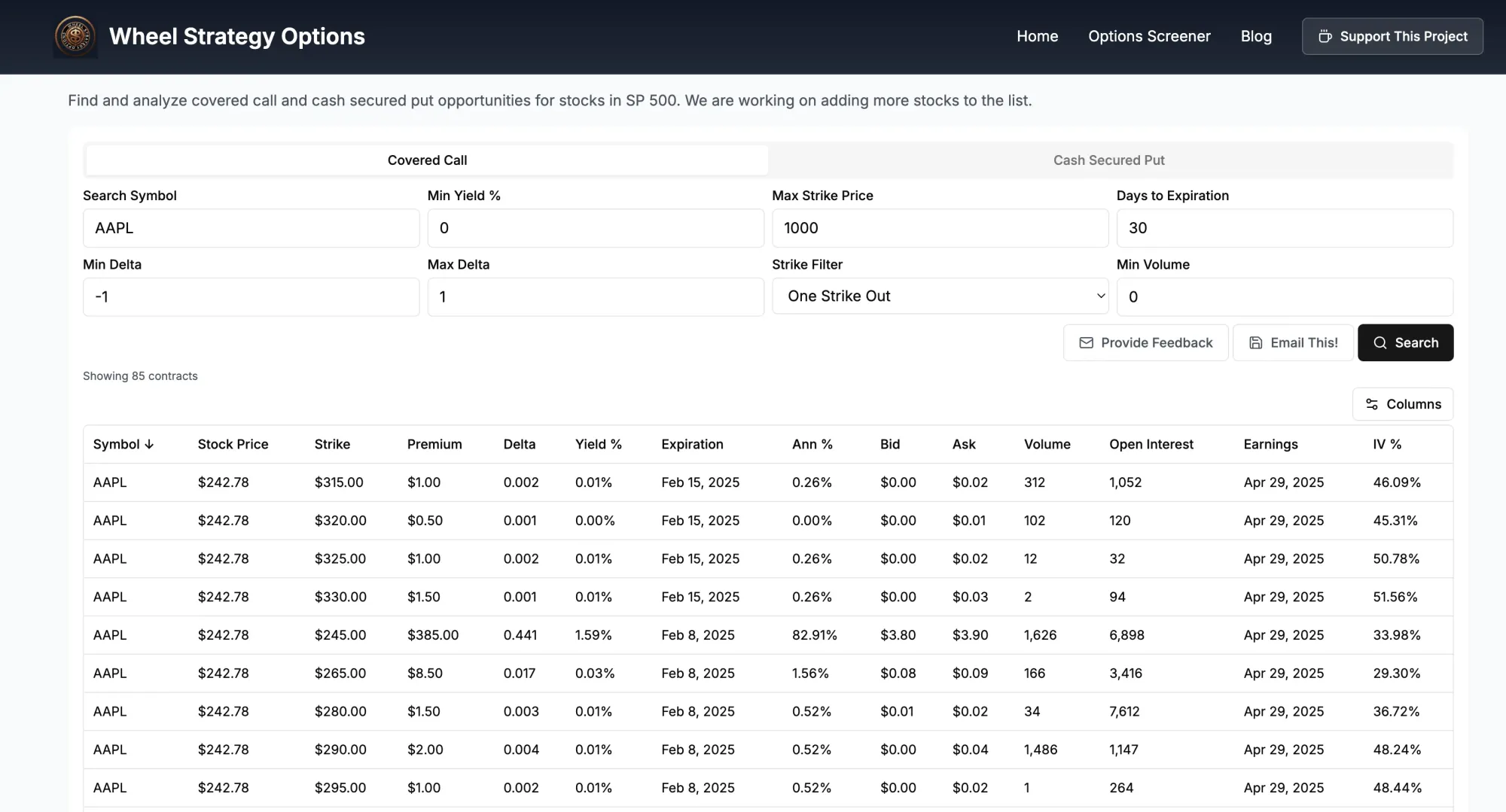

Ready to adapt your wheel strategy for any market condition? Explore our wheel strategy screener to find suitable stocks and optimize your option selections!

Key Takeaways

- The wheel strategy faces challenges in falling markets due to increased assignment risk for cash secured puts and decreased premiums for covered calls.

- Adapt your approach in bear markets by using wider strikes, shorter expirations, and smaller position sizes for cash secured puts.

- For covered calls in downturns, consider higher strikes, patience in waiting for rallies, and focusing on dividend-paying stocks.

- Risk management is paramount: reduce capital allocation, consider stop-losses on assigned stocks, and diversify your holdings.

- Expert opinions vary on selling options in bear markets; a cautious, adaptable, and risk-aware approach is generally recommended.

- Consider alternatives like pausing the wheel, exploring bearish strategies, or focusing on learning during downturns.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()