Dodging Assignment: The Art of Rolling Short Puts

Introduction

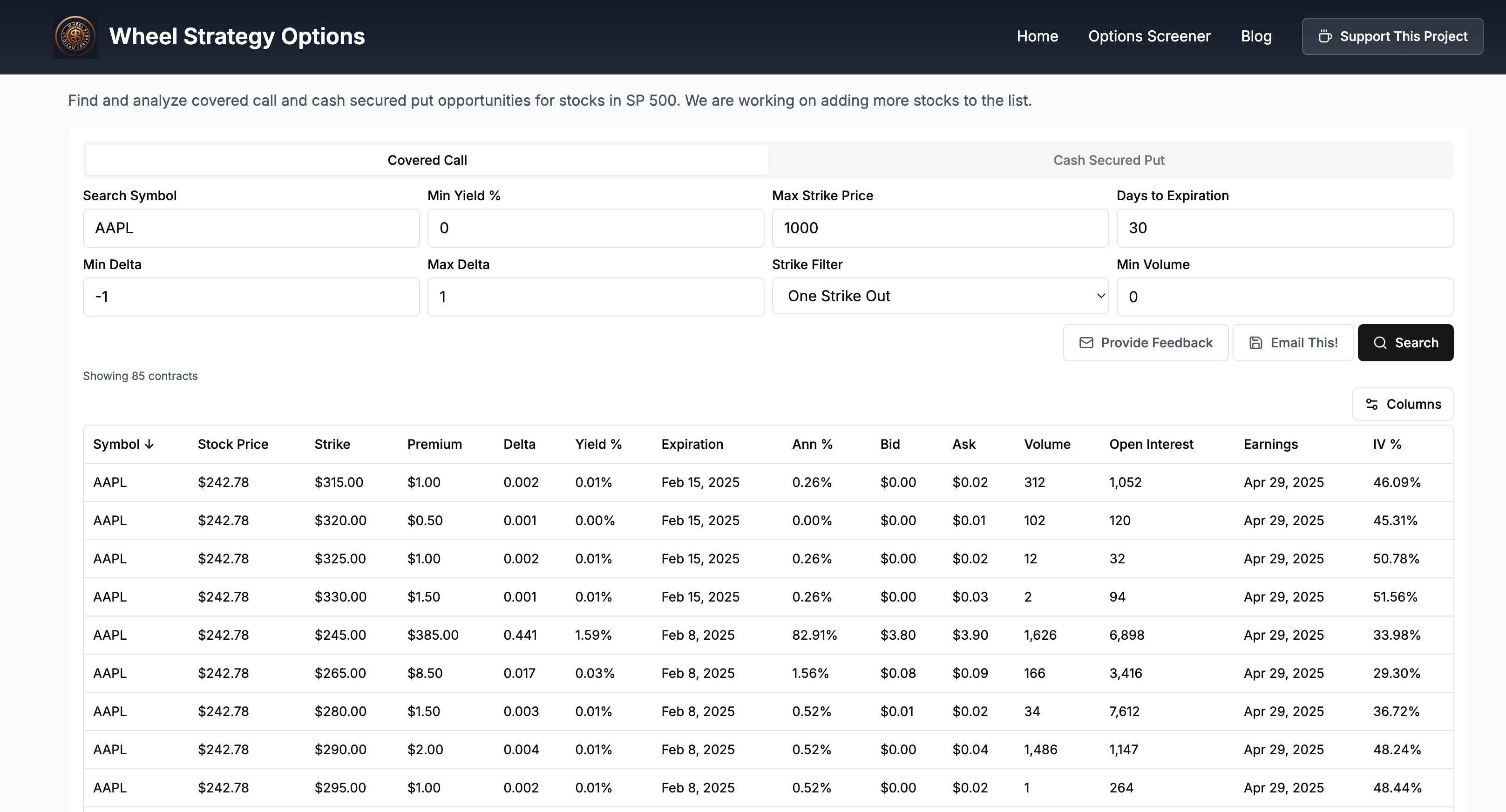

Let's get one thing straight: Nobody likes getting assigned. It's like showing up to a party you didn't RSVP for – awkward and potentially expensive. So, if you're selling puts, you need an exit strategy. And rolling those bad boys is often the most elegant escape route. We highly recommend trying our Wheel Options screener here to follow along better.

Why Roll?

Rolling isn't about admitting defeat; it's about strategically repositioning yourself. Think of it as a tactical retreat, not a full-blown surrender. Rolling allows you to:

- Defer Assignment: Kick the can down the road and give the underlying asset more time to move in your favor.

- Reduce Loss Potential: By rolling to a further-out expiration, you can decrease the probability of assignment and potentially reduce your max loss.

- Generate Additional Premium: Collect more credit by selling a new put at a higher strike or further expiration.

When to Roll?

Knowing *when* to roll is as crucial as knowing *how*. Consider rolling when:

- The Underlying is Tanking: If the underlying plummets towards your short put strike, rolling can prevent assignment and mitigate further losses.

- Implied Volatility is High: Take advantage of inflated premiums by rolling to a lower IV environment, potentially locking in profits.

- Time Decay is Working Against You: As expiration nears, theta decay accelerates. Rolling can buy you more time and slow down the decay.

How to Roll:

Rolling involves two steps: closing your existing short put and simultaneously opening a new short put at a different strike price or expiration date. Here are some scenarios:

- Rolling Down and Out: If you're bearish on AAPL and sold a $170 put expiring this week, but the price dips to $165, you could roll down and out to a $160 put expiring next week. This gives you more downside protection and additional time for the price to recover.

- Rolling Up and Out: If TSLA is consolidating near your short $250 put strike, you could roll up and out to a $260 put expiring next month. This lowers your assignment risk while collecting more premium.

- Rolling Out in Time: If MSFT is fluctuating around your $330 put strike, and time decay is eating into your profits, roll it out to the next expiration cycle.

Risk and Benefits

Rolling, like any options strategy, carries inherent risks:

- Increased Commission Costs: Each roll involves two trades, potentially increasing commission expenses.

- Missed Profit Opportunities: If the underlying recovers quickly after rolling, you might miss out on potential profits.

However, the benefits often outweigh the risks:

- Avoidance of Unwanted Assignment: This is the primary reason for rolling.

- Potential for Increased Profit: Rolling for a credit can boost overall returns.

- Flexibility: Adjust your position dynamically based on market conditions.

Disclaimer:

This article is for informational purposes only and should not be considered financial advice. Investments are subject to risk, and you should carefully analyze your situation before making any investment decisions.

Follow us on:

Comments ()