Advanced Yield Optimization & Drawdown Mitigation in the Wheel Strategy for Experienced Traders

Discover advanced strategies for optimizing yield and mitigating drawdowns in your Wheel Strategy, moving beyond basic options selling.

In the dynamic landscape of options trading, the pursuit of consistent income often leads experienced participants to strategies like the Wheel. While its foundational mechanics of selling options - specifically cash secured puts and covered calls - are well-understood, achieving superior, risk-adjusted returns demands a nuanced approach beyond mere premium collection. Recent market volatility, evidenced by the VIX index frequently oscillating outside its historical averages, underscores the critical need for advanced strategies to optimize yield and, more importantly, mitigate drawdowns within your wheel options framework.

Beyond Basic Premium Collection: Elevating Your Wheel Strategy Yield

The allure of collecting weekly or monthly premiums can sometimes overshadow the deeper considerations necessary for long-term success with the Wheel Strategy. Advanced traders understand that maximizing yield isn't just about the highest premium, but rather the sustainable, risk-adjusted returns generated over time. This involves meticulous selection of underlyings and dynamic adjustment of strike prices and expirations.

Strategic Underlyings: Beyond High-Beta Traps

For the sophisticated practitioner, choosing the right underlying stock is paramount. While high-beta stocks might offer inflated premiums due to higher implied volatility, they also carry significantly greater risk of substantial drawdowns, undermining the core principle of capital preservation central to the Wheel. Instead, focus should be on fundamentally sound companies with stable earnings, manageable debt, and a clear competitive advantage. Consider XYZ Corp, a mature, dividend-paying tech company with consistent cash flow, versus ABC Trading Group, a nascent biotech firm with volatile earnings and unpredictable clinical trial outcomes. While ABC might offer a 2% weekly premium on a cash secured put, the probability of assignment at a significantly lower price is far greater, potentially tying up capital in a depreciating asset. XYZ, offering perhaps 0.5% weekly, might prove more profitable over time due to its stability and lower risk of severe assignment.

Dynamic Strike and Expiration Selection

Fixed rules for strike selection (e.g., always 10% OTM) limit flexibility and profitability. Experienced traders adjust strike prices based on the underlying's technical levels (support/resistance), expected volatility, and overall market sentiment. Similarly, expiration periods should be dynamic. In periods of high implied volatility, shorter-dated options (10-30 days to expiration) may offer disproportionately higher premiums, allowing for more frequent cycles of selling options. Conversely, during low volatility, extending the duration slightly might be necessary to capture sufficient premium, but always balancing time decay (theta) against the increased risk of prolonged exposure. Understanding implied volatility skew and term structure is also crucial; often, a slight adjustment to a different strike or expiration within the same week can significantly improve the risk-reward profile of a cash secured put or covered call.

Mitigating Drawdowns: Robust Risk Management for Wheel Practitioners

The greatest threat to long-term profitability in the Wheel Strategy is the unmanaged drawdown. Effective risk management is not merely a defensive measure; it is an integral component of yield optimization.

Proactive Assignment Management: Rolling Strategies and Delta Adjustment

Getting assigned shares is an inherent part of the Wheel. However, it's how you manage that assignment that determines your strategy's resilience. When a cash secured put is in danger of being in-the-money, evaluating a roll becomes critical. Should you roll down and out (lower strike, further expiration) to collect more premium and avoid immediate assignment, or simply take assignment and transition to covered calls? The decision hinges on your conviction in the underlying, its new support levels, and the premiums available. If assigned shares of XYZ Corp at $100 and it dips to $95, you might roll your covered call down to the $95 strike and out to a further expiration, collecting premium and waiting for a recovery, rather than immediately selling for a loss. For larger positions or high-conviction stocks, some traders might even consider small delta adjustments, selling additional puts or calls to balance the portfolio's directional exposure if the stock moves significantly against them post-assignment.

“The most important thing in investing is not to lose money.”- Warren Buffett

Position Sizing and Portfolio Diversification

Concentration risk, while potentially amplifying gains, can decimate a portfolio during adverse events. Position sizing should be a function of account size, volatility of the underlying, and correlation with other positions. Avoid allocating more than 5-10% of your total capital to any single underlying, especially for a strategy that involves both long and short options positions. Furthermore, diversifying across different sectors or industries can reduce overall portfolio beta and mitigate systemic risks. If all your Wheel positions are in technology stocks, a sector-wide downturn could severely impact your entire portfolio, regardless of individual company strength.

Hedging with Options: Beyond the Wheel Itself

While the Wheel is income-focused, sophisticated traders may employ external hedges. For instance, if you have a significant portion of your capital tied up in assigned shares or expect a broader market correction, purchasing out-of-the-money (OTM) long puts on your major holdings, or even index ETFs, can provide inexpensive portfolio insurance. This acts as a 'circuit breaker' for unexpected, sharp declines, allowing you to absorb losses and re-evaluate without significant capital impairment.

Navigating Market Cycles and Macroeconomic Influences

The Wheel Strategy is not static; its optimal application adapts to prevailing market conditions. In bullish or range-bound markets, the strategy tends to thrive, capturing consistent premiums. However, in bearish or highly volatile environments, the risk of assignment at unfavorable prices increases significantly. Experienced traders adjust by:

- Reducing position size: Limiting exposure when uncertainty is high.

- Widening strike distances: Selling further out-of-the-money puts to decrease assignment probability.

- Focusing on defensive sectors: Shifting to less cyclical industries or dividend aristocrats.

- Prioritizing capital preservation: Sometimes, the best trade is no trade, or simply holding cash.

Macroeconomic factors like interest rate changes, inflation, and geopolitical events also cast a long shadow. Rising interest rates, for example, can increase the cost of capital and impact valuations, potentially leading to lower stock prices and reduced option premiums. Keeping a keen eye on central bank policies and economic reports is crucial for anticipating market shifts and adjusting your Wheel accordingly.

“The biggest mistake investors make is to think about how much money they can make, rather than how much money they can lose.”- Ray Dalio

The Psychological Edge: Discipline and Data-Driven Decisions

Even with the most robust strategy, human psychology remains the Achilles' heel for many traders. Emotional decisions, driven by fear or greed, can quickly derail a well-constructed plan. The discipline to stick to your risk management rules, cut losses when necessary, and avoid chasing premiums in overextended markets is paramount.

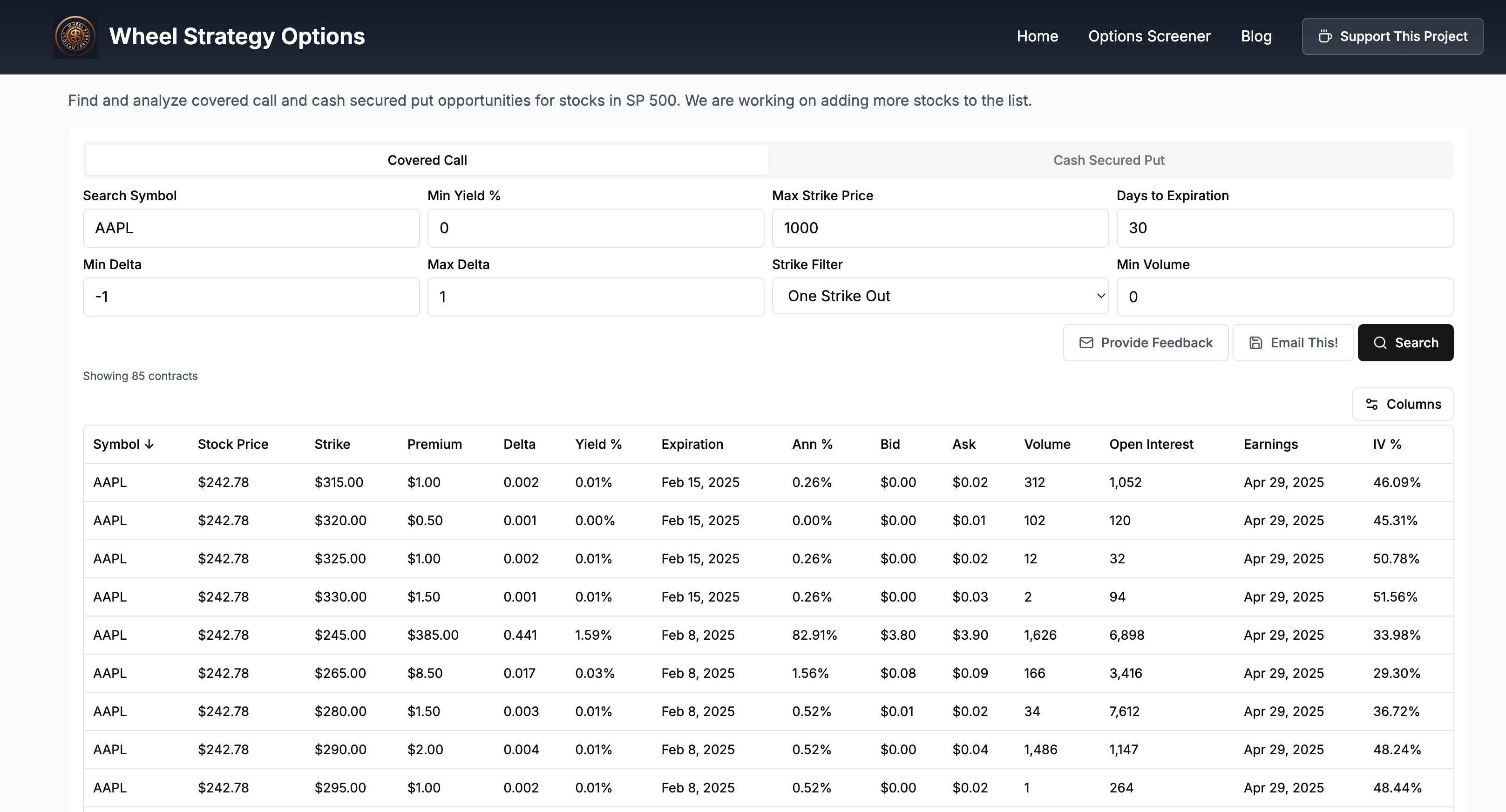

Furthermore, relying on data and analysis to inform your decisions, rather than gut feeling, is a hallmark of professional trading. Track your win rates, average premium collected, average loss on assigned shares, and overall capital utilization. Tools like a sophisticated wheel strategy screener can provide invaluable insights, helping you identify optimal setups, analyze historical performance, and backtest different parameters for your wheel options strategy. This data-driven approach fosters objectivity and allows for continuous improvement.

“My main point in this book is that if you want to get rich, you need to understand that all returns are random, and that the best way to deal with randomness is to have a robust strategy that doesn't rely on predicting the future.”- Nassim Nicholas Taleb

Ultimately, mastering the Wheel Strategy at an advanced level transcends basic trade execution. It involves a holistic understanding of market dynamics, rigorous risk management, continuous adaptation, and unwavering psychological discipline. By integrating these advanced principles, experienced traders can transform the Wheel from a simple income strategy into a powerful engine for consistent, risk-adjusted portfolio growth.

Key Takeaways

- Optimize yield by selecting fundamentally strong underlyings and dynamically adjusting strike prices and expirations based on market conditions and volatility.

- Proactively manage assignment risk through strategic rolling of cash secured puts and covered calls, and consider delta adjustments for large positions.

- Implement robust portfolio-level risk management through disciplined position sizing and diversification across sectors.

- Consider external hedging strategies, such as purchasing OTM long puts, to protect against significant market downturns.

- Adapt your wheel options strategy to different market cycles and macroeconomic influences, potentially reducing exposure during periods of high uncertainty.

- Cultivate psychological discipline and rely on data-driven decisions, leveraging tools like the wheel strategy screener to enhance your analytical edge.

Disclaimer: *This blog post is for informational purposes only and should not be considered financial advice. Trading options involves risk of loss. Conduct thorough research and consult with a qualified financial advisor before making any investment decisions.*

Follow us on:

Threads | X (Twitter) | Reddit | Instagram

Comments ()