Maximize Your Options Income: The Ultimate Guide to the Wheel Strategy

Introduction to the Wheel Options Strategy

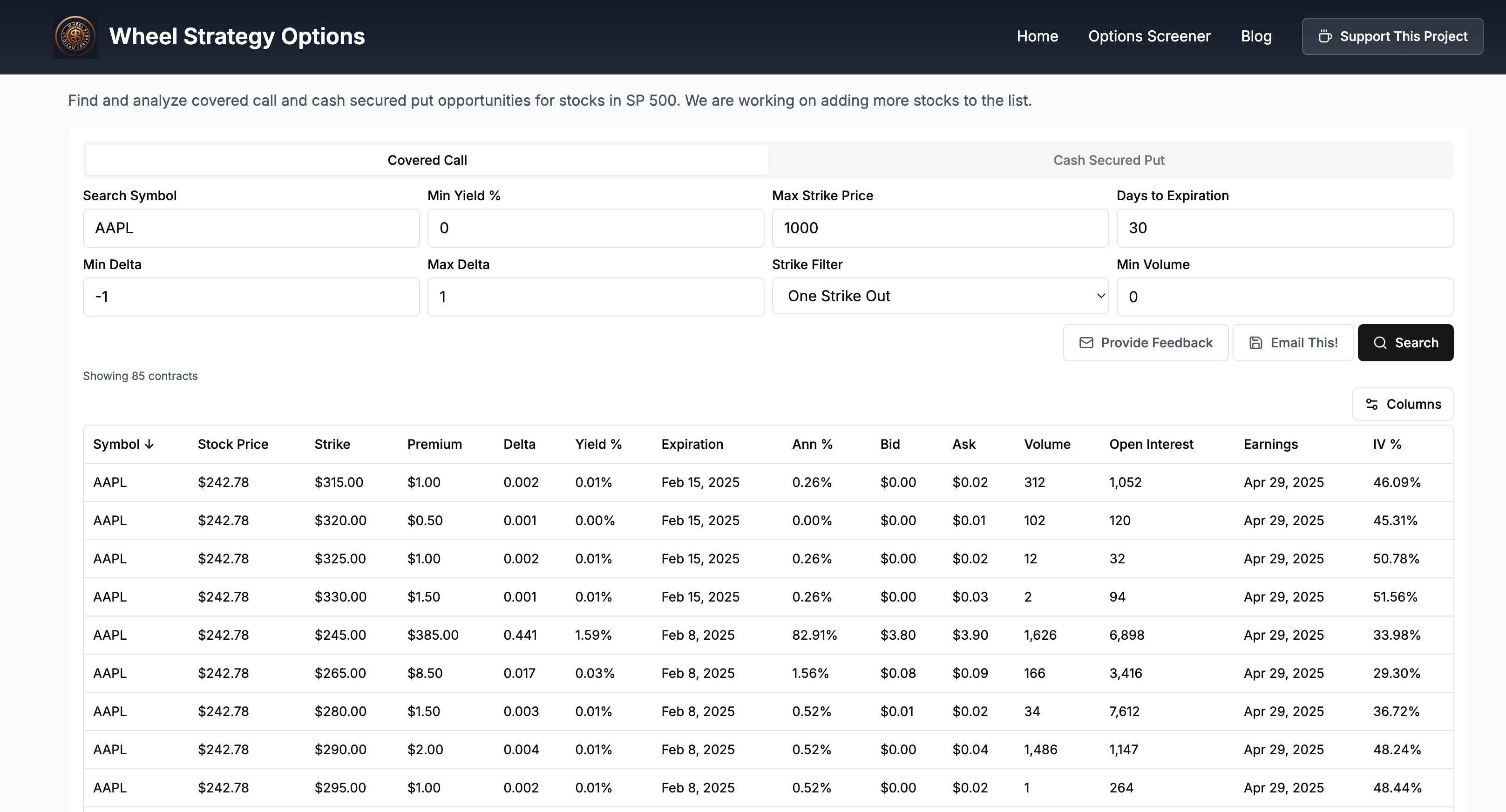

The Wheel strategy is a popular options trading method that aims to generate consistent income by selling puts and calls on underlying assets. It's often considered a conservative approach, suitable for intermediate options traders who understand the risks and rewards involved. This strategy can be especially beneficial when combined with a powerful screener that helps you identify the right opportunities. Speaking of screeners, you might find our screener to be huge accelerator to find winning wheel strategy trades.

Who Benefits Most from the Wheel Strategy?

The Wheel strategy is particularly well-suited for investors who:

- Desire Consistent Income: The primary goal of the Wheel strategy is income generation through premiums collected from selling options.

- Have a Neutral-to-Bullish Outlook: While the strategy can profit in various market conditions, a neutral-to-bullish outlook aligns best with its mechanics.

- Are Comfortable Owning the Underlying Asset: Since selling puts can lead to assignment (buying the underlying asset), traders should be prepared to own the asset at the strike price.

- Understand Options Trading Mechanics: A solid understanding of options Greeks, implied volatility, and option pricing is crucial for successful Wheel trading.

- Consistent income generation

- Potential for capital appreciation (if the underlying asset price rises)

- Defined risk (limited to the strike price minus the premium received)

- Potential for capital loss (if the underlying asset price falls significantly)

- Opportunity cost (if the underlying asset price rises rapidly)

- Assignment risk (obligated to buy the underlying asset if the put is exercised)

Can Manage Risk Effectively: Like all trading strategies, the Wheel strategy involves risks, and traders must be prepared to manage potential losses. Our previous blog post on risk management in options trading offers valuable insights.

Real-World Example

Let's say you're interested in trading the stock XYZ, currently priced at $100. You could sell a put option with a strike price of $95, expiring in 30 days, for a premium of $1. If XYZ stays above $95, you keep the premium. If it falls below $95 and you're assigned, you buy 100 shares at $95. You can then sell covered calls against your shares to generate further income.

Conclusion

The Wheel strategy can be a powerful tool for generating income from options trading. It's best suited for traders who understand options mechanics, manage risk effectively, and are prepared to own the underlying asset. Remember that options trading involves risks, and it's essential to conduct thorough research and analysis before implementing any strategy.

Disclaimer: This article is for educational purposes only and should not be considered financial advice. Investments are subject to risk and should be carefully analyzed before making any decisions.

Follow us on:

Comments ()