Best Stocks for the Wheel Strategy: The Essentials

Introduction to the Wheel Strategy

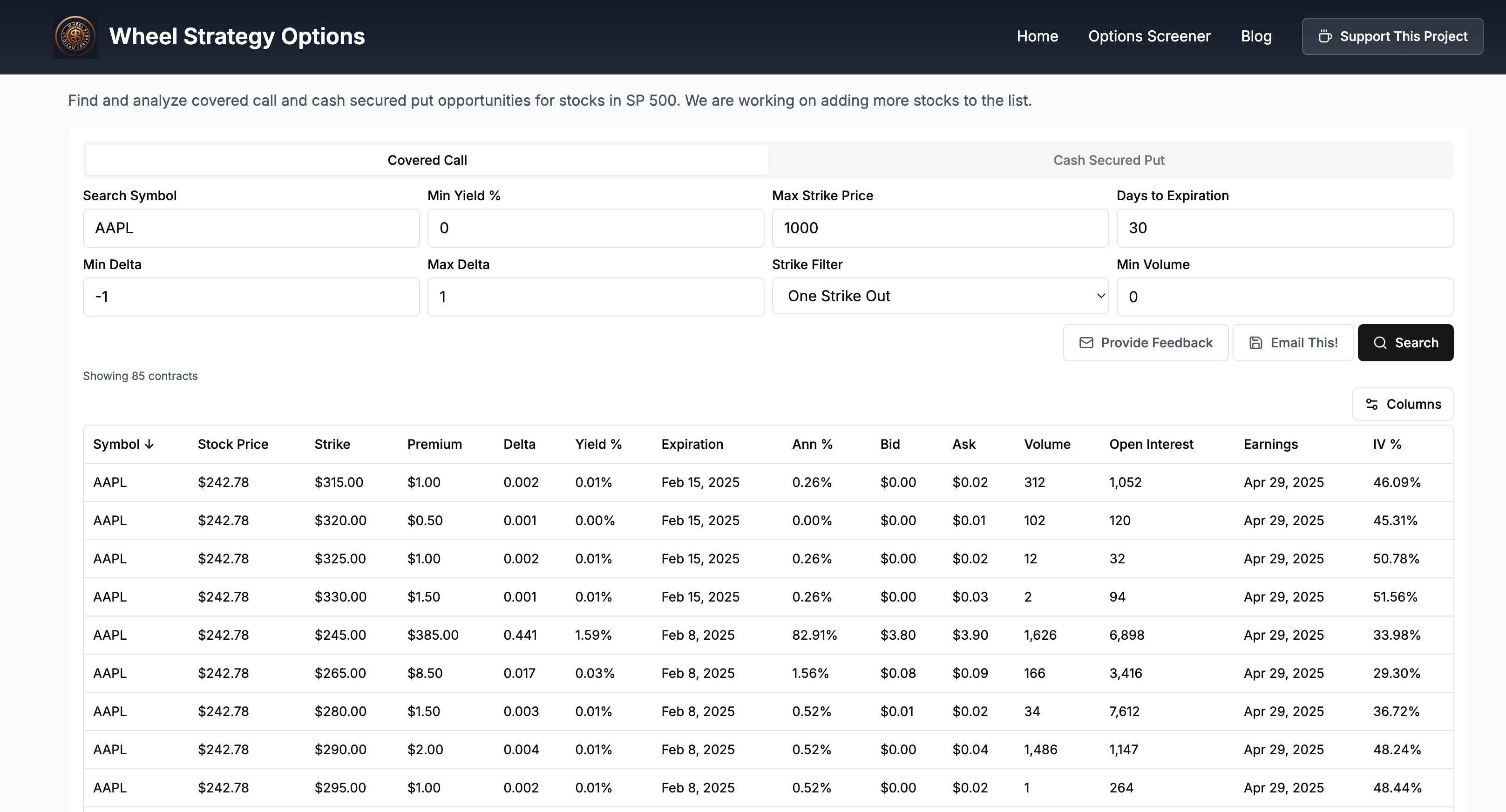

The Wheel Strategy is a popular options trading strategy that aims to generate income by selling puts and calls on underlying assets. It involves selling cash-secured puts, then selling covered calls if the put is assigned. This strategy is best suited for investors with a neutral to bullish outlook on the underlying asset. We highly recommend trying our Wheel Options screener here to follow along better.

Choosing the Right Stocks for the Wheel Strategy

Selecting the right stocks is crucial for the success of the Wheel Strategy. Here's what to consider:

- High-quality companies: Focus on well-established companies with a history of consistent profitability and strong fundamentals. This reduces the risk of significant price drops.

- Liquid options: Opt for stocks with high options trading volume and narrow bid-ask spreads. This ensures you can easily enter and exit trades at favorable prices.

- Decent dividend yield (optional): While not mandatory, a dividend can provide an additional income stream while you're wheeling the stock.

- Implied Volatility (IV): Higher IV generally translates to higher premiums for options, which is beneficial for the Wheel Strategy.

Examples of Suitable Stocks

Stocks like AAPL, MSFT, and GOOGL are often favored by Wheel traders due to their high liquidity, strong fundamentals, and decent option premiums. However, remember that market conditions and individual stock performance can significantly impact the success of the strategy.

Real-Life Scenario

Let's say you choose to wheel AAPL. You start by selling a cash-secured put with a strike price below the current market price. If the stock price stays above the strike price at expiration, you keep the premium. If the price falls below the strike price, you are assigned the shares. Now, you sell covered calls against your shares, generating further income. You can explore more details in this post on covered call premium generation.

Risks and Benefits of the Wheel Strategy

Benefits

- Income generation: The primary benefit is the potential for consistent income from premiums.

- Reduced cost basis (if assigned): When puts are assigned, your cost basis for the shares is reduced by the premium received.

Risks

- Capital tied up: Capital is required to secure the puts, limiting your investment flexibility.

- Potential for losses: If the stock price drops significantly, you could experience losses if you are assigned shares.

Disclaimer: This blog post is for informational purposes only and should not be construed as financial advice. Investments are subject to risk and should be carefully analyzed before making any decisions.

Follow us on:

Comments ()