Decoding Cost Basis in Options Selling

Confused about cost basis when selling options? This guide breaks down approaches for wheel strategy traders, from simple to sophisticated, with pros, cons & recommendations.

Alright, future titans of the Wheel Strategy, let's talk about something that might sound drier than week-old toast, but is as crucial as having a solid exit strategy: cost basis when selling options. We all know the thrill of pocketing that juicy premium from selling cash secured puts or covered calls. But when it comes to tax time, or even just tracking your performance like a hawk, things can get a bit…murky. And in a market where volatility is the only constant, understanding this stuff isn't just good practice—it's your trading lifeline. Consider this: retail investors who actively traded options saw an average net loss of over $1,100 in 2023 alone, according to a study by the Options Clearing Corporation. Don't let confusion about cost basis contribute to that statistic!

The Not-So-Obvious “Cost” of Selling Options

Now, if you’re thinking, “Cost basis? Isn’t that for when I buy something?” you're not wrong, grasshopper. But when you're slinging options like a short option Jedi, the concept takes on a slightly different flavor. Think of it less as what you paid, and more about how you account for the premium you receive. Because let's be honest, that premium is the whole point of selling options in the first place, especially when we're running the wheel options strategy.

Here’s the deal: when you sell to open a cash secured put or a covered call, you're essentially creating an obligation. Uncle Sam, and your own performance tracking, want to know how to handle the money you got upfront and the potential outcomes down the road.

Method 1: The “Premium as Pure Income” Approach (Simplicity Reigns)

This is the simplest way to think about it, and for many, it’s perfectly adequate. When you sell that cash secured put or covered call and collect your premium, you simply treat it as income. Boom. Done. No muss, no fuss.

Pros:

- Easy Peasy Lemon Squeezy: Seriously, it doesn't get simpler than this. Premium received = income.

- Tax-Friendly (Potentially): The IRS generally sees option premiums as income in the year they are received (for cash-settled options or when options expire unexercised).

- Good Enough for Government Work: For basic tax reporting and a high-level view, this works fine.

Cons:

- Performance Tracking Caveats: This method doesn’t really link the premium to the underlying stock's performance. It's harder to see the direct impact of your option selling on your overall wheel strategy returns.

- Nuance? What Nuance?: Doesn't account for situations where you might roll options or get assigned. It's a bit… blunt.

Example: You sell a cash secured put on XYZ Corp with a strike price of $50 and collect a $2 premium. Using this method, you simply record $200 (for 1 contract) as income. If the option expires worthless, great! If you get assigned, your cost basis in the 100 shares of XYZ Corp is simply $50 per share. The premium is just extra gravy.

Method 2: The “Adjusted Cost Basis” Approach (For the Detail-Oriented Trader)

Now, for those of you who like to get down into the weeds and want a more granular view of your wheel strategy performance, we have the “adjusted cost basis” approach. This method tries to integrate the option premium more directly into your stock basis. Think of it as a bit more… sophisticated.

Pros:

- Performance Tracking Power-Up: This gives you a clearer picture of how your option selling is affecting your returns on the underlying stock. You can see how the premium reduces your effective cost basis if assigned on a put, or enhances your return on a covered call.

- More Realistic View: Arguably provides a more accurate representation of your investment's profitability, especially over the long haul with the wheel strategy.

Cons:

- Slightly More Complex: Requires a bit more record-keeping and calculation. Not rocket science, but not as brain-dead simple as Method 1.

- Tax Disconnect (Potentially): Remember, the IRS still largely treats the premium as income in the year received. This adjusted cost basis is more for your internal performance tracking than necessarily for tax purposes.

Example (Cash Secured Put): You sell a cash secured put on ABC Trading Group with a strike of $75 and receive a $3 premium. If assigned, your cost basis in the shares is adjusted downward by the premium. So, instead of a $75 cost basis, it becomes $72 ($75 strike - $3 premium). This reflects that you effectively paid less for the stock because of the premium you collected. As Warren Buffett famously said,

Price is what you pay. Value is what you get.- Warren Buffett

In this case, the premium enhances the value you receive for potentially owning the stock.

Example (Covered Call): You own 100 shares of XYZ Corp at a cost basis of $60 per share. You sell a covered call with a strike of $65 and collect a $2 premium. If the call is exercised, your effective selling price is adjusted upward by the premium. So, instead of just selling at $65, you effectively sold at $67 ($65 strike + $2 premium). This shows how the covered call premium boosted your return.

Method 3: The “Hybrid” Approach (Best of Both Worlds?)

Can't decide? Why not have your cake and eat it too? The hybrid approach combines the simplicity of Method 1 for tax purposes with the performance insights of Method 2.

Here's how it works: For tax reporting, you treat the premium as income in the year received (Method 1). But for your own performance tracking and analysis, you use the adjusted cost basis (Method 2). This way, you keep the taxman happy and still have a clear picture of your wheel strategy’s effectiveness.

Pros:

- Tax Compliance: Aligns with the standard tax treatment of option premiums.

- Robust Performance Insights: Provides a more detailed and nuanced view of your trading performance.

- Flexibility: Gives you the best of both worlds – simplicity where needed (taxes) and detail where desired (performance).

Cons:

- Slightly More Record Keeping: You're essentially running two sets of books (one for taxes, one for performance). But let's be real, if you're seriously running the wheel strategy, you should be tracking your trades diligently anyway.

Recommendation: Keep it Simple, But Stay Informed

For most wheel strategy traders, especially those starting out, Method 1 (Premium as Pure Income) or Method 3 (Hybrid) are likely the most practical. Simplicity has its virtues, and for tax purposes, treating the premium as income is generally straightforward. However, if you are serious about optimizing your wheel strategy and want to deeply understand your performance, especially over time, embracing the adjusted cost basis concept (Method 2 or 3) for your own tracking is highly recommended.

Ultimately, the “best” method depends on your individual needs and preferences. There’s no single “right” answer. The key is to be consistent in your approach and understand the implications of your chosen method. And remember, as Naval Ravikant wisely said,

Seek wealth, not money or status. Wealth is having assets that earn while you sleep. Money is how we transfer time and wealth. Status is your place in the social hierarchy.- Naval Ravikant

Understanding your true returns, factoring in option premiums and cost basis, is a step towards building that wealth through smart options trading.

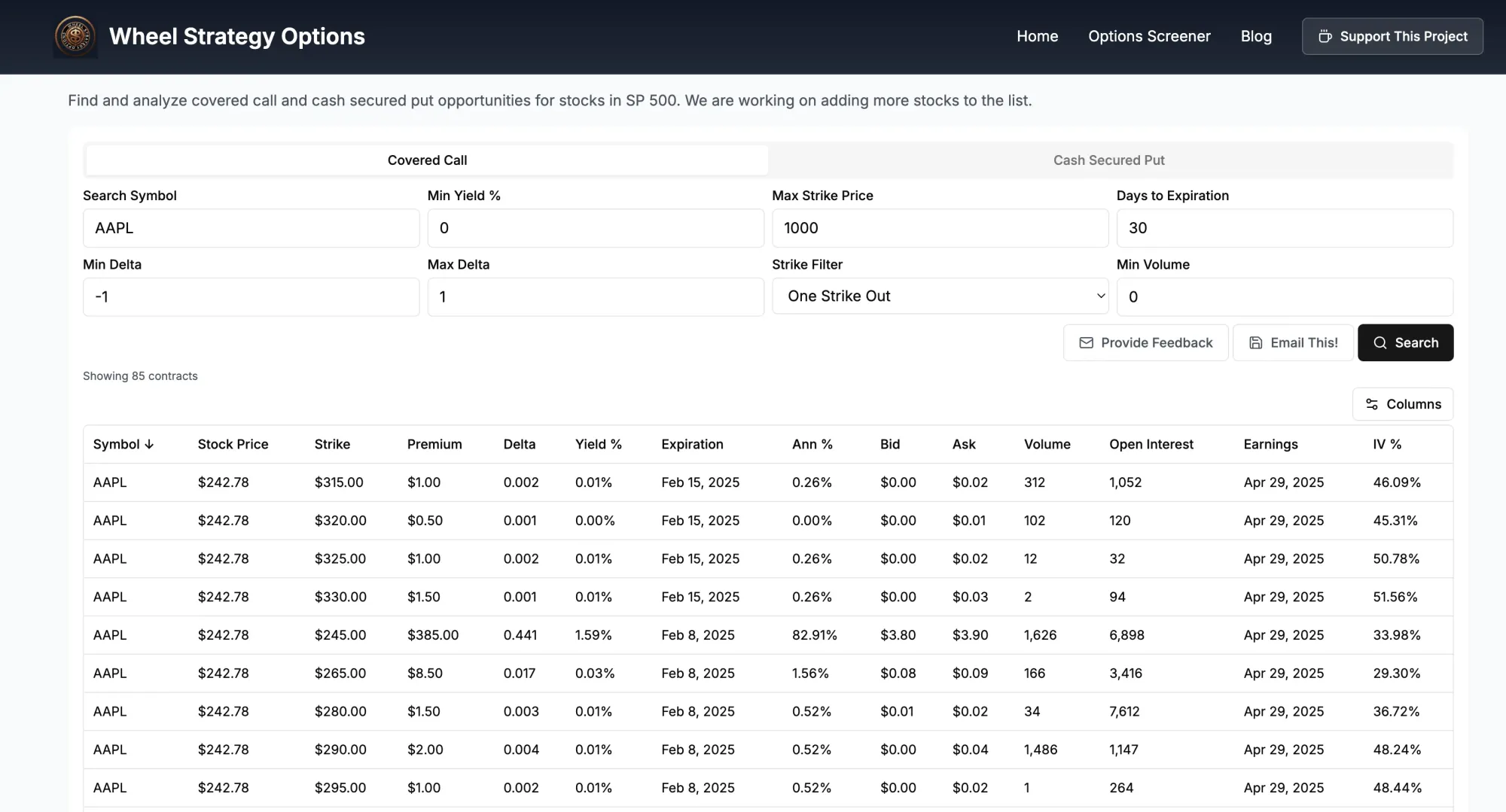

To make your wheel strategy journey even smoother, be sure to check out our wheel strategy screener. It's designed to help you find optimal opportunities for selling cash secured puts and covered calls, so you can focus on racking up those premiums and, now, understanding exactly how they fit into your overall picture.

Key Takeaways:

- Premium is King (or Queen): When selling options, the premium received is the initial reward. How you account for it matters.

- Simplicity vs. Granularity: Choose a cost basis method that balances ease of use with the level of performance insight you need.

- Taxman Cometh: Be mindful of the IRS's treatment of option premiums for tax reporting, which is generally as income.

- Consistency is Key: Whatever method you choose, stick with it for clear and comparable performance tracking.

- Screener Power: Leverage tools like our wheel strategy screener to find better option selling opportunities.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()