Building a Killer Options Selling Watchlist for CCs and CSPs

Level up your wheel strategy for selling options with a killer CC and CSP watchlist. Learn how to select robust underlying assets.

Its no surprise that option selling strategies like covered calls and cash-secured puts are extremely prevalent and widely used by both retail and institutional traders. Smart traders are raking in premiums, and a killer options selling watchlist is their secret weapon.

But, money is not easy! Like anything important in life, your strategy for selling options must be well thought and efficient. This blog post covers both aspects. Caution: this does call upon some critical thinking! It was painful the first time I had to do it. However, maintaining it is much easier and has exponential returns. Be it for efficiency, income, effective tracking or even sleeping well knowing your have your investments backed by sound thinking.

Forget throwing darts in the dark—let's build a watchlist that sets you up for profitable wheeling.

The Foundation: Defining Your Wheel Strategy Parameters

Before diving into specific tickers, nail down your wheeling criteria. Are you a yield hog or a risk-averse maestro? What's your ideal holding period? Clarify your risk tolerance and financial goals to define parameters for your watchlist. Use this checklist as a guide to your thinking process.

As the insightful Charlie Munger says,

Knowing what you want from your wheel strategy is half the battle.

Quality Over Quantity: Selecting Robust Underlying Assets

Now comes the fun part: populating your watchlist with tickers that meet your wheeling criteria. Analyze potential candidates with surgical precision, looking for characteristics like stable price history, decent option premiums, and solid fundamentals. Here is a solid checklist.

Wheel Strategy Watchlist Builder - Quality over Quantity Checklist:

✅ Solid Fundamentals First:

- Is this a company you'd be comfortable owning long-term if assigned? (Consider profitability, debt, industry position). Does the company have a reasonably stable and understandable business model?

✅ Moderate Historical Volatility (HV): Find Your Sweet Spot:

- Is the stock's historical volatility neither excessively high (leading to likely early assignment and stress) nor too low (resulting in meager premiums)?

✅ Decent Option Premium - Is it Worth Wheeling?:

- At your target delta (e.g., 0.30 delta puts), does the premium offered for cash-secured puts provide an acceptable annualized return based on your risk tolerance and yield goals?

- (Action: Check option chains for potential put premiums at your desired delta. Calculate potential annualized return. Does it meet your minimum yield target?)

w✅ Sufficient Option Liquidity - Smooth Trading Essential:

- Are the bid-ask spreads on the option chain reasonably tight, allowing for efficient entry and exit without excessive slippage?

- Is there sufficient open interest and volume in the options you plan to trade (especially at your target strike prices and expiration dates)?

- (Action: Examine the option chain. Look for tight bid-ask spreads and reasonable open interest/volume across multiple strikes and expirations.)

✅ Stable Price History (Relative to Industry):

- Does the stock price generally exhibit a degree of stability and predictable movement, or is it prone to erratic, large swings unrelated to broad market movements?

- (Action: Briefly review a price chart over the past year. Look for trends and patterns. Avoid tickers with a history of sudden, unpredictable price spikes or crashes.)

✅ (Bonus) Dividend Yield (If Seeking Extra Income):

- Does the company pay a dividend, offering potential extra income, particularly when selling covered calls in the wheel? (Consider if dividend capture is part of your strategy).

- (Action: Check dividend yield. If dividend income is a priority, note the ex-dividend dates and yield percentage.)

Building the Framework: Sectors, Industries, and Market Cap

Diversification is key. Spread your watchlist across different sectors and industries to mitigate systemic risks. Balance your picks across large-cap behemoths for stability and some mid-cap dynamos for potential growth. You don't want all your eggs in one shaky basket.

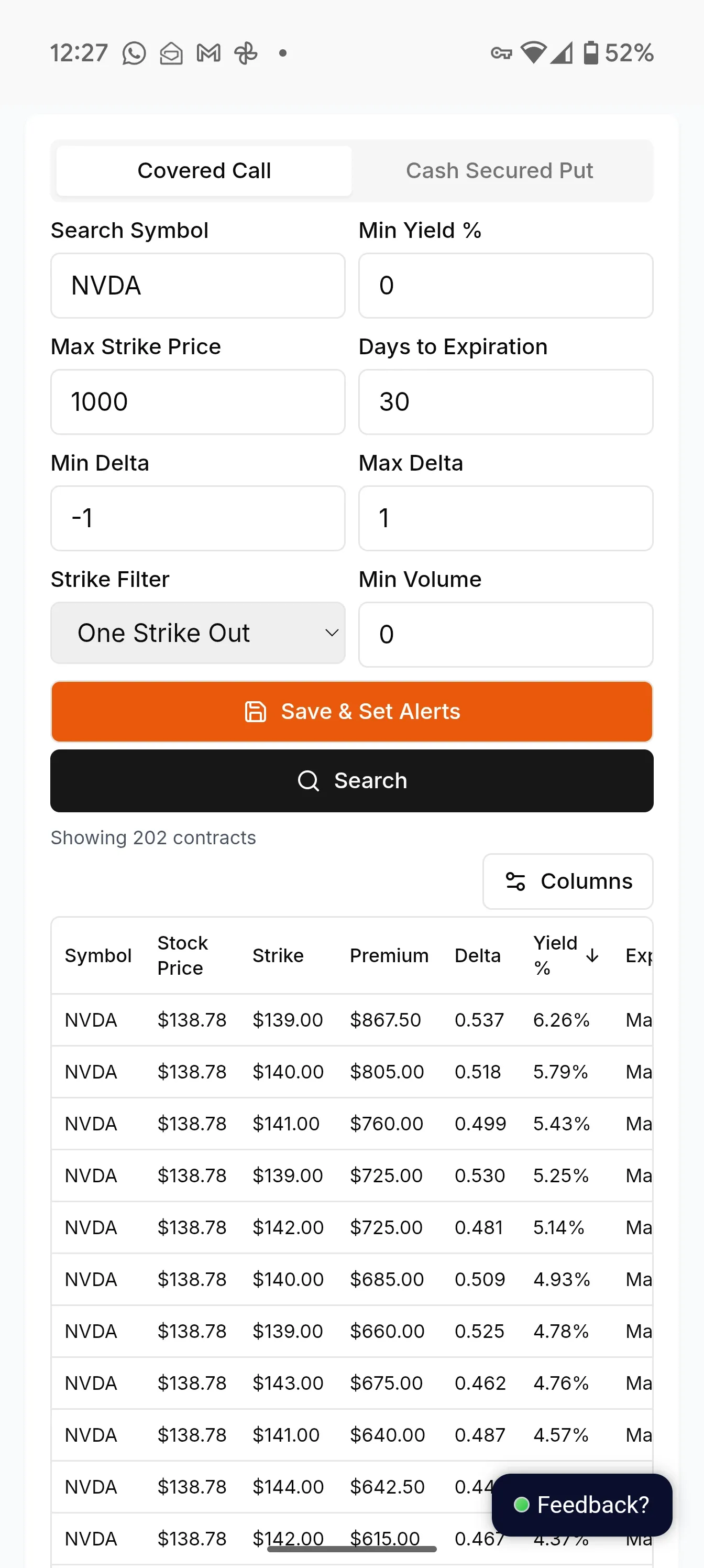

Leveraging the Power: Using a Wheel Strategy Screener

Streamline your search and analysis using the wheel strategy screener to quickly identify potential opportunities that fit your unique trading style and risk profile. You can even automate some of the watch list monitoring by setting up free alerts that land in your inbox.

The Ongoing Task: Regular Review and Adjustment

Market conditions shift faster than a politician's promises. Regularly review and adjust your CSP watchlist. Remove underperformers, add promising newcomers, and update your criteria as needed. Your watchlist is a living document, not a dusty relic. I recommend a reminder for 9 AM 1st Saturday of each month, works for me. Warren Buffett wisely advises,

The same applies to managing your watchlist - adapt and conquer.

Side Note: Mastering the Art of the Wheel Strategy

While this guide focuses on watchlist creation, mastering the entire wheel strategy, including selling options, optimizing covered calls and effectively managing cash secured puts requires continued learning. Explore our extensive blog library for in-depth articles on every aspect of this powerful options trading strategy.

Key Takeaways

- Define clear parameters for your wheel strategy.

- Focus on quality assets with good liquidity and premiums.

- Diversify across sectors and market caps.

- Regularly review and adjust your watchlist.

Disclaimer: This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()