Comparing Strategies for Selling Options: Covered Calls, Cash-Secured Puts, Iron Condors, Credit Spreads, and Naked Options

Covered calls vs. cash-secured puts vs. iron condors: Which option selling strategy best fits your income goals and risk tolerance?

The options market, a realm of both significant opportunity and considerable risk, has consistently intrigued investors seeking enhanced returns. In today's volatile market, where traditional investment strategies might fall short, selling options presents a compelling avenue for generating income and strategically managing risk.

This in-depth guide delves into the nuances of various options selling strategies, empowering intermediate to advanced traders to navigate this complex landscape with greater confidence and potentially amplify their portfolio's performance.

Covered Calls

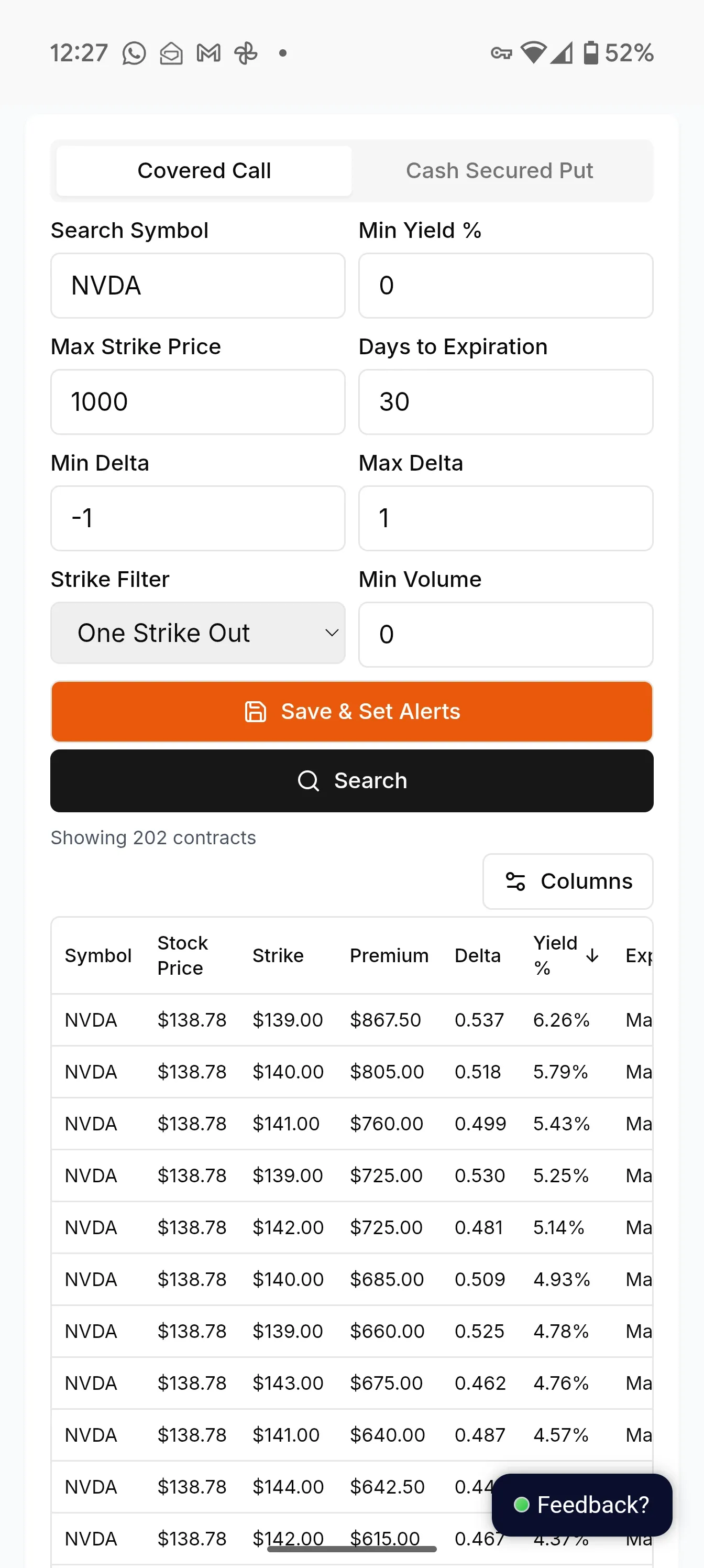

Covered calls involve selling call options on underlying assets you already own. This strategy generates income (premium received) but limits your upside potential if the underlying price surges. Think of it as renting out your upside potential in exchange for steady cash flow.

Best used: In a neutral to slightly bullish market. A solid understanding of selling options is crucial for executing covered calls.

Example: You own 100 shares of XYZ Corp. and sell one call option contract with a strike price above the current market value. If XYZ remains below the strike price, you keep the premium. If it surpasses the strike, your shares may be called away.

Cash-Secured Puts

Cash-secured puts involve selling put options, obligating you to buy the underlying asset if the price drops below the strike price. Essentially, you're stating your willingness to purchase the asset at a specified price (the strike price).

Best used: In a bullish to neutral market, particularly when you are looking for an entry point into a stock.

Example: You sell a cash-secured put on ABC Trading Group. If the price stays above the strike, you keep the premium. If it falls below, you buy 100 shares at the strike price.

Iron Condors

Iron condors are a defined-risk strategy involving both puts and calls, creating a profit range within which you benefit.

Best used: This is a more neutral strategy, ideal for sideways or range-bound markets.

Example: You construct an iron condor on XYZ Corp, defining a lower and upper price range. As long as XYZ's price remains within this range at expiration, you profit. Selling options can often be optimized with strategies like iron condors in volatile times.

Vertical Credit Spreads

Vertical credit spreads involve selling one option and buying another (either both calls or both puts) with different strike prices, defining a risk/reward profile.

Best used: They are versatile and can be used in various market conditions, depending on how they are constructed.

Example: Selling a call spread on ABC Trading Group with a lower strike price below the current market value and a higher strike price above it allows you to profit if the price stays below the higher strike.

Naked Options (Advanced)

Naked options involve selling calls or puts without owning the underlying asset or having a hedging position. This strategy carries significant risk but also offers the potential for substantial profits.

Best used: Suitable only for experienced traders with a high risk tolerance.

Example: Selling a naked call exposes you to unlimited losses if the underlying price skyrockets. Conversely, selling a naked put exposes you to significant losses if the underlying price plummets. Selling naked options requires significant capital and understanding.

Wheel Options Trading

The Wheel options trading strategy combines covered calls and cash-secured puts. Cash-secured puts can help acquire the underlying stock for selling covered calls, which is known as “wheeling” into a covered call position. You can also wheel into cash-secured put options after selling your call option. This strategy maximizes income generation from the premium received and capital appreciation of the underlying asset.

Want to supercharge your wheel strategy? Check out our wheel strategy screener to identify optimal options trades and streamline your process.

Key Takeaways

- Selling options can generate income and enhance portfolio returns.

- Covered calls and cash-secured puts are fundamental strategies for selling options, especially within the wheel strategy.

- Iron condors and vertical credit spreads offer defined risk profiles.

- Naked options carry higher risks but also higher potential rewards.

- Matching strategies to market conditions is crucial for success in selling options.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()