Advanced Wheel Strategy Adjustments: Master Dynamic Risk Management

Learn to strategically roll options, manage risk in volatile markets, make adjustments using technical indicators

The Wheel Strategy is a favorite among options traders for its straightforward approach: sell cash-secured puts to acquire stock at a discount, then sell covered calls to generate income. While this simple cycle works well in stable markets, experienced traders know that markets are rarely that cooperative. Volatility spikes, unexpected assignments, and shifting technical landscapes demand more sophisticated adjustments to maintain profitability and manage risk effectively.

In this article, we’ll dive deep into advanced wheel strategy adjustments, covering:

- Rolling Options Strategically

- Managing Assignment Risk in Volatile Markets

- Incorporating Spreads with the Wheel

- Dynamic Adjustments Using Technical Indicators

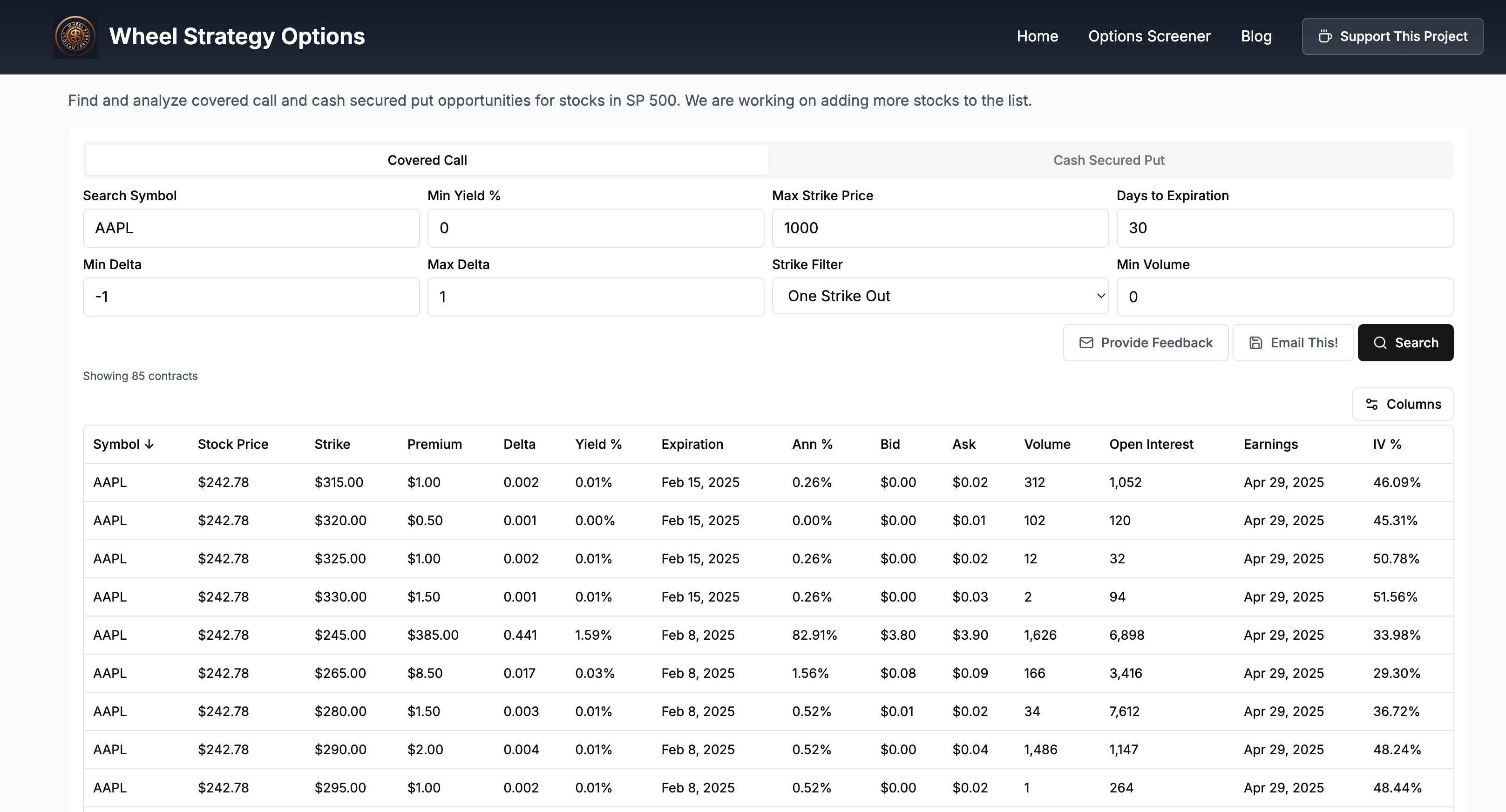

Let’s explore how to elevate your Wheel Strategy beyond the basics. We highly recommend trying our Wheel Options screener here to follow along better.

1. Rolling Options Strategically: Turning Adversity into Opportunity

Rolling options—adjusting the strike price and/or expiration date—is a cornerstone tactic for experienced Wheel traders. However, it’s not just about "buying time." Strategic rolling can enhance profitability, reduce risk, and adapt to changing market conditions.

When to Roll:

- Defensive Rolling: When a short put or call is deep ITM, and assignment could lead to undesirable exposure.

- Offensive Rolling: When maximizing premium collection while capitalizing on directional bias.

Rolling Techniques:

- Vertical Rolls (Strike Adjustments): Roll up or down to a new strike within the same expiration. For example, if a short put at $100 is ITM and the stock has dropped to $95, rolling down to a $90 strike for a credit reduces risk while collecting more premium.

- Calendar Rolls (Expiration Adjustments): Roll to a later date, maintaining the same strike to benefit from more time decay and higher premium. This is common when the trade thesis remains intact, but more time is needed.

- Diagonal Rolls: Change both the strike and expiration. For instance, rolling a $100 strike expiring this Friday to a $95 strike expiring in two weeks. This allows you to adjust for market movement and volatility shifts simultaneously.

Key Considerations:

- Cost of Rolling: Always calculate if rolling for a debit is justified. Sometimes, taking an assignment or accepting a loss can be more strategic.

- IV Environment: In high IV scenarios, rolling can be expensive. Consider partial rolls or combining with spreads (discussed below).

2. Managing Assignment Risk in Volatile Markets

While assignment is part of the Wheel, managing when and how you’re assigned can significantly impact profitability, especially in volatile markets.

Tactics to Manage Assignment:

- Avoid Last-Minute Gamma Risk: The final days before expiration carry heightened gamma risk, where small price moves lead to significant delta changes. Rolling early helps manage this risk.

- Use of Stop-Loss Levels: Some traders set mental stop-loss levels for options, rolling or closing when these thresholds are breached, rather than risking assignment in unfavorable conditions.

- Dynamic Position Sizing: In volatile markets, reduce the size of positions to ensure you have sufficient capital to handle multiple assignments if needed.

Proactive Assignment Defense:

- Delta Hedging: If a put is ITM and assignment is imminent, offset risk by buying protective calls to hedge downside exposure.

- Trading Around the Position: Use short-term trades (like buying/selling additional options) to reduce assignment risk while maximizing income.

3. Using Spreads in Conjunction with the Wheel Strategy

Adding spreads to the Wheel Strategy is an advanced technique that can optimize returns and reduce directional risk.

Credit Spreads for Income Enhancement:

Instead of naked puts, consider bull put spreads. For example, instead of selling a $100 put, sell the $100 put and buy a $95 put. This limits downside risk while still generating premium. Yes, you’ll collect less premium, but you significantly cap potential losses—ideal in high-volatility environments.

Covered Call Spreads (Diagonal/Calendar):

When holding stock, rather than a simple covered call, use a call spread (sell a call at one strike, buy a call further OTM). This creates a "risk-defined" covered call, reducing the chance of large losses if the stock rallies sharply.

Ratio Spreads:

If you’re slightly bullish on a stock you’re assigned, consider ratio spreads—for example, selling two OTM calls and buying one further OTM call. This generates extra premium but requires careful management to avoid unlimited risk.

4. Dynamic Adjustments Using Technical Indicators

Relying solely on price action limits your strategic edge. Incorporating technical indicators can signal optimal times to adjust positions, enhancing both profitability and risk management.

Key Indicators for Wheel Adjustments:

- Relative Strength Index (RSI):

- Overbought (>70): Great time to sell covered calls or roll calls higher.

- Oversold (<30): Consider rolling down puts or preparing for assignment.

- Moving Averages (50/200-Day):

- Stocks holding above the 50-day MA often maintain bullish momentum, favoring aggressive put selling.

- A cross below the 200-day MA signals potential downtrends—reduce position size or shift to spreads.

- Bollinger Bands:

- Upper Band Touch: Roll covered calls up/forward to capture more premium.

- Lower Band Touch: Roll puts down to reduce assignment risk or position for rebound.

- Implied Volatility (IV) Rank/Percentile:

- High IV = wider strikes and higher premiums; favor spreads to manage risk.

- Low IV = tighter strikes, but consider avoiding overexposure due to reduced premium potential.

Bringing It All Together: An Advanced Adjustment Playbook

Here’s a sample scenario applying these advanced techniques:

Scenario:

- You sold a $100 cash-secured put on XYZ, collected $3 premium. Stock drops to $95 amid a market correction.

- IV spikes, and RSI hits 25 (oversold).

Adjustment Plan:

- Evaluate Rolling: Roll down to a $90 strike, out 2 weeks, collecting an additional $2 premium.

- Spread Hedge: Add a bull put spread (sell $90, buy $85) to reduce net delta exposure.

- Dynamic Monitoring: Use RSI recovery to exit the spread early if the stock rebounds, locking in profits.

- Assignment Defense: If XYZ drops below $90, manage the assignment with dynamic covered calls, potentially adding a call spread to limit upside risk during rebounds.

Final Thoughts: The Art of Adaptation

The Wheel Strategy isn’t just about selling puts and calls—it’s about managing trades dynamically to maximize income and minimize risk. Advanced adjustments like rolling strategies, managing assignment in volatile markets, incorporating spreads, and leveraging technical indicators help experienced traders stay ahead of the curve.

If you’re serious about refining your Wheel Strategy, check out our Options Screener for the Wheel Strategy. It’s designed to help you identify optimal trades, manage adjustments, and make data-driven decisions with confidence.

Ready to take your Wheel Strategy to the next level? Start screening smarter today

Disclaimer: The information provided in this article is for educational and informational purposes only and should not be considered financial advice. Trading options involves significant risk and is not suitable for all investors. Always conduct your own research, consult with a qualified financial advisor, and understand the risks before making any trading decisions.

Follow us on:

Comments ()